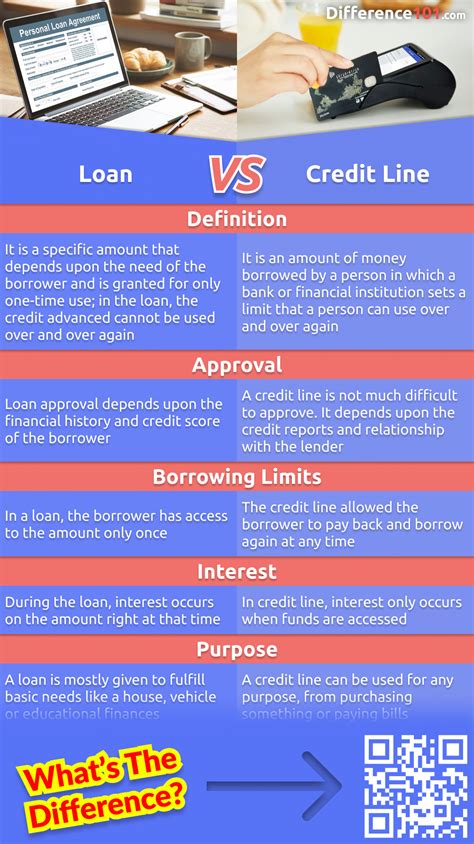

What's The Difference: Line Of Credit Vs Loan?

Understanding the difference between a line of credit and a loan is crucial for anyone seeking financial assistance. While both are common methods of borrowing money, they operate under distinct principles and serve different purposes. This comprehensive analysis will delve into the nuances of each, highlighting their unique features, advantages, and suitability for various financial scenarios.

Line of Credit: A Flexible Financial Tool

A line of credit, often referred to as a LOC, is a flexible borrowing arrangement between a borrower and a financial institution. It can be thought of as a pre-approved loan with a set credit limit, allowing the borrower to draw funds as needed, up to the approved limit. One of the key advantages of a LOC is its flexibility, making it a versatile tool for managing cash flow and financing various expenses.

Key Characteristics of a Line of Credit

A line of credit offers several distinctive features:

- Revolving Credit: A LOC is a revolving credit facility, meaning that as the borrower repays the drawn amount, the available credit limit is replenished. This allows for continuous borrowing and repayment cycles.

- Interest Calculation: Interest is typically charged only on the amount drawn, making it a cost-effective option for borrowers who use only a portion of the approved credit limit.

- Variable Limits: The credit limit on a LOC can be adjusted based on the borrower's creditworthiness and repayment history, providing an opportunity for increased borrowing capacity over time.

LOCs are particularly beneficial for individuals or businesses with fluctuating cash flow needs, as they provide access to funds when required without the need for repeated loan applications.

Suitable Scenarios for a Line of Credit

A line of credit is an excellent choice in the following situations:

- Business Operations: Businesses often use LOCs to manage day-to-day expenses, especially during periods of high operational costs or slow revenue cycles.

- Home Renovations: Homeowners may opt for a LOC to finance home improvement projects, as it provides the flexibility to draw funds as needed without incurring interest on the entire amount.

- Emergency Funds: LOCs can serve as a financial safety net, providing quick access to funds during unexpected expenses or emergencies.

Loan: A Traditional Borrowing Method

A loan, in contrast to a line of credit, is a more structured and fixed borrowing arrangement. It involves a lender providing a borrower with a specific amount of money, known as the principal, which must be repaid over a predetermined period, typically with interest.

Key Characteristics of a Loan

Loans exhibit the following distinctive features:

- Fixed Repayment: Loans have a fixed repayment schedule, with a set number of installments or a balloon payment at the end of the term. This provides borrowers with a clear repayment plan.

- Interest Accrual: Interest is calculated on the entire principal amount, even if the borrower chooses to repay the loan early. This makes loans a less flexible option compared to LOCs.

- Specific Purposes: Loans are often designed for specific purposes, such as home mortgages, auto loans, or personal loans. Each type of loan has unique terms and conditions tailored to its intended use.

Loans are a traditional and reliable method of borrowing, offering a structured approach to financing larger purchases or managing significant expenses.

Suitable Scenarios for a Loan

Loans are ideal in the following situations:

- Home Purchase: Mortgage loans provide a stable financing option for homebuyers, offering long-term repayment plans and fixed interest rates.

- Vehicle Acquisition: Auto loans are designed to finance the purchase of vehicles, offering competitive interest rates and flexible repayment terms.

- Consolidation of Debt: Debt consolidation loans allow borrowers to combine multiple debts into a single loan, simplifying repayment and potentially reducing overall interest costs.

Comparative Analysis: Line of Credit vs. Loan

When deciding between a line of credit and a loan, several factors come into play. Here's a comparative analysis to help you choose the right option:

| Category | Line of Credit | Loan |

|---|---|---|

| Flexibility | Highly flexible, allowing borrowers to draw funds as needed | Less flexible with a fixed repayment schedule and interest accrual |

| Interest Calculation | Interest is charged only on the drawn amount | Interest is calculated on the entire principal |

| Repayment Terms | Revolving credit with continuous borrowing and repayment cycles | Fixed repayment schedule with a set number of installments |

| Suitability | Ideal for managing cash flow and financing variable expenses | Suitable for larger purchases and specific financial goals |

Choosing the Right Option

The choice between a line of credit and a loan depends on your specific financial needs and circumstances. Here are some guidelines to help you decide:

- Short-Term Financing: If you require funds for a temporary period and have the means to repay quickly, a line of credit is a suitable option.

- Long-Term Investments: For larger purchases or investments, such as a home or vehicle, a loan provides a stable and structured financing solution.

- Flexibility vs. Predictability: If you value flexibility and the ability to manage cash flow dynamically, a line of credit is preferable. However, if you prefer a clear repayment plan and predictability, a loan is the better choice.

What are the typical interest rates for lines of credit and loans?

+Interest rates for lines of credit and loans can vary based on several factors, including the borrower’s creditworthiness, the purpose of the loan, and the financial institution’s policies. Generally, lines of credit tend to have higher interest rates compared to loans, especially for unsecured options. However, the interest rate on a line of credit is often variable, which means it can fluctuate over time based on market conditions. In contrast, loans typically have fixed interest rates, providing borrowers with a stable repayment plan.

Can I have both a line of credit and a loan simultaneously?

+Yes, it is possible to have both a line of credit and a loan simultaneously. Many individuals and businesses utilize multiple financing options to manage their financial needs effectively. However, it’s important to consider your overall debt capacity and ensure that you can manage the repayments for both. Consulting with a financial advisor can help you determine the best strategy for your specific situation.

Are there any penalties for early repayment of a line of credit or loan?

+The presence of early repayment penalties depends on the terms and conditions set by the financial institution. Some lenders may charge a fee for early repayment of a loan, especially if it’s a fixed-term loan with a specific repayment schedule. However, lines of credit often do not have early repayment penalties, as they are designed to be flexible and allow for dynamic borrowing and repayment cycles.