Usda Building Loan

The USDA Building Loan, officially known as the USDA Construction-to-Permanent Loan, is a specialized financing option offered by the United States Department of Agriculture (USDA) through its Rural Development program. This loan program is designed to assist homebuyers in rural areas by providing a seamless process for constructing or substantially renovating their homes while leveraging the benefits of USDA's rural housing loans.

Overview of the USDA Building Loan Program

The USDA Building Loan program aims to address the unique needs of individuals seeking to build or significantly improve their homes in eligible rural areas. It combines the construction financing stage with the long-term mortgage, eliminating the need for separate construction and permanent loans. This approach simplifies the homeownership process, making it more accessible and cost-effective for borrowers.

One of the key advantages of this program is the USDA's guarantee, which significantly reduces the risk for lenders. This guarantee allows for more favorable terms, including 100% financing and flexible credit requirements, making homeownership a reality for many rural residents who might otherwise face challenges in obtaining traditional mortgage loans.

Eligible Properties and Locations

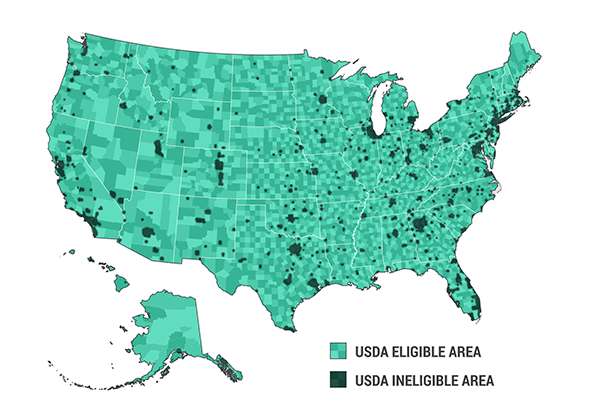

The USDA Building Loan is specifically tailored for properties located in designated rural areas. These areas are determined by the USDA and are subject to periodic updates. The program’s focus on rural development ensures that borrowers can access affordable housing options in less densely populated regions.

Eligible properties include single-family dwellings that will be the borrower's primary residence. The loan can be used for new construction, substantial rehabilitation, or the purchase of a property with the intent to renovate it. It's important to note that the loan-to-value (LTV) ratio for this program is typically higher than traditional construction loans, often reaching up to 100% with no down payment required.

| Property Type | Eligible |

|---|---|

| Single-Family Homes | Yes |

| Multi-Unit Properties | No |

| Mobile Homes | Not for New Construction |

| Mixed-Use Properties | No |

Loan Process and Requirements

The USDA Building Loan process involves several key stages, each with its own set of requirements. Here’s an overview of the process:

Pre-Qualification and Property Selection

Borrowers interested in the USDA Building Loan should start by pre-qualifying with a participating lender. This involves providing financial information, such as income, assets, and credit history, to determine eligibility. Simultaneously, borrowers should identify a suitable property or land in an eligible rural area.

The USDA provides an online tool to help borrowers determine if a property is located in a qualifying rural area. Additionally, borrowers should consult with their lender to ensure that the proposed construction or renovation plans align with the program's guidelines.

Construction Loan Stage

Once pre-qualified and a suitable property is identified, borrowers enter the construction loan stage. This phase involves securing a loan to cover the cost of construction or renovation. The loan amount is typically based on the estimated value of the completed home, with funds disbursed in stages as construction progresses.

Borrowers must provide a detailed construction plan, including estimates and timelines, to the lender. The lender will then review and approve the plan, ensuring it meets all necessary standards and regulations. During this stage, borrowers will also need to select a builder or contractor who can provide the necessary documentation and meet the loan's requirements.

| Documentation Required | Purpose |

|---|---|

| Builder's License and Insurance | To ensure the builder is qualified and insured |

| Construction Contract | Outlines the scope of work and costs |

| Construction Budget | Details the estimated costs of construction |

| Building Permits | Required for legal construction |

Permanent Loan Conversion

Upon completion of construction or renovation, the construction loan is converted into a permanent mortgage. This transition is seamless, and borrowers benefit from the long-term mortgage terms, including fixed interest rates and affordable monthly payments. The USDA guarantee remains in effect, providing continued support for the borrower.

