Why Are Rhode Island Income Taxes So High? A Taxpayer's Guide

Rhode Island, known as the "Ocean State," is a small but densely populated state in the northeastern United States. It has a unique tax structure compared to its neighboring states, which often leads to the perception that Rhode Island income taxes are significantly higher. This perception is not entirely unfounded, as the state's tax policies and economic factors contribute to a relatively higher tax burden for its residents. In this comprehensive guide, we will delve into the reasons behind Rhode Island's high income taxes, explore its tax system, and provide insights for taxpayers to navigate this complex landscape.

The Tax Landscape of Rhode Island

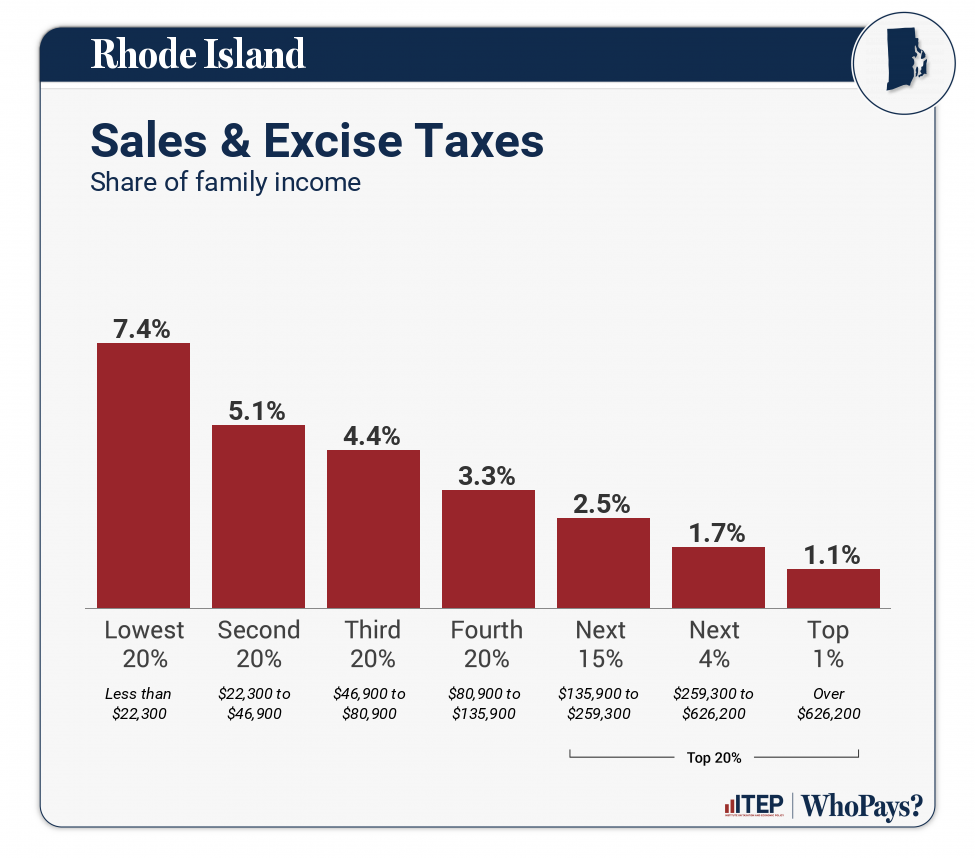

Rhode Island's tax system is characterized by a combination of income, sales, and property taxes, with income taxes being a significant source of revenue for the state. The state's tax policies aim to fund various public services, infrastructure development, and social programs. However, several factors contribute to the perception of high taxes in Rhode Island, and understanding these factors is crucial for taxpayers and policymakers alike.

