Why Will The Ct Minimum Wage Change In 2025?

The Connecticut (CT) minimum wage is set to increase in 2025 due to a series of legislative actions and a progressive approach to ensuring fair wages for workers in the state. This change is part of a broader movement towards increasing the minimum wage across the United States, with many states and localities implementing their own wage adjustments to combat inflation and rising living costs.

Legislative Actions and Policy Changes

The upcoming minimum wage increase in Connecticut can be attributed to the passage of Public Act 19-55, which was signed into law in 2019. This act established a progressive schedule for minimum wage increases, with the aim of gradually raising the wage floor to provide workers with a livable income.

The law outlines a step-by-step process, with the minimum wage increasing by a certain amount each year until it reaches the targeted level. This approach allows businesses and employers to plan and adjust their operations accordingly, ensuring a smoother transition to a higher wage floor.

The specific timeline and wage amounts are as follows:

- January 1, 2020: Minimum wage increased to $11.00 per hour.

- January 1, 2021: Minimum wage increased to $12.00 per hour.

- January 1, 2022: Minimum wage increased to $13.00 per hour.

- January 1, 2023: Minimum wage increased to $14.00 per hour.

- January 1, 2024: Minimum wage will increase to $15.00 per hour.

- January 1, 2025: Minimum wage will be adjusted based on the Consumer Price Index (CPI), ensuring that it keeps up with the cost of living.

By indexing the minimum wage to the CPI, Connecticut aims to ensure that the wage floor remains a reliable indicator of a livable income, even in the face of economic fluctuations and rising costs.

The Impact of Inflation and Cost of Living

One of the primary motivations behind the minimum wage increase is the rising cost of living in Connecticut and the need to ensure that workers can afford basic necessities. Inflation, which has been a persistent issue in recent years, erodes the purchasing power of a static minimum wage, making it difficult for low-wage earners to make ends meet.

By adjusting the minimum wage to keep pace with the CPI, the state aims to prevent the real value of the minimum wage from declining. This approach helps to maintain the minimum wage's effectiveness as a tool for reducing poverty and promoting economic stability for low-income workers.

The table below illustrates the historical and projected minimum wage rates in Connecticut, highlighting the progressive nature of the wage increases:

