Why Sign A Share Purchase Agreement? A Legal Guide

The share purchase agreement (SPA) is a critical document in the process of acquiring shares or businesses. It outlines the terms and conditions of the transaction, protecting the interests of both the buyer and the seller. This legal guide aims to explore the significance of the SPA, its key components, and the reasons why it is an essential step in any share purchase transaction.

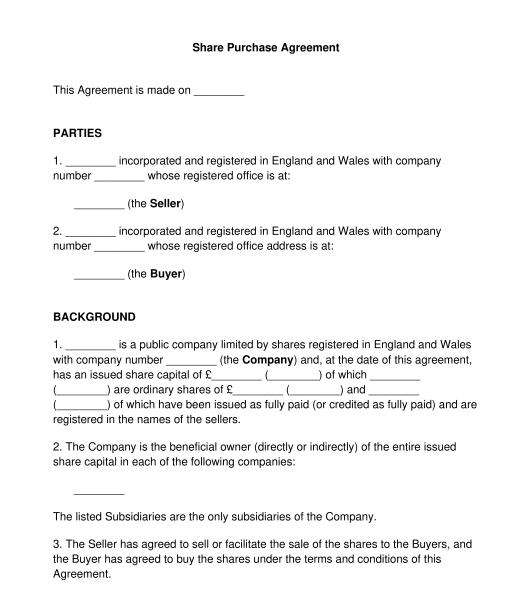

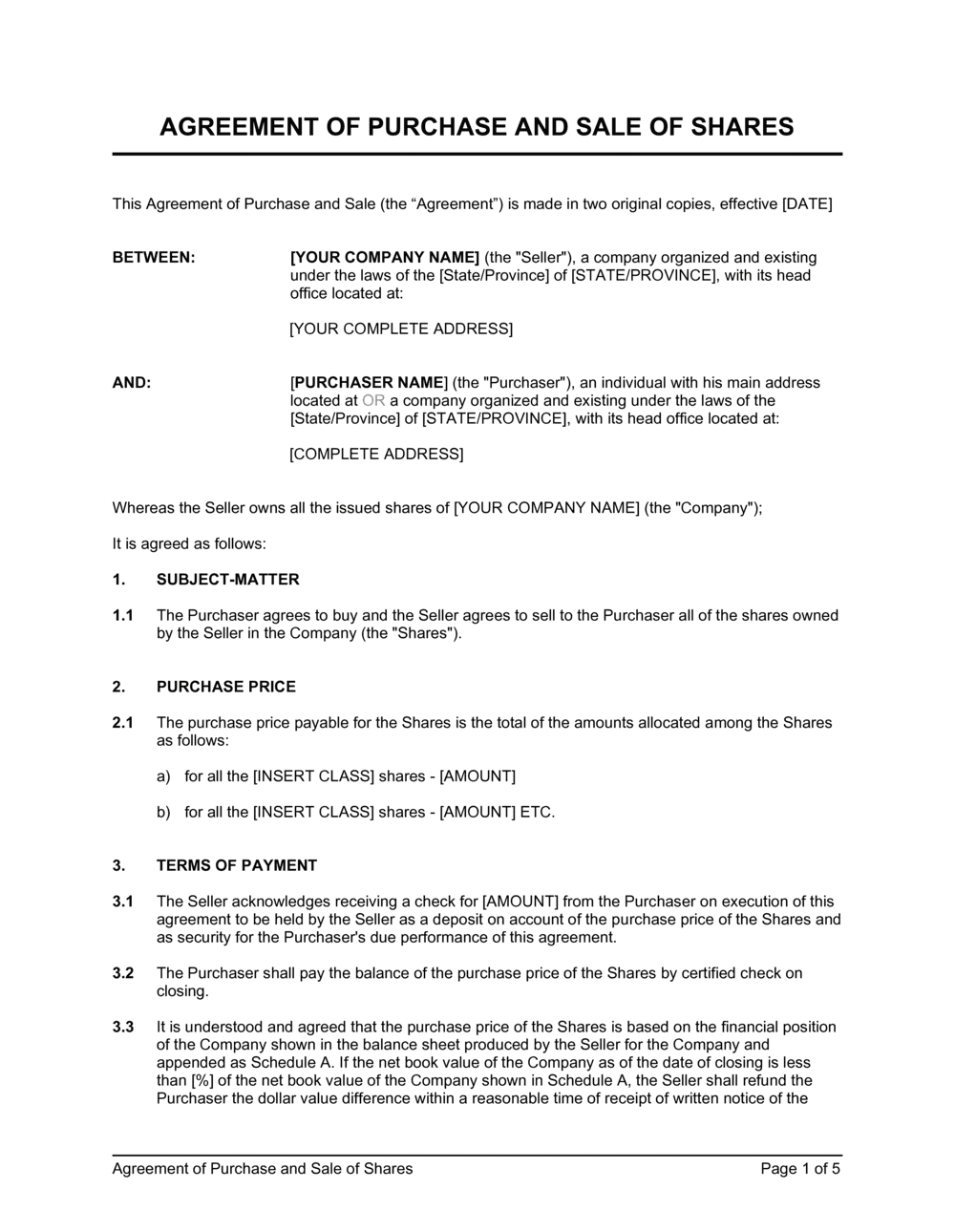

Understanding the Share Purchase Agreement

The Share Purchase Agreement is a legally binding contract that governs the sale and transfer of shares in a company. It is a comprehensive document that details the rights, obligations, and expectations of both parties involved in the transaction. The SPA provides a framework for the acquisition process, ensuring clarity and minimizing potential disputes.

The agreement typically covers a wide range of aspects, including but not limited to:

- Identification of the parties involved and their respective roles.

- Description of the shares being purchased, including their quantity, class, and value.

- Purchase price, payment terms, and any adjustments or conditions related to the price.

- Representations and warranties made by the seller regarding the company's financial health, legal status, and operations.

- Conditions precedent that must be met before the transaction can be completed.

- Post-closing obligations and covenants, such as non-compete agreements or ongoing support from the seller.

- Indemnification provisions to protect the buyer from any undisclosed liabilities or issues.

- Governing law and dispute resolution mechanisms.

Key Reasons to Sign a Share Purchase Agreement

Legal Protection and Certainty

The primary purpose of an SPA is to provide legal protection and certainty to both the buyer and the seller. By signing the agreement, the parties acknowledge and agree to the terms outlined, reducing the risk of future disputes and misunderstandings. The SPA ensures that all parties understand their rights, responsibilities, and the potential consequences of the transaction.

It also provides a clear roadmap for the acquisition process, including the steps to be taken, the timelines involved, and the expected outcomes. This level of detail helps prevent delays and ensures a smoother transaction.

Due Diligence and Information Disclosure

The SPA is an opportunity for the buyer to conduct thorough due diligence on the target company. It allows the buyer to request and review critical information about the company’s financial position, legal status, intellectual property, contracts, and other relevant aspects. This due diligence process is essential to make an informed decision about the investment.

The seller, on the other hand, is obligated to disclose accurate and complete information. Any misrepresentation or omission can lead to legal consequences and invalidate the agreement. Thus, the SPA promotes transparency and encourages honest disclosure, which is crucial for a successful transaction.