Progressive Income Tax Structure

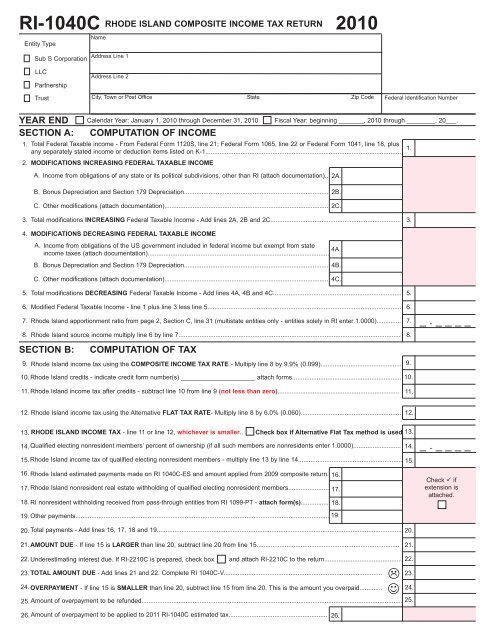

One of the primary reasons for Rhode Island's relatively high income taxes is its progressive tax system. Unlike a flat tax rate, where everyone pays the same percentage regardless of income, Rhode Island employs a progressive tax structure. This means that as an individual's income increases, so does their tax rate. The state currently has five income tax brackets, ranging from 3.75% to 5.99% for taxable income above $173,000.

| Tax Bracket | Tax Rate |

|---|---|

| 0 to $21,700 | 3.75% |

| $21,701 to $43,400 | 4.75% |

| $43,401 to $108,500 | 5.25% |

| $108,501 to $173,000 | 5.99% |

| Above $173,000 | 5.99% |

While this progressive system ensures that higher-income earners contribute a larger share of their income, it can result in a higher overall tax burden for those in the upper tax brackets. Additionally, Rhode Island's tax brackets have not been adjusted for inflation in recent years, which means that more taxpayers may find themselves in higher tax brackets over time.

Lack of Income Tax Deductions

Another factor contributing to the perception of high taxes is the limited availability of income tax deductions in Rhode Island. Unlike some other states, Rhode Island does not offer a wide range of deductions that can reduce taxable income. For instance, the state does not allow deductions for federal income taxes paid, which is a common deduction in many other states.

The absence of these deductions means that Rhode Island taxpayers have fewer opportunities to lower their taxable income and, consequently, their tax liability. This can result in a higher effective tax rate for individuals and businesses, especially when compared to states with more generous deduction policies.

High Property Taxes

In addition to income taxes, Rhode Island is known for having relatively high property taxes. Property taxes are a significant source of revenue for local governments and are used to fund public services such as education, public safety, and infrastructure. According to recent data, Rhode Island ranks among the top states in the nation for property tax rates.

The combination of high property taxes and income taxes can create a substantial financial burden for Rhode Island residents, especially those with higher incomes and valuable properties. This dual tax burden is a key factor in the state's reputation for having a high tax environment.

Economic Factors and Tax Policy

Understanding the economic context and tax policies of Rhode Island is essential to grasp the reasons behind its high income taxes. Several economic factors and policy decisions have influenced the state's tax landscape over the years.

State Budget and Fiscal Challenges

Rhode Island, like many other states, faces fiscal challenges and budget constraints. The state's budget is primarily funded through a combination of income, sales, and property taxes, with income taxes being a significant contributor. The need to balance the budget and fund essential public services often leads to higher tax rates and a reliance on progressive taxation.

Additionally, Rhode Island has experienced economic downturns and financial crises in the past, which have further impacted its tax policies. During these times, the state may have implemented temporary tax increases or relied on higher tax rates to generate revenue and stabilize its finances.

Social Programs and Public Services

Rhode Island's tax revenue is used to fund a range of social programs and public services, including education, healthcare, and infrastructure development. The state has a commitment to providing quality public education, maintaining a robust healthcare system, and investing in infrastructure projects. These initiatives require substantial funding, which is largely derived from income taxes.

The state's progressive tax structure ensures that those with higher incomes contribute more to these public services, reflecting the principle of ability to pay. However, this also means that taxpayers in higher income brackets may bear a disproportionate share of the tax burden.