| Year | Minimum Wage |

|---|---|

| 2019 | $10.10 |

| 2020 | $11.00 |

| 2021 | $12.00 |

| 2022 | $13.00 |

| 2023 | $14.00 |

| 2024 | $15.00 |

| 2025 | CPI-Adjusted |

Economic Implications and Benefits

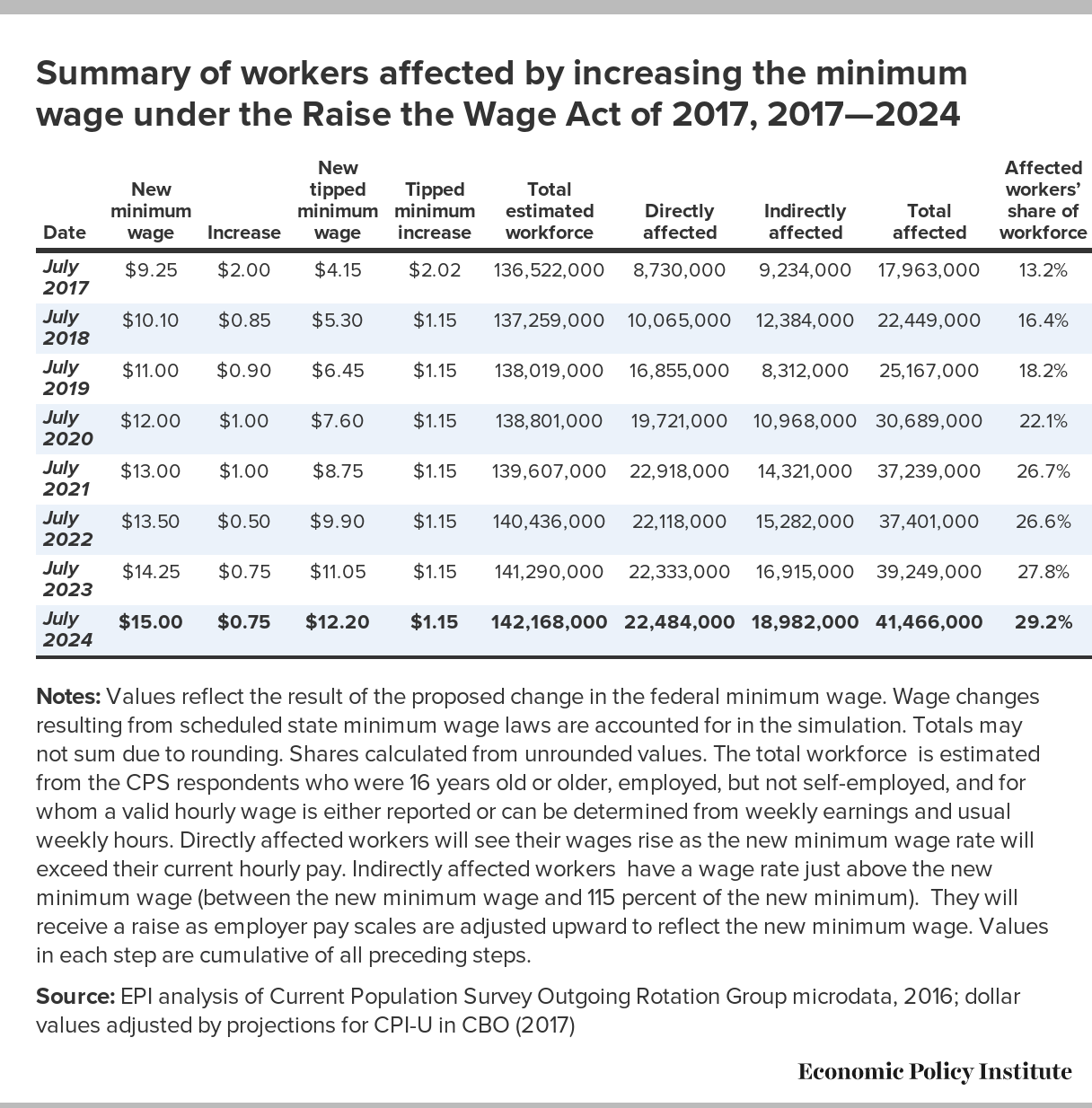

The minimum wage increase is expected to have several positive economic impacts on Connecticut's workforce and economy:

- Increased Spending Power: Higher wages will put more money into the pockets of low-income workers, stimulating local economies as these individuals have a higher propensity to spend on goods and services.

- Reduced Income Inequality: By raising the floor for wages, the state aims to narrow the gap between high- and low-income earners, promoting a more equitable distribution of wealth.

- Improved Worker Retention: Businesses may experience improved employee retention rates as workers are more likely to stay with employers who offer a livable wage.

- Enhanced Productivity: With higher wages, workers may feel more valued and motivated, leading to increased productivity and efficiency in the workplace.

However, it is important to note that there are also potential challenges associated with minimum wage increases. Some businesses, particularly small businesses with tight margins, may face increased costs and pressure to adjust their operations to accommodate the higher wage floor. The state government has recognized this and has implemented various support programs and tax incentives to help businesses navigate these changes.

Future Outlook and Considerations

The future of minimum wage policies in Connecticut and beyond remains a topic of ongoing debate and discussion. While the current schedule for increases is set until 2025, there are calls for further adjustments to keep pace with the rising cost of living and to continue the progress towards a livable wage for all workers.

Advocates for a higher minimum wage argue that it is a necessary step to address income inequality and provide a basic standard of living for all workers. On the other hand, some businesses and economists express concerns about the potential negative impacts on employment and business operations, particularly in industries with thin profit margins.

As Connecticut and other states continue to navigate the complex landscape of minimum wage policies, it is crucial to strike a balance between supporting workers' rights and ensuring the long-term viability of businesses. Finding this balance will require ongoing dialogue, research, and a commitment to evidence-based policy-making.

How will the minimum wage increase affect small businesses in Connecticut?

+Small businesses may face increased costs as a result of the minimum wage increase. However, the state government has implemented various support programs and tax incentives to help alleviate the financial burden. Additionally, higher wages can lead to improved employee retention and productivity, which may offset some of the initial costs.

What is the impact of minimum wage increases on employment rates?

+The relationship between minimum wage increases and employment rates is a subject of debate. Some studies suggest that higher minimum wages can lead to job losses, particularly in low-wage industries. However, other research indicates that the impact on employment may be minimal, and the benefits to workers and the economy as a whole outweigh any potential negative effects.

Are there any exceptions to the minimum wage law in Connecticut?

+Yes, there are certain exceptions and special cases outlined in the minimum wage law. For example, tipped employees, such as waitstaff, may be paid a lower base wage as long as their total earnings (including tips) meet or exceed the minimum wage. Additionally, there are provisions for certain types of workers, such as students and individuals with disabilities, who may be paid a training wage.