Risk Mitigation and Indemnification

Share purchase agreements often include indemnification clauses that protect the buyer from potential liabilities and losses. These clauses specify the circumstances under which the seller will compensate the buyer for any damages or losses incurred due to breaches of representations, warranties, or other obligations outlined in the agreement.

Indemnification provides a safety net for the buyer, ensuring that they are not left vulnerable to unforeseen issues or hidden liabilities. It also encourages the seller to conduct their own due diligence and disclose any potential risks or problems associated with the company.

Clarity on Post-Closing Obligations

The SPA clearly defines the post-closing obligations of both parties. This includes matters such as employee retention, ongoing support, non-compete agreements, and any other commitments made by the seller to ensure a smooth transition and continued success of the business.

By outlining these obligations, the SPA helps prevent future conflicts and ensures that the buyer receives the full benefit of their investment. It also provides a framework for resolving any disputes that may arise regarding these post-closing obligations.

Flexibility and Customization

Share purchase agreements can be tailored to the specific needs and circumstances of the transaction. While there are standard clauses and provisions, the agreement can be customized to address unique aspects of the deal. This flexibility allows for a more precise reflection of the parties’ intentions and expectations.

For example, the SPA can include provisions related to tax liabilities, environmental concerns, intellectual property rights, or specific industry-related issues. By customizing the agreement, the parties can address their specific concerns and create a more comprehensive and effective contract.

The Process of Negotiating and Finalizing an SPA

Negotiating a share purchase agreement is a complex process that requires careful consideration and legal expertise. The following steps outline a typical negotiation and finalization process:

- Initial Negotiations: The buyer and seller discuss the key terms of the transaction, including the purchase price, payment terms, and any initial conditions or representations. This stage often involves back-and-forth negotiations to reach an agreement on these critical aspects.

- Due Diligence: The buyer conducts a thorough due diligence investigation, reviewing the target company's financial records, legal documents, contracts, and other relevant information. This process helps the buyer identify potential risks and negotiate appropriate representations and warranties.

- Drafting the SPA: Once the initial terms are agreed upon, a draft of the SPA is prepared. This draft is typically prepared by the buyer's legal team and includes detailed provisions covering all aspects of the transaction. The draft is then sent to the seller for review and negotiation.

