What's The Navy Federal Internal Score And Why Does It Matter?

The Navy Federal Internal Score is a unique credit scoring system used by Navy Federal Credit Union, one of the largest credit unions in the United States. This scoring model is an in-house creation, tailored specifically to the needs and demographics of the credit union's membership, primarily serving active and retired military personnel and their families. Unlike traditional credit scores, such as FICO or VantageScore, which are widely used across the industry, Navy Federal's internal score is an alternative assessment tool designed to offer a more comprehensive evaluation of a member's creditworthiness.

Understanding the Navy Federal Internal Score

The Navy Federal Internal Score is a proprietary credit scoring model, developed and utilized exclusively by the credit union. It serves as a crucial tool for assessing the creditworthiness of its members, especially those with limited or no traditional credit history. This score plays a significant role in determining the eligibility of members for various financial products and services, including loans, credit cards, and mortgages. It provides a more nuanced evaluation of an individual’s financial health, taking into account factors beyond the standard credit report.

Key Features and Benefits

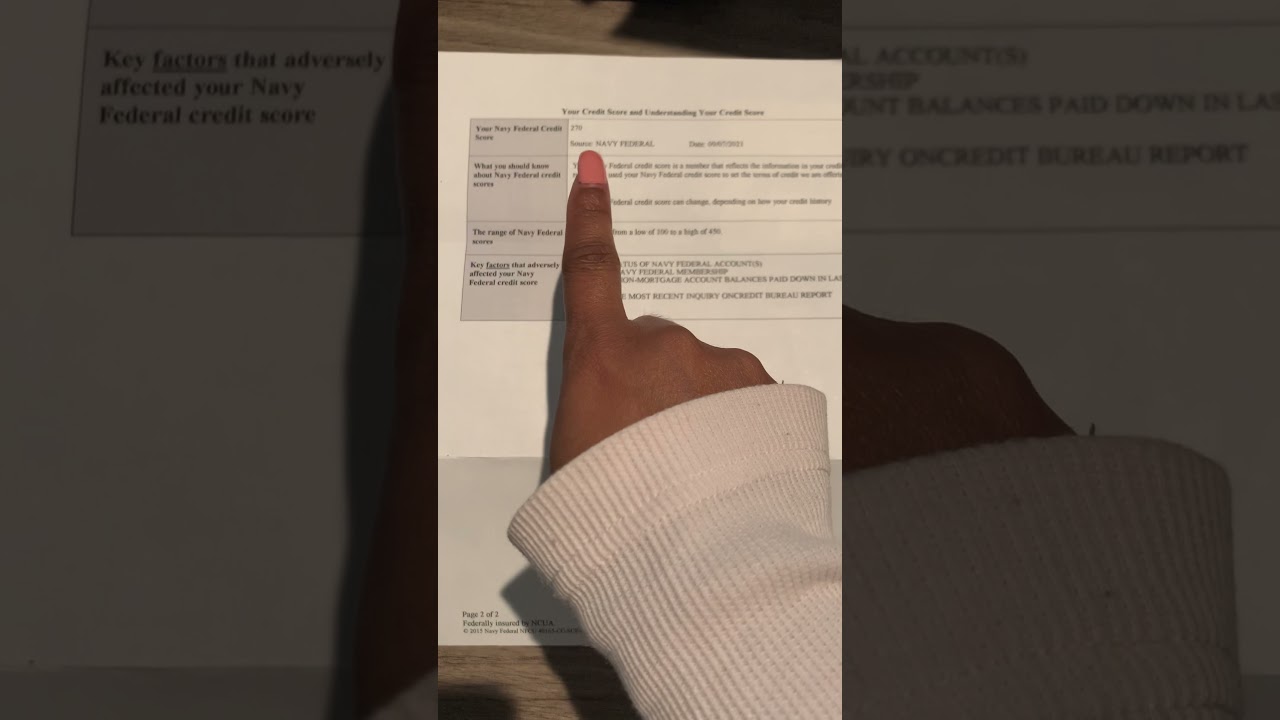

One of the standout features of the Navy Federal Internal Score is its ability to consider a broader range of data points. While traditional credit scores primarily rely on information from credit bureaus, Navy Federal’s score takes into account additional factors such as:

- Military Service Records: Given the credit union’s focus on military personnel, their service records, including length of service and deployment history, can positively influence their internal score.

