Payment Management System: Streamline Your Business With Secure Transactions

In today's fast-paced business landscape, efficient payment management is crucial for the success and growth of any enterprise. A robust and secure payment management system not only streamlines financial transactions but also enhances customer satisfaction, improves cash flow, and reduces operational costs. This comprehensive guide delves into the world of payment management, exploring its importance, key components, and the myriad benefits it offers to businesses across industries.

The Evolution of Payment Management: A Historical Perspective

The concept of payment management has evolved significantly over the years, shaping the way businesses handle financial transactions. From the early days of barter systems to the introduction of currency, the journey towards efficient payment management has been a long and transformative one.

The industrial revolution brought about a shift towards more complex payment systems, with the emergence of cheques and the establishment of banking institutions. This period saw the standardization of payment processes, laying the foundation for the modern payment management systems we know today.

The advent of technology in the 20th century revolutionized payment management. The introduction of credit cards, followed by the advent of electronic payment systems, online banking, and mobile payments, has transformed the way businesses handle transactions. These innovations have not only made payments more convenient but have also enhanced security measures, reducing the risk of fraud and ensuring a more seamless experience for both businesses and customers.

Key Components of a Payment Management System

A robust payment management system is built upon several crucial components, each playing a vital role in ensuring smooth and secure transactions. These components work in harmony to facilitate efficient payment processing, from the initial transaction to the final settlement.

Payment Gateways

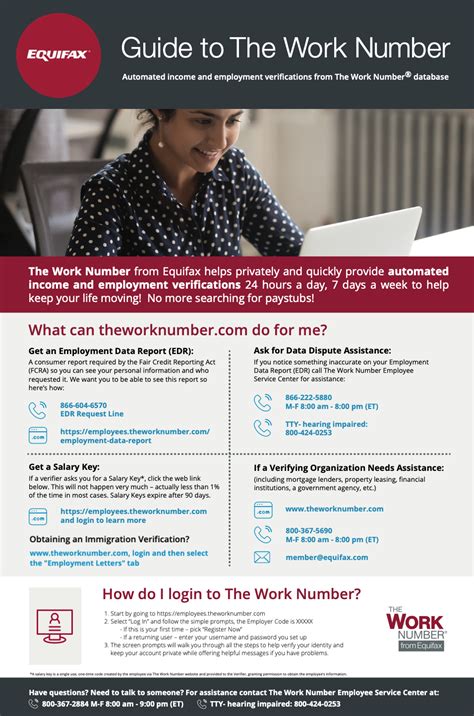

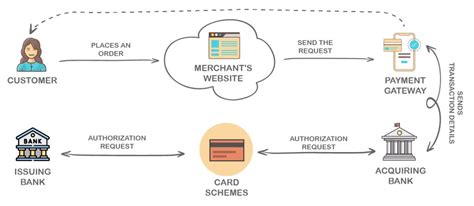

Payment gateways act as the intermediary between the customer’s payment information and the merchant’s bank account. They ensure that the transaction is secure, encrypting sensitive data to prevent unauthorized access. Payment gateways also facilitate the authorization process, verifying the customer’s identity and ensuring that the transaction is legitimate.

Merchant Accounts

A merchant account is a special type of bank account that allows businesses to accept payments, particularly credit and debit card transactions. It serves as a secure holding place for funds until they are transferred to the business’s regular bank account. Merchant accounts are essential for businesses that accept card payments, as they facilitate the smooth processing of transactions and ensure compliance with industry regulations.

Payment Processing

Payment processing is the backbone of any payment management system. It involves the actual transfer of funds from the customer’s account to the merchant’s account. This process is typically automated, with the payment gateway and merchant account working in tandem to ensure a seamless and secure transaction. Payment processing includes several steps, such as authorization, clearing, and settlement, each playing a critical role in the overall transaction process.

Security Measures

Security is a paramount concern in payment management systems. With the increasing prevalence of cyber threats and fraud, businesses must implement robust security measures to protect sensitive customer data and ensure the integrity of transactions. This includes encryption protocols, tokenization, and multi-factor authentication, among other security measures.

Compliance and Regulations

Payment management systems must adhere to a myriad of regulations and compliance standards to ensure the safety and security of transactions. These regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), govern how businesses handle and store sensitive payment information. Compliance with these standards is crucial to avoid legal repercussions and maintain the trust of customers.

Benefits of a Robust Payment Management System

Implementing a well-designed payment management system offers a multitude of benefits to businesses, enhancing their operations and overall success. These benefits extend across various aspects of the business, from improved customer experience to enhanced financial management.

Enhanced Customer Experience

A seamless and secure payment process is crucial for delivering an exceptional customer experience. By implementing a robust payment management system, businesses can offer their customers a wide range of payment options, from traditional credit and debit cards to newer methods like digital wallets and mobile payments. This flexibility not only caters to the diverse preferences of customers but also enhances their overall satisfaction and loyalty.

