Why Choose Navy Federal? Benefits & Services Explained

Navy Federal Credit Union is a leading financial institution that offers a range of services and benefits tailored to the unique needs of military personnel, veterans, and their families. With a rich history dating back to 1933, Navy Federal has grown into one of the largest credit unions in the United States, serving over 11 million members worldwide. In this comprehensive guide, we will explore the reasons why Navy Federal stands out as a preferred financial partner and delve into the advantages and services it provides to its members.

The Navy Federal Advantage: A Commitment to Military Community

Navy Federal Credit Union was founded with a clear mission: to empower and support the financial well-being of those who serve or have served in the armed forces, along with their families. This commitment to the military community sets Navy Federal apart from traditional banks and financial institutions. Here’s how Navy Federal stands out:

1. Member-Centric Approach

Navy Federal operates as a not-for-profit cooperative, meaning its focus is on serving its members rather than maximizing profits for shareholders. This member-centric approach translates into competitive rates, lower fees, and a wide range of financial products and services designed to meet the specific needs of military personnel.

2. Expertise in Military Finances

With a deep understanding of the unique financial challenges faced by military members, Navy Federal offers specialized guidance and support. From managing frequent relocations to planning for retirement, Navy Federal’s financial experts provide personalized advice tailored to the military lifestyle.

3. Strong Community Presence

Navy Federal has a physical presence in many military communities, with branches located near military bases and installations. This allows members to access their financial services conveniently and fosters a sense of community and support.

4. Digital Innovation

Navy Federal stays at the forefront of digital banking, offering a user-friendly mobile app and online platform. Members can easily manage their accounts, make payments, and access a wide range of financial tools and resources from anywhere in the world.

Benefits and Services: Enhancing Financial Well-Being

Navy Federal Credit Union offers a comprehensive suite of financial products and services designed to cater to the diverse needs of its members. Let’s explore some of the key benefits and services that make Navy Federal a trusted financial partner.

1. Competitive Interest Rates

Navy Federal is known for offering competitive interest rates on a wide range of products, including savings accounts, certificates of deposit (CDs), and loans. Members can benefit from higher returns on their savings and more affordable borrowing options.

2. Low or No Fees

Navy Federal keeps fees to a minimum, often offering no-fee checking accounts, free ATM withdrawals, and low-cost loan options. This fee structure helps members maximize their financial resources and avoid unnecessary expenses.

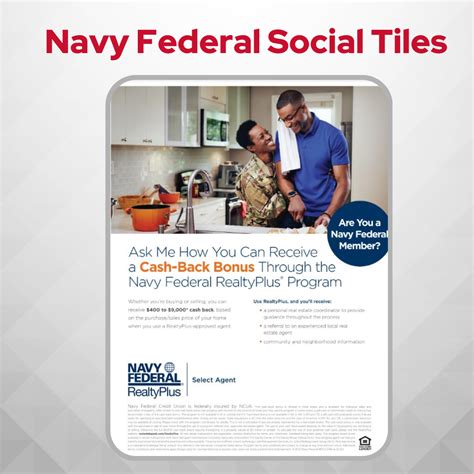

3. Military-Friendly Loans

Navy Federal provides a variety of loan options tailored to the needs of military members. These include VA loans for buying a home, military-specific auto loans, and personal loans with flexible terms. The credit union also offers loan protection and assistance programs to help members manage their financial obligations during times of deployment or hardship.

4. Comprehensive Banking Services

Members have access to a full range of banking services, including checking and savings accounts, credit cards, mortgages, and investment options. Navy Federal’s banking services are designed to be user-friendly and accessible, with online and mobile banking options that make managing finances convenient.

5. Retirement Planning and Investment Services

Navy Federal understands the importance of long-term financial planning, especially for military members. The credit union offers retirement planning services, including IRAs and 401(k) options, as well as investment advice and access to a wide range of investment products. Members can work with financial advisors to create a personalized retirement strategy.

6. Insurance and Protection Services

Navy Federal provides a comprehensive suite of insurance products, including auto, home, life, and health insurance. Members can also access identity theft protection services and financial protection plans to safeguard their finances and peace of mind.

7. Educational Resources and Financial Literacy

Navy Federal is committed to promoting financial literacy and empowering its members to make informed financial decisions. The credit union offers a wealth of educational resources, including online articles, webinars, and workshops, covering topics such as budgeting, saving, investing, and managing debt.

| Product/Service | Benefits |

|---|---|

| Checking Accounts | No-fee options, overdraft protection, and convenient mobile check deposit. |

| Savings Accounts | Competitive interest rates, no minimum balance requirements, and automatic savings plans. |

| Credit Cards | Low introductory rates, rewards programs, and fraud protection. |

| Mortgages | VA loan expertise, low down payment options, and flexible financing terms. |

| Investment Services | Access to a wide range of investment products, personalized advice, and retirement planning tools. |

Is Navy Federal only for active-duty military personnel?

+No, Navy Federal serves a wide range of individuals, including active-duty military, veterans, DoD civilians, and their families. Eligibility extends to those with a direct connection to the military, such as spouses, children, and even some grandparents.

What sets Navy Federal’s loan products apart?

+Navy Federal’s loan products are designed with military members in mind. They offer competitive rates, flexible terms, and specialized loan programs like VA loans and military auto loans. Additionally, the credit union provides loan protection and assistance programs to support members during deployments or financial hardships.

How does Navy Federal’s digital banking platform compare to traditional banks?

+Navy Federal’s digital banking platform is highly regarded for its user-friendliness and comprehensive features. Members can access their accounts, make payments, and manage their finances from anywhere in the world. The platform offers a seamless experience, with a mobile app and online tools that rival or exceed those of traditional banks.