- Savings and Investment Accounts: Navy Federal evaluates the size and stability of a member’s savings and investment accounts, indicating their financial discipline and ability to manage funds.

- Loan and Credit Card Usage: The credit union analyzes how members utilize their existing loans and credit cards, including repayment history and credit utilization, to assess their financial responsibility.

- Employment and Income Stability: Stable employment and a consistent income stream are favorable factors that can enhance a member’s internal score.

Application Process and Impact

When a member applies for a loan or credit card with Navy Federal, their internal score is a key factor in the decision-making process. A higher score increases the likelihood of approval and may also result in more favorable terms, such as lower interest rates or higher credit limits. This scoring system is particularly beneficial for members with limited credit histories, as it allows them to demonstrate their creditworthiness through other means, such as their military service or savings.

Comparison with Traditional Credit Scores

While Navy Federal’s internal score shares some similarities with traditional credit scores, there are notable differences. For instance, traditional credit scores heavily weigh credit history and payment behavior, while Navy Federal’s score places additional emphasis on the unique circumstances and financial behaviors of its members. This alternative scoring model provides a more holistic view of an individual’s financial situation, which can be especially advantageous for those who may not have a lengthy credit history or who have experienced financial challenges in the past.

| Scoring Factor | Navy Federal Internal Score | Traditional Credit Scores (e.g., FICO) |

|---|---|---|

| Credit History | Considers, but not as heavily weighted | Heavily weighted |

| Payment Behavior | Analyzes, but considers other factors | Primary focus |

| Military Service | Positive influence | Not considered |

| Savings and Investments | Evaluated | Not typically included |

| Employment Stability | Important factor | Varies based on scoring model |

The Impact on Navy Federal Members

The Navy Federal Internal Score has a direct and significant impact on the financial opportunities available to its members. A strong internal score can lead to access to a wider range of financial products and services, often with more favorable terms. This scoring system allows members to leverage their unique circumstances, such as their military service or stable employment, to their advantage, especially when traditional credit scores may not fully reflect their financial responsibility.

Case Study: Military Members with Limited Credit History

Consider the case of John, an active-duty military member who has recently deployed overseas. During his deployment, he was unable to establish a traditional credit history due to the nature of his service. Upon returning, John applies for a mortgage with Navy Federal Credit Union. Despite his limited credit history, his exemplary military service record and stable employment positively impact his internal score. This allows him to secure a mortgage with competitive rates, demonstrating the effectiveness of Navy Federal’s alternative scoring model in recognizing the unique financial situations of its members.

Future Implications and Industry Trends

The development and utilization of alternative credit scoring models, such as Navy Federal’s internal score, highlight a growing trend in the financial industry. As more institutions recognize the limitations of traditional credit scores, especially for specific demographics or unique circumstances, there is a shift towards more inclusive and holistic assessment methods. This trend is expected to continue, with further innovation in credit scoring models to better serve the diverse financial needs of consumers.

Can Navy Federal members access their internal score?

+Navy Federal members do not have direct access to their internal score. However, the credit union provides regular credit score updates and educational resources to help members understand and improve their creditworthiness. These resources often include tips on how to maintain a healthy financial profile, specifically tailored to the unique circumstances of military personnel.

How does Navy Federal’s internal score compare to other alternative scoring models?

+Navy Federal’s internal score is unique to the credit union and is designed specifically for its member base. While there are other alternative scoring models in the industry, each model is tailored to specific institutions or demographics. Navy Federal’s score stands out for its focus on military service and financial stability, which are crucial factors for its members.

What steps can Navy Federal members take to improve their internal score?

+To improve their internal score, Navy Federal members can focus on maintaining a healthy financial profile. This includes consistently making on-time payments, keeping credit card balances low, and building a positive repayment history. Additionally, members can leverage the credit union’s resources and educational programs to learn more about credit management and financial planning.