- Negotiation and Revisions: Both parties negotiate the terms of the SPA, discussing and revising the draft to reach a mutually acceptable agreement. This process may involve multiple rounds of revisions and negotiations to address concerns and ensure that the agreement is fair and balanced.

- Finalization and Execution: After the negotiations are complete and both parties are satisfied with the terms, the final version of the SPA is signed by all parties involved. This marks the formalization of the agreement, and the transaction can proceed towards closing.

- Closing: The closing process involves the transfer of ownership of the shares and the payment of the purchase price. This step typically occurs after all conditions precedent outlined in the SPA have been met or waived.

Best Practices and Considerations

When navigating the share purchase agreement process, it is essential to keep the following best practices in mind:

- Seek Legal Advice: Engage experienced legal counsel who specializes in corporate transactions and share purchases. They can provide valuable guidance and ensure that your interests are protected throughout the process.

- Conduct Thorough Due Diligence: Due diligence is a critical aspect of the SPA negotiation. Ensure that you have access to all relevant information and conduct a comprehensive review of the target company's operations, finances, and legal status.

- Negotiate Fairly: Strive for a fair and balanced agreement that considers the interests of both parties. Avoid aggressive negotiation tactics that may lead to an unbalanced agreement, as this can create future disputes and legal challenges.

- Address Key Concerns: Identify and address any specific concerns or risks associated with the transaction. This may include tax liabilities, environmental issues, or industry-specific challenges. Ensure that the SPA includes provisions to mitigate these risks.

- Maintain Open Communication: Foster open and transparent communication between the buyer and seller throughout the negotiation process. Clear communication helps build trust and ensures that both parties are aligned on the key terms and expectations.

- Consider Future Growth: When drafting the SPA, consider the potential for future growth and expansion of the business. Include provisions that allow for flexibility and adaptation as the business evolves.

Case Study: A Successful Share Purchase Transaction

Consider the following hypothetical case study to illustrate the practical application of a share purchase agreement:

Company X, a leading technology firm, decides to acquire a majority stake in Company Y, a promising startup with innovative products. Company X's legal team drafts a comprehensive SPA outlining the following key terms:

- Purchase Price: $10 million, with a 10% deposit to be paid upon signing the SPA and the remaining amount due at closing.

- Representations and Warranties: Company Y represents and warrants that it has no undisclosed liabilities, is in compliance with all applicable laws, and has valid intellectual property rights.

- Due Diligence Period: Company X is granted a 60-day due diligence period to review Company Y's financial statements, contracts, and other relevant documents.

- Indemnification: Company Y agrees to indemnify Company X for any losses or damages resulting from breaches of representations or warranties, or any undisclosed liabilities.

- Post-Closing Obligations: Company Y's founders agree to a two-year non-compete agreement and commit to providing ongoing support and consulting services to ensure a smooth transition.

After thorough negotiations and due diligence, both parties sign the SPA, and the transaction proceeds smoothly. The due diligence process reveals no major issues, and the founders of Company Y provide valuable insights and support during the transition period. The successful acquisition allows Company X to expand its product portfolio and enter new markets, benefiting from Company Y's innovative technology and talented workforce.

Frequently Asked Questions

What happens if a party breaches the terms of the share purchase agreement?

+In the event of a breach, the non-breaching party may have the right to seek legal remedies, including specific performance (forcing the breaching party to fulfill their obligations), damages (compensation for losses incurred), or rescission (canceling the agreement and returning the parties to their pre-agreement positions). The specific remedies available will depend on the terms of the SPA and applicable laws.

<div class="faq-item">

<div class="faq-question">

<h3>Can the share purchase agreement be amended after it is signed?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the SPA can be amended or modified with the mutual consent of both parties. Amendments are typically made in writing and signed by all parties to ensure their validity. It is important to carefully consider any proposed amendments and seek legal advice to ensure that the changes do not negatively impact the transaction or the rights of either party.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any common mistakes to avoid when negotiating a share purchase agreement?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Some common mistakes to avoid include:</p>

<ul>

<li>Failing to conduct thorough due diligence, which can lead to undisclosed liabilities or legal issues.</li>

<li>Neglecting to address key concerns and risks specific to the industry or transaction.</li>

<li>Not seeking professional legal advice, which can result in an unbalanced or ineffective agreement.</li>

<li>Rushing the negotiation process, as this may lead to oversight of critical provisions or inadequate protection of interests.</li>

</ul>

</div>

</div>

</div>

The share purchase agreement is a vital tool in the acquisition process, providing legal protection, certainty, and transparency to both the buyer and the seller. By understanding the key components and best practices associated with the SPA, parties can navigate the transaction process with confidence and minimize potential risks. A well-drafted and negotiated SPA sets the foundation for a successful and mutually beneficial share purchase transaction.