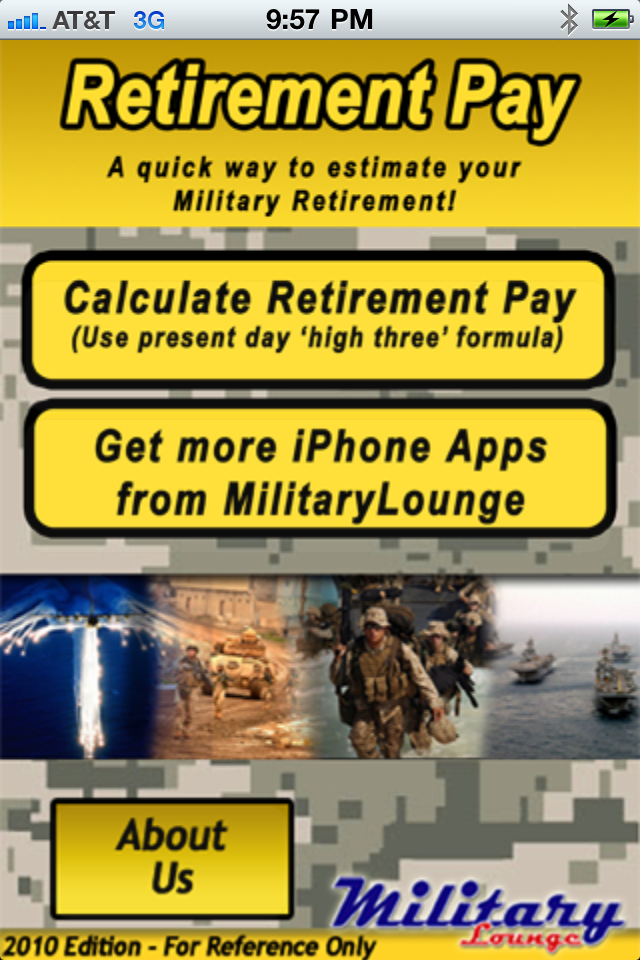

Navy Retirement Calculator

The Navy Retirement Calculator is a valuable tool used by active-duty Navy personnel and veterans to estimate their retirement benefits. It provides an essential service by helping individuals plan for their financial future and make informed decisions about their careers and retirement. This article will delve into the intricacies of the Navy Retirement Calculator, its features, and its significance for those who have served or are currently serving in the United States Navy.

Understanding the Navy Retirement System

The United States Navy offers a comprehensive retirement system to its service members, providing them with financial security upon their retirement from active duty. The retirement benefits are calculated based on various factors, including the member’s years of service, pay grade, and retirement plan type. Understanding the Navy’s retirement system is crucial for anyone looking to plan their financial future accurately.

Retirement Eligibility

To be eligible for retirement benefits, Navy personnel must meet specific criteria. Typically, individuals must serve for a minimum of 20 years of active duty and reach a specific age, which can vary depending on their retirement plan. The two primary retirement plans offered by the Navy are the High-36 and the Final Pay plans.

High-36 Retirement Plan

The High-36 retirement plan is one of the most common options for Navy retirees. Under this plan, the retirement pay is calculated based on the highest 36 months of base pay during the member’s career. This plan ensures that individuals receive a retirement income based on their highest-earning years, providing a stable and predictable financial future.

| Plan | Calculation |

|---|---|

| High-36 | Highest 36 months of base pay |

Final Pay Retirement Plan

The Final Pay retirement plan, on the other hand, calculates retirement pay based on the member’s final base pay before retirement. This plan is often chosen by those who have served for an extended period and expect their pay grade to remain stable or increase before retirement. It provides a straightforward and predictable retirement income calculation.

| Plan | Calculation |

|---|---|

| Final Pay | Final base pay before retirement |

The Navy Retirement Calculator: A Powerful Tool

The Navy Retirement Calculator is an online tool designed to assist Navy personnel in estimating their retirement benefits accurately. It takes into account various factors, such as the member’s pay grade, years of service, retirement plan, and other relevant variables, to provide a detailed estimate of their future retirement income.

Key Features of the Navy Retirement Calculator

- Easy-to-Use Interface: The calculator boasts a user-friendly interface, making it accessible to individuals with varying levels of technical expertise. Users can input their personal details and receive an instant estimate of their retirement benefits.

- Accurate Calculations: Utilizing the latest algorithms and data, the Navy Retirement Calculator ensures precise calculations, providing individuals with reliable estimates of their future retirement income.

- Customizable Inputs: Users can input their specific details, such as their current pay grade, years of service, and retirement plan, to receive a personalized estimate. This feature allows for a more accurate representation of their unique situation.

- Retirement Plan Comparison: The calculator offers a side-by-side comparison of the High-36 and Final Pay retirement plans, allowing individuals to understand the potential differences in their retirement income based on their chosen plan.

- Benefit Projections: In addition to retirement pay, the calculator provides estimates for other benefits, such as healthcare coverage, commissary privileges, and base access, giving users a comprehensive overview of their post-retirement benefits.

