Navy Federal Scams

Navy Federal Credit Union, one of the largest credit unions in the United States, is a trusted financial institution that serves the military community and their families. However, like any other financial entity, it is not immune to fraudulent activities and scams. Scammers often target credit unions and their members, exploiting vulnerabilities and the trust placed in these institutions. Navy Federal Credit Union actively works to protect its members from such scams, but it is essential for members to be vigilant and aware of the various scams that exist.

Common Navy Federal Scams and How They Work

Scammers employ various tactics to deceive and defraud Navy Federal members. Understanding these scams is crucial for members to protect their financial well-being. Here are some of the most common Navy Federal scams and how they