Navy Federal St Marys Ga

Navy Federal Credit Union (NFCU) is a prominent financial institution in the United States, offering a wide range of banking and financial services to military personnel, veterans, and their families. This credit union has a significant presence across the country, including in the state of Georgia. Today, we delve into the specific location of Navy Federal in St. Marys, Georgia, exploring its services, impact on the local community, and the unique aspects that make it an essential financial hub for military-affiliated individuals in the area.

A Financial Haven for Military Families in St. Marys, GA

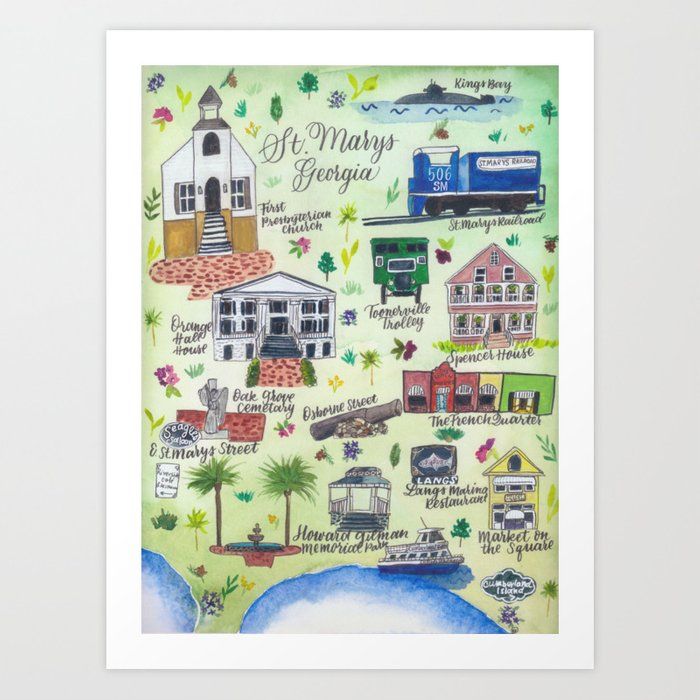

St. Marys, a charming coastal city in Camden County, Georgia, is home to a vibrant community with a strong military presence. Navy Federal Credit Union’s branch in this region is more than just a financial institution; it’s a vital resource for the military families who call St. Marys home. With a rich history dating back to 1933, NFCU has established itself as a trusted partner for those serving or having served in the military, providing tailored financial solutions and a sense of community.

Comprehensive Financial Services

The Navy Federal St. Marys branch offers a comprehensive suite of financial services designed to meet the unique needs of military personnel and their families. This includes a wide range of checking and savings accounts, with options tailored to different life stages and financial goals. For instance, the Active Duty Checking account offers fee waivers and unique benefits for those currently serving, while the Hero Checking account caters to veterans and their families, providing a seamless transition from active duty to civilian life.

In addition to these tailored checking accounts, Navy Federal also provides a diverse array of savings options. The Money Market Account offers competitive interest rates and flexible access, making it an ideal choice for those looking to grow their savings while maintaining liquidity. Furthermore, the Certificate Accounts provide fixed rates and terms, allowing members to lock in higher interest rates for a set period, perfect for those with a longer-term savings goal.

Lending Solutions for Military Families

Navy Federal understands the diverse financial needs of military families, especially when it comes to lending. The credit union offers a comprehensive lending suite, including mortgage loans, auto loans, personal loans, and credit cards. These lending options are designed with military life in mind, offering flexible terms, competitive rates, and tailored benefits.

For instance, the VA Loan program, backed by the U.S. Department of Veterans Affairs, provides eligible veterans and active-duty service members with a path to homeownership, often with little to no down payment required. Additionally, Navy Federal's Military Auto Advantage Program offers exclusive savings on new and used vehicles, providing a seamless and cost-effective way for military families to upgrade their rides.

| Lending Product | Key Benefits |

|---|---|

| VA Loans | Low or no down payment, competitive rates, and flexible terms for eligible veterans and active-duty service members. |

| Military Auto Advantage Program | Exclusive savings on new and used vehicles, with a simple and efficient application process. |

| Personal Loans | Flexible loan amounts and terms, with the option to use the loan for any purpose, from debt consolidation to home improvements. |

Community Engagement and Support

Navy Federal’s commitment to the military community extends beyond financial services. The St. Marys branch actively engages with the local community, supporting various initiatives and organizations that align with the values and needs of military families. This includes partnerships with local charities, sponsorship of community events, and participation in volunteer programs.

For instance, Navy Federal has been a long-time supporter of the Wounded Warrior Project, an organization dedicated to aiding wounded veterans and their families. Through financial contributions and employee volunteerism, the credit union plays a vital role in helping these heroes transition back into civilian life. Additionally, the branch often hosts financial literacy workshops and seminars, empowering military families with the knowledge and tools to make informed financial decisions.

A Digital-First Approach with Personalized Service

While Navy Federal is known for its extensive branch network, including the St. Marys location, the credit union also embraces a digital-first approach, ensuring members have access to their financial services anytime, anywhere. The NFCU Mobile App and online banking platform provide a seamless and secure way to manage accounts, transfer funds, and stay on top of financial goals.

However, despite the focus on digital convenience, Navy Federal understands the importance of personalized service, especially for those with complex financial needs. The St. Marys branch is staffed with knowledgeable and friendly financial experts who are dedicated to providing tailored advice and support. Whether it's navigating the complexities of military pay or planning for a secure financial future, these professionals are a valuable resource for military families.

Future Outlook and Expansion

As the military community in St. Marys continues to grow, Navy Federal is well-positioned to meet the evolving financial needs of its members. With a strong foundation of trust and a commitment to innovation, the credit union is likely to expand its services and offerings to stay ahead of the curve. This could include enhanced digital capabilities, further tailored financial products, and an increased focus on community engagement and support.

Furthermore, as the financial landscape evolves, Navy Federal is likely to explore new partnerships and collaborations, both locally and nationally, to provide its members with access to a broader range of financial services and resources. This proactive approach ensures that the credit union remains a trusted and relevant financial partner for military families, not just in St. Marys, but across the country.

What are the operating hours of the Navy Federal St. Marys branch?

+The Navy Federal St. Marys branch is typically open from 9:00 a.m. to 5:00 p.m., Monday through Friday. However, it’s always best to check the official website or contact the branch directly for the most up-to-date information, especially during holiday periods or for any temporary changes in operating hours.

Does Navy Federal offer special rates or benefits for active-duty military personnel?

+Yes, Navy Federal is dedicated to supporting active-duty military personnel with a range of special rates and benefits. This includes fee waivers on certain accounts, exclusive loan programs like the VA Loan, and discounted rates on auto loans through the Military Auto Advantage Program. These benefits are designed to ease the financial burden for those serving our country.

How can I become a member of Navy Federal Credit Union?

+Membership in Navy Federal Credit Union is open to active-duty military, veterans, DoD civilians, and their families. To become a member, you’ll need to meet the eligibility criteria and open an account with a minimum deposit. You can join online, by phone, or in person at any Navy Federal branch, including the St. Marys location.