Benefits of Using the Navy Retirement Calculator

The Navy Retirement Calculator offers several advantages to active-duty personnel and veterans alike. By utilizing this tool, individuals can:

- Gain a clear understanding of their retirement income and plan their financial future accordingly.

- Make informed decisions about their retirement plan, considering the potential impact on their retirement benefits.

- Compare the High-36 and Final Pay plans to determine which option aligns best with their financial goals.

- Identify any potential gaps in their retirement income and take appropriate measures to bridge them.

- Educate themselves about the various retirement benefits offered by the Navy, ensuring they maximize their eligibility.

How to Use the Navy Retirement Calculator

Using the Navy Retirement Calculator is a straightforward process. Here’s a step-by-step guide to help you navigate the tool effectively:

- Access the Calculator: Visit the official Navy Retirement Calculator website or locate the tool through reputable Navy-related resources.

- Select Your Retirement Plan: Choose between the High-36 and Final Pay retirement plans based on your eligibility and preferences.

- Input Your Details: Provide accurate information about your current pay grade, years of service, and any other relevant details requested by the calculator.

- Review the Results: Once you've submitted your information, the calculator will generate an estimate of your retirement pay and other benefits. Review the results carefully to understand your potential retirement income.

- Compare and Analyze: If you're eligible for both retirement plans, compare the estimates side by side to determine which plan offers the most favorable outcome for your financial goals.

- Seek Professional Advice: While the calculator provides valuable estimates, it's essential to consult with financial advisors or retirement specialists to create a comprehensive retirement plan tailored to your needs.

Factors Affecting Navy Retirement Benefits

The Navy Retirement Calculator takes into account several factors that can impact an individual’s retirement benefits. Understanding these factors is crucial for accurate retirement planning.

Years of Service

The number of years served in the Navy is a significant factor in retirement benefit calculations. Generally, the longer an individual serves, the higher their retirement pay will be. The Navy Retirement Calculator considers the member’s years of service to provide an accurate estimate of their retirement income.

Pay Grade

An individual’s pay grade, which is determined by their rank and position within the Navy, also plays a vital role in retirement benefit calculations. Higher pay grades typically result in higher retirement pay, as they reflect the individual’s responsibility and experience within the organization.

Retirement Plan

As mentioned earlier, the choice of retirement plan can significantly impact an individual’s retirement income. The High-36 and Final Pay plans offer different calculation methods, and individuals must carefully consider which plan aligns best with their financial goals and circumstances.

Other Factors

In addition to the above factors, other variables can influence retirement benefits, such as:

- Bonuses and special pays received during service.

- Cost-of-living adjustments (COLAs) applied to retirement pay.

- Any additional benefits or allowances, such as housing or subsistence allowances.

- Tax implications and deductions applicable to retirement income.

Planning for Retirement: A Comprehensive Approach

While the Navy Retirement Calculator provides a valuable estimate of retirement benefits, it’s essential to adopt a holistic approach to retirement planning. Here are some additional considerations to ensure a secure and comfortable retirement:

Diversify Your Retirement Portfolio

Relying solely on Navy retirement benefits may not provide sufficient financial security for the long term. Diversifying your retirement portfolio by investing in other retirement plans, such as IRAs or 401(k)s, can help mitigate risks and provide a more stable financial future.

Seek Professional Financial Advice

Consulting with financial advisors or retirement specialists is crucial to developing a comprehensive retirement plan. These professionals can offer personalized advice based on your unique circumstances, helping you maximize your retirement benefits and achieve your financial goals.

Understand Tax Implications

Retirement income is subject to taxation, and understanding the tax implications is essential for accurate financial planning. Consult with tax professionals to ensure you’re aware of any deductions, credits, or exemptions that may apply to your retirement income.

Explore Additional Benefits

The Navy offers a range of benefits beyond retirement pay, such as healthcare coverage, housing allowances, and education benefits. Explore these additional benefits to understand how they can enhance your overall retirement package and provide financial stability.

Conclusion: Empowering Navy Personnel

The Navy Retirement Calculator is a powerful tool that empowers Navy personnel to take control of their financial future. By utilizing this calculator, individuals can make informed decisions about their retirement plans, maximize their retirement benefits, and plan for a secure and comfortable retirement. Remember, retirement planning is an ongoing process, and staying informed about your options is crucial for a successful transition to retirement.

What if I haven’t served for 20 years yet?

+If you haven’t completed 20 years of service, you may still be eligible for retirement benefits under certain circumstances, such as medical retirement or early retirement due to service-related disabilities. Consult with a military retirement specialist to understand your options and eligibility.

Can I change my retirement plan after using the calculator?

+Yes, you can change your retirement plan at specific intervals during your career. However, it’s essential to consult with a retirement specialist to understand the implications and ensure you make an informed decision.

Are there any disadvantages to using the Navy Retirement Calculator?

+While the Navy Retirement Calculator is a valuable tool, it’s important to remember that it provides estimates based on the information you input. It’s always recommended to consult with financial advisors and retirement specialists for a comprehensive understanding of your retirement benefits and options.