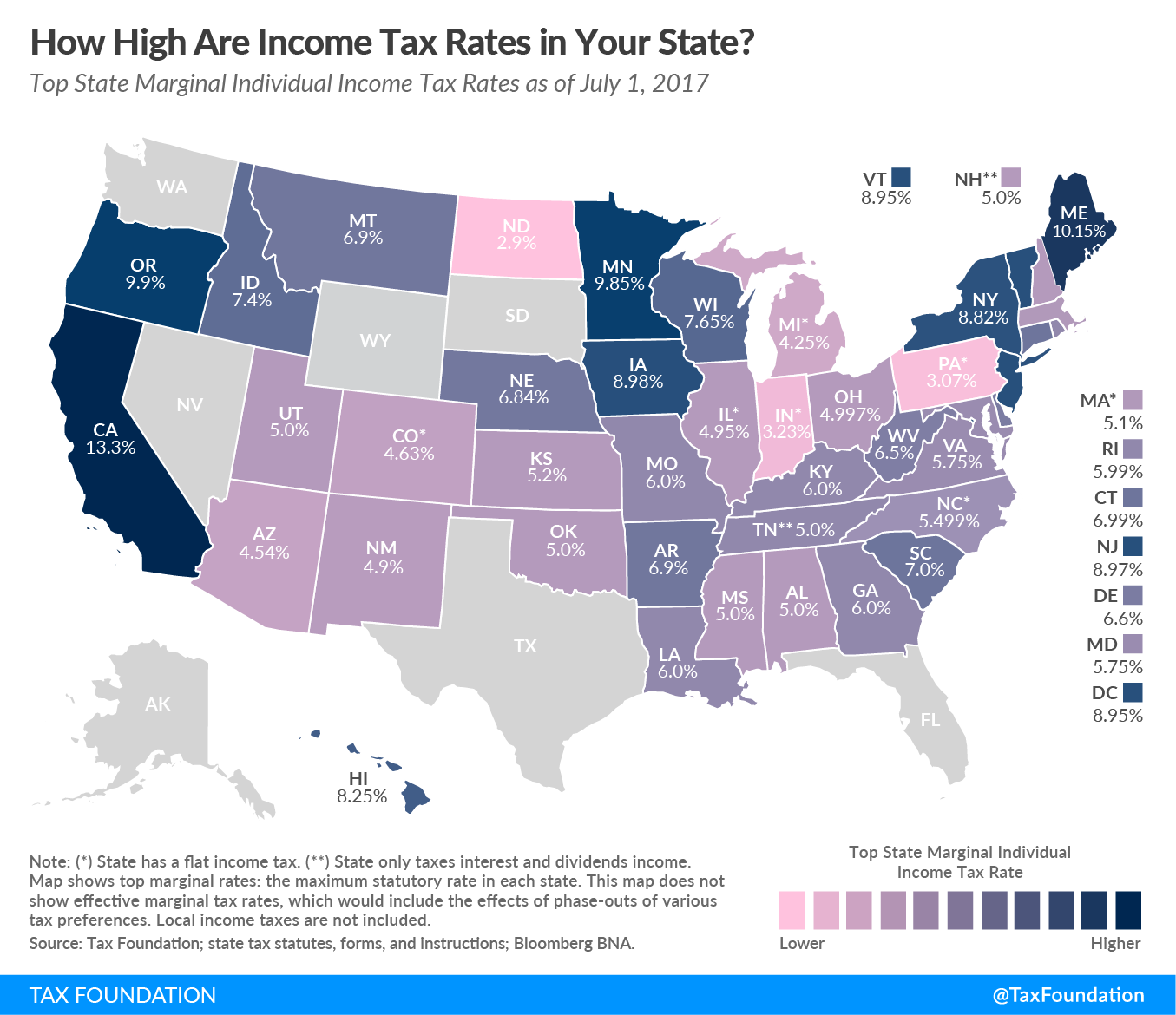

Comparison with Neighboring States

When examining Rhode Island's tax landscape, it is essential to consider how it compares to its neighboring states. Massachusetts, Connecticut, and New York, for example, also have progressive income tax systems, but their tax rates and brackets may differ significantly. This can create a perception of higher taxes in Rhode Island, especially when taxpayers compare their tax liabilities to those in nearby states.

Additionally, some neighboring states offer more generous tax incentives, deductions, and credits, which can make them more attractive to businesses and high-income earners. Rhode Island's tax policies may, therefore, need to be competitive to attract and retain taxpayers and businesses.

Tax Planning and Strategies for Rhode Island Taxpayers

Navigating the complex tax landscape of Rhode Island requires careful planning and an understanding of the available strategies. Here are some key considerations and strategies for Rhode Island taxpayers to manage their tax obligations effectively.