During the conversion process, the lender will conduct a final inspection to ensure the property meets all program requirements and is in habitable condition. This step is crucial to ensure the safety and quality of the newly constructed or renovated home.

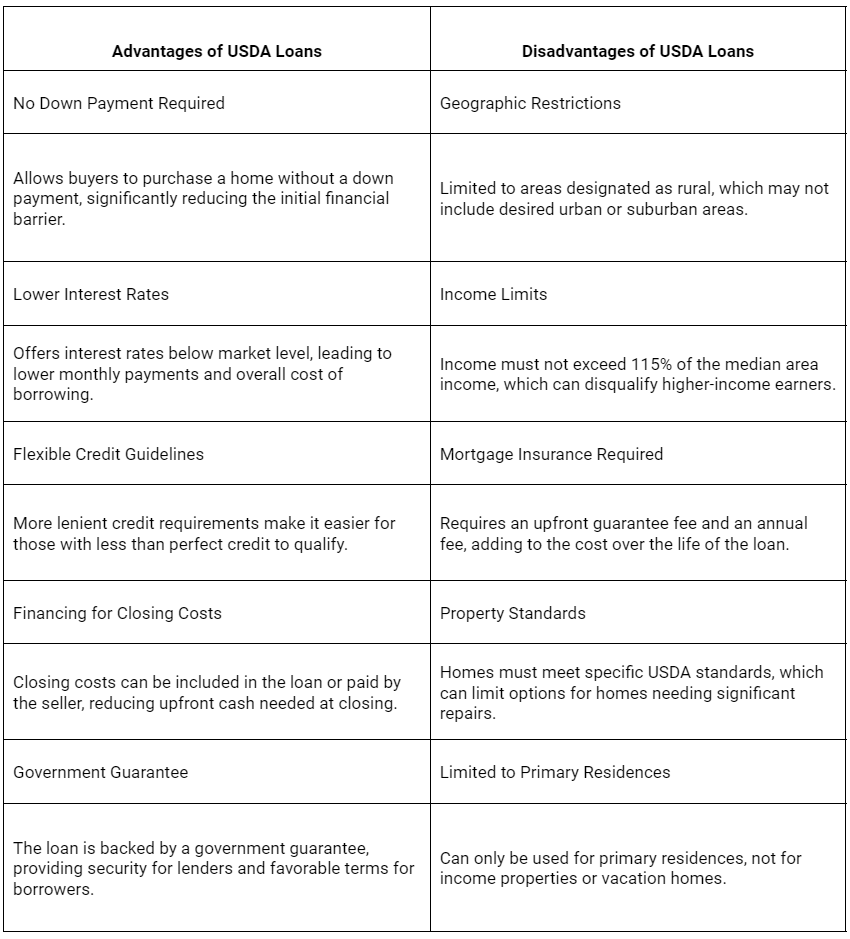

Benefits and Considerations

The USDA Building Loan offers several advantages for rural homebuyers:

- 100% Financing: Borrowers can secure a loan with no down payment, making homeownership more accessible.

- Flexible Credit Requirements: The program is designed to accommodate a range of credit profiles, including those with lower credit scores.

- Lower Interest Rates: The USDA guarantee often results in competitive interest rates, reducing the overall cost of borrowing.

- Streamlined Process: By combining construction and permanent financing, borrowers save time and avoid the complexities of separate loan applications.

- Eligible Rural Areas: The program supports the development of rural communities, offering an opportunity for homeowners to contribute to the growth of these areas.

However, there are also considerations to keep in mind:

- Location Restrictions: The loan is only available in designated rural areas, limiting its reach to urban or suburban borrowers.

- Income Limits: USDA loans have income limits to ensure the program benefits those who need it most. These limits vary by location and household size.

- Property Requirements: The property must meet specific standards, including energy efficiency and accessibility guidelines, to be eligible for the loan.

- Construction Process: Borrowers must carefully manage the construction process, ensuring timely completion and adherence to the approved plan.

Comparing USDA Building Loans to Other Construction Loans

When considering a construction loan, borrowers often compare the USDA Building Loan to other traditional options. Here’s a brief comparison:

USDA Building Loan vs. Conventional Construction Loans

Conventional construction loans typically require a higher down payment and have stricter credit requirements. While they offer flexibility in terms of loan amounts and property types, they may not be as accessible for borrowers with limited financial resources or those seeking to build in rural areas.

In contrast, the USDA Building Loan provides 100% financing and has more flexible credit guidelines. However, it is specifically tailored for rural properties, making it a unique option for borrowers in these areas.

USDA Building Loan vs. VA Construction Loans

VA Construction Loans are similar to the USDA Building Loan in that they offer 100% financing for eligible borrowers. These loans are designed for military personnel and veterans, providing an opportunity to build or substantially renovate their homes without a down payment.

While both programs offer significant benefits, the USDA Building Loan has a broader reach, serving a wider range of borrowers in rural areas. VA Construction Loans, on the other hand, are exclusively for military-affiliated individuals.

Case Study: A Successful USDA Building Loan Experience

John and Emily, a young couple, had always dreamed of building their home in a quiet, rural setting. They were attracted to the idea of a fresh start and the opportunity to design a home that suited their unique needs. After exploring their options, they discovered the USDA Building Loan program, which seemed like a perfect fit.

With the help of a local lender, John and Emily began the pre-qualification process. They provided their financial information and were delighted to learn that their credit profile met the program's requirements. Simultaneously, they identified a beautiful piece of land in a small, rural town, which they knew would be an ideal location for their new home.

The couple worked closely with an experienced builder who guided them through the construction process. They carefully planned their dream home, considering every detail from the layout to the energy-efficient features. The builder provided a detailed construction contract and budget, which was reviewed and approved by the lender.

Throughout the construction phase, John and Emily received regular updates from their builder. They were impressed by the progress and the attention to detail. As the home took shape, they felt a sense of pride and excitement, knowing that they were creating a space that would be their sanctuary for years to come.

Once construction was complete, the lender conducted a final inspection. The home exceeded all expectations, and the couple was thrilled to receive the keys to their new home. The seamless transition from construction loan to permanent mortgage made the process efficient and stress-free. John and Emily couldn't believe they had achieved their dream of homeownership without a down payment, thanks to the USDA Building Loan program.

Looking back, they felt grateful for the opportunity to build their home in a rural setting, surrounded by nature and a sense of community. The USDA Building Loan had not only made their dream a reality but had also allowed them to contribute to the growth and development of their chosen rural area.

Conclusion

The USDA Building Loan program offers a unique and valuable opportunity for rural homebuyers to build or renovate their dream homes. With its flexible terms, 100% financing, and focus on rural development, it has become a popular choice for those seeking to establish roots in less densely populated areas. While the program has specific requirements and limitations, it continues to empower individuals and families to pursue homeownership, contributing to the growth and vitality of rural communities across the United States.

Can I use a USDA Building Loan for a mobile home or mixed-use property?

+No, the USDA Building Loan is specifically designed for single-family dwellings in rural areas. Mobile homes and mixed-use properties are not eligible for this program.

What are the income limits for the USDA Building Loan program?

+Income limits vary depending on the location and household size. It’s best to consult with a USDA-approved lender to determine your eligibility based on your specific circumstances.

Are there any restrictions on the type of builder or contractor I can use for the construction phase?

+Yes, the builder or contractor must be licensed, insured, and able to provide the necessary documentation, including a construction contract and budget. It’s essential to work with a reputable builder who meets all program requirements.