Okd Navy Credit Card

The Navy Federal Credit Union (NFCU) offers a range of financial services, including the Okd Navy Credit Card, designed specifically for members of the armed forces and their families. This credit card aims to provide military personnel with a convenient and secure way to manage their finances while offering exclusive benefits tailored to their unique needs.

Key Features and Benefits of the Okd Navy Credit Card

The Okd Navy Credit Card boasts a comprehensive set of features that cater to the financial requirements of military personnel. Here's an in-depth look at some of its key attributes:

Competitive Interest Rates

One of the standout advantages of the Okd Navy Credit Card is its low interest rates. NFCU understands the financial challenges faced by service members and offers variable APRs that are often more favorable compared to traditional credit cards. This can significantly reduce the overall cost of carrying a balance, making it a cost-effective option for managing expenses.

| APR Type | Rate |

|---|---|

| Purchase APR | 7.74% - 18.00% |

| Balance Transfer APR | The same as the Purchase APR |

| Cash Advance APR | 18.00% |

No Annual Fee

Unlike many premium credit cards, the Okd Navy Credit Card does not impose an annual fee. This means that cardholders can enjoy the benefits and services of the card without incurring additional costs, making it an attractive option for those seeking long-term financial management tools.

Military-Focused Rewards

NFCU recognizes the sacrifices made by military personnel and their families, which is why the Okd Navy Credit Card offers a unique rewards program tailored to their needs. Cardholders can earn cash back on various military-related purchases, such as military exchanges, commissaries, and even certain travel expenses. These rewards can be redeemed for statement credits, gift cards, or other benefits, providing a tangible way to appreciate the service of our armed forces.

Enhanced Security Features

Security is a top priority for NFCU, especially when it comes to protecting the financial well-being of military members. The Okd Navy Credit Card is equipped with advanced security measures, including chip and PIN technology, to safeguard against fraud and unauthorized transactions. Additionally, cardholders have access to real-time transaction alerts and the ability to monitor their account activity through the NFCU mobile app, ensuring they stay informed and in control of their finances.

Flexible Payment Options

NFCU understands that military life can be unpredictable, which is why the Okd Navy Credit Card offers flexible payment options. Cardholders can choose to make payments online, by phone, or through the NFCU mobile app, ensuring convenience and accessibility regardless of their location or duty status. Furthermore, the card provides automatic payment options, allowing users to set up recurring payments to ensure timely payments and avoid late fees.

Military Discounts and Benefits

As a credit union dedicated to serving the military community, NFCU partners with various organizations and businesses to offer exclusive discounts and benefits to its members. The Okd Navy Credit Cardholders can enjoy special offers on travel, entertainment, and everyday purchases, providing significant savings and added value to their financial management strategy.

Eligibility and Application Process

The Okd Navy Credit Card is exclusively available to active-duty military personnel, veterans, and their families. To be eligible, applicants must meet the following criteria:

- Be a member of the Navy Federal Credit Union.

- Have a valid military ID or proof of military service.

- Meet the creditworthiness requirements set by NFCU.

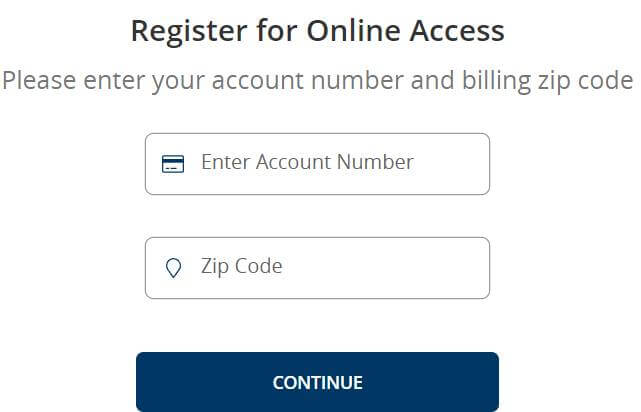

The application process is straightforward and can be completed online or through the NFCU mobile app. Applicants will need to provide personal and financial information, including their social security number, date of birth, and employment details. NFCU will then review the application and make a decision based on the applicant's creditworthiness and eligibility.

Fees and Charges

While the Okd Navy Credit Card boasts many benefits, it's essential to understand the associated fees and charges. Here's an overview:

| Fee | Amount |

|---|---|

| Balance Transfer Fee | 3% of the transferred amount |

| Cash Advance Fee | 3% of the advance amount |

| Foreign Transaction Fee | 1% of each transaction in U.S. dollars |

| Late Payment Fee | Up to $28 |

| Returned Payment Fee | Up to $28 |

Customer Service and Support

NFCU is renowned for its exceptional customer service, offering 24/7 support to its members. Cardholders can reach out to the NFCU team via phone, email, or live chat for assistance with any queries or concerns. Additionally, the NFCU mobile app provides a convenient way to manage the Okd Navy Credit Card account, offering features such as real-time balance checks, transaction history, and the ability to dispute charges.

Comparative Analysis

When compared to other credit cards in the market, the Okd Navy Credit Card stands out for its military-focused benefits and competitive interest rates. While some cards may offer higher rewards rates or more extensive travel benefits, the Okd Navy Credit Card is specifically designed to cater to the unique needs of military personnel and their families. Its combination of low rates, no annual fee, and exclusive military rewards makes it a compelling option for those seeking a credit card that understands and appreciates their service.

Conclusion

The Okd Navy Credit Card from Navy Federal Credit Union is a testament to the credit union's commitment to serving the military community. With its competitive rates, military-focused rewards, and advanced security features, it offers a comprehensive financial management tool tailored to the needs of active-duty military, veterans, and their families. By understanding the unique challenges faced by this community, NFCU has created a credit card that provides both convenience and value, making it a popular choice among those who serve our nation.

Can I use the Okd Navy Credit Card for balance transfers from other cards?

+Yes, the Okd Navy Credit Card allows balance transfers from other credit cards. However, it’s important to note that there is a balance transfer fee of 3% of the transferred amount. It’s a great way to consolidate your debt and potentially save on interest, especially with the card’s low APR.

Are there any additional benefits for active-duty military personnel?

+Absolutely! Active-duty military personnel can enjoy special discounts and benefits through the Okd Navy Credit Card. These include exclusive offers on travel, entertainment, and everyday purchases, providing added value and savings for those who serve our country.

How can I monitor my Okd Navy Credit Card account activity?

+You can monitor your Okd Navy Credit Card account activity through the NFCU mobile app or by logging into your online account. The app provides real-time transaction alerts and allows you to view your balance, transaction history, and make payments conveniently.