Improved Cash Flow and Financial Management

Efficient payment management systems can significantly improve a business’s cash flow and financial management. By streamlining the payment process, businesses can reduce the time it takes to receive payments, minimizing the risk of late payments and enhancing overall cash flow. Additionally, with real-time transaction data and advanced reporting capabilities, businesses can gain valuable insights into their financial performance, enabling better decision-making and strategic planning.

Reduced Operational Costs

Automating payment processes through a robust payment management system can lead to significant cost savings for businesses. By reducing the need for manual intervention and minimizing errors, businesses can save on labor costs and improve overall operational efficiency. Additionally, with the ability to process transactions quickly and securely, businesses can reduce the time and resources required for reconciliation and dispute resolution.

Enhanced Security and Fraud Prevention

Security is a top priority for any business, and a robust payment management system plays a critical role in ensuring the safety of sensitive customer data. By implementing advanced security measures, such as encryption, tokenization, and multi-factor authentication, businesses can significantly reduce the risk of fraud and data breaches. This not only protects the business’s reputation but also safeguards the financial well-being of its customers.

Compliance and Regulatory Adherence

Adhering to industry regulations and compliance standards is essential for businesses operating in the payment space. A well-designed payment management system ensures that businesses meet these requirements, minimizing the risk of legal repercussions and potential fines. By implementing robust security measures and following industry best practices, businesses can maintain the trust of their customers and stakeholders.

The Future of Payment Management: Trends and Innovations

The payment management landscape is continually evolving, driven by technological advancements and changing consumer preferences. As businesses strive to stay ahead of the curve, several key trends and innovations are shaping the future of payment management.

Contactless and Mobile Payments

The rise of contactless and mobile payment methods has revolutionized the way people make purchases. With the widespread adoption of smartphones and the increasing use of contactless cards, businesses are embracing these payment methods to cater to the changing preferences of their customers. Contactless and mobile payments offer a fast, convenient, and secure way to make transactions, enhancing the overall customer experience.

Digital Wallets and Payment Apps

Digital wallets and payment apps have gained significant traction in recent years, offering a seamless and secure way to make payments. These platforms allow customers to store their payment information in a secure digital environment, enabling them to make purchases with just a few taps on their smartphones. With the integration of biometric authentication and advanced security measures, digital wallets and payment apps are becoming an increasingly popular choice for consumers.

Real-Time Payments and Instant Settlement

The demand for real-time payments and instant settlement is growing, driven by the need for faster and more efficient transactions. With the advent of technologies like blockchain and distributed ledger systems, businesses are exploring ways to facilitate real-time payments, reducing the time it takes to complete a transaction and improving overall liquidity.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming the payment management landscape, offering advanced capabilities for fraud detection and prevention. By analyzing vast amounts of data and identifying patterns, AI and ML algorithms can detect suspicious activities and potential fraud, helping businesses mitigate risks and protect their customers’ interests.

Biometric Authentication

Biometric authentication, such as fingerprint and facial recognition, is gaining popularity as a secure and convenient way to authenticate payments. By leveraging the unique biological characteristics of individuals, businesses can enhance the security of transactions, reducing the risk of fraud and unauthorized access. Biometric authentication offers a seamless user experience, eliminating the need for complex passwords or PINs.

Conclusion: Embracing the Power of Payment Management

A robust payment management system is no longer a luxury but a necessity for businesses operating in today’s competitive landscape. By streamlining financial transactions, enhancing security measures, and improving the overall customer experience, businesses can stay ahead of the curve and drive their success. With the continuous evolution of payment management, businesses must stay abreast of the latest trends and innovations to remain competitive and meet the evolving needs of their customers.

What are the key benefits of implementing a payment management system for businesses?

+Implementing a payment management system offers several key benefits to businesses, including enhanced customer experience, improved cash flow and financial management, reduced operational costs, and enhanced security and fraud prevention. It also ensures compliance with industry regulations, protecting the business’s reputation and customer trust.

How does a payment management system improve customer experience?

+A payment management system improves customer experience by offering a wide range of payment options, including traditional cards and newer methods like digital wallets and mobile payments. This flexibility caters to diverse customer preferences, enhancing satisfaction and loyalty.

What are some of the security measures implemented in payment management systems?

+Payment management systems implement various security measures, such as encryption protocols, tokenization, and multi-factor authentication, to protect sensitive customer data and ensure the integrity of transactions. These measures help prevent fraud and data breaches, safeguarding the business’s reputation and customer trust.

How do payment management systems contribute to improved cash flow and financial management?

+Payment management systems streamline the payment process, reducing the time it takes to receive payments and minimizing the risk of late payments. This improves cash flow and provides businesses with valuable insights into their financial performance through real-time transaction data and advanced reporting capabilities.

What are some of the key trends and innovations shaping the future of payment management?

+The future of payment management is shaped by trends such as contactless and mobile payments, digital wallets and payment apps, real-time payments and instant settlement, artificial intelligence and machine learning for fraud detection, and biometric authentication for secure transactions.