Maximizing Deductions and Credits

While Rhode Island's deduction options may be limited, taxpayers should still explore all available deductions and credits to reduce their taxable income. For instance, the state offers a standard deduction, which can be claimed by individuals who do not itemize their deductions. Additionally, Rhode Island provides tax credits for various purposes, such as the Low and Moderate-Income Housing Tax Credit and the Rhode Island Renewable Energy Tax Credit.

Taxpayers should also consider contributing to retirement accounts, such as 401(k)s or IRAs, which can provide tax benefits by reducing taxable income in the current year.

Strategic Income Management

For individuals with flexible income sources, strategic income management can be a powerful tool to minimize tax liability. By spreading income across tax years, taxpayers can potentially reduce their overall tax burden. For example, if an individual has the option to defer income to a later tax year, they may be able to take advantage of a lower tax bracket or avoid moving into a higher tax bracket altogether.

Business Ownership and Tax Benefits

Business owners in Rhode Island have access to various tax benefits and incentives. The state offers tax credits for business investments, job creation, and research and development. Additionally, Rhode Island has a Small Business Development Center (SBDC) that provides resources and support to help small businesses navigate tax obligations and take advantage of available incentives.

Business owners should explore these opportunities and consult with tax professionals to ensure they are maximizing their tax benefits.

Hiring Tax Professionals

Given the complexity of Rhode Island's tax system and the potential for significant tax savings, many taxpayers choose to engage the services of tax professionals. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are licensed and trained to provide tax advice and prepare tax returns. They can help taxpayers navigate the state's tax laws, identify deductions and credits, and ensure compliance with tax regulations.

Future Implications and Tax Reform

The high income taxes in Rhode Island have sparked debates and discussions about tax reform and potential changes to the state's tax policies. Here are some future implications and considerations for taxpayers and policymakers.

Tax Reform and Policy Changes

There have been ongoing discussions and proposals for tax reform in Rhode Island. Some policymakers and taxpayers advocate for a flattening of the tax brackets or a reduction in the top tax rate to make the state more competitive with its neighbors. Others suggest expanding the tax base or introducing new taxes to generate additional revenue without increasing tax rates.

Any significant tax reform would likely require careful consideration of the state's budget, economic impact, and potential consequences for taxpayers. Policymakers must strike a balance between generating sufficient revenue for public services and creating a tax environment that is attractive to businesses and taxpayers.

Economic Development and Business Attraction

Rhode Island's high income taxes can impact the state's ability to attract and retain businesses. High tax rates may deter companies from establishing operations in the state, especially if they perceive the tax burden to be excessive. To address this, the state has implemented various business incentives and tax credits to encourage economic development and job creation.

The success of these initiatives will be crucial in shaping the state's economic future and its ability to generate tax revenue sustainably.

Population Migration and Tax Base

High income taxes can also influence population migration patterns. Some taxpayers, particularly those with higher incomes, may choose to relocate to states with more favorable tax environments. This can have a significant impact on Rhode Island's tax base, as the state relies heavily on income taxes for revenue.

Policymakers must carefully consider the potential consequences of tax policies on population retention and attraction. Finding the right balance between generating revenue and maintaining a competitive tax environment is essential for the long-term economic health of the state.

How do Rhode Island’s income taxes compare to other states?

+Rhode Island’s income tax rates are generally higher than those of its neighboring states, such as Massachusetts and Connecticut. However, it is important to consider the overall tax burden, which includes property taxes and sales taxes. Rhode Island’s property taxes are also relatively high, contributing to a higher overall tax burden compared to some other states.

Are there any tax incentives for businesses in Rhode Island?

+Yes, Rhode Island offers various tax incentives and credits to attract and support businesses. These include tax credits for job creation, research and development, and business investments. The state also has a Small Business Development Center (SBDC) that provides resources and assistance to small businesses.

Can I reduce my taxable income in Rhode Island?

+Yes, taxpayers in Rhode Island can explore various strategies to reduce their taxable income. This includes claiming the standard deduction, contributing to retirement accounts, and taking advantage of available tax credits. It is important to consult with a tax professional to identify the most beneficial deductions and credits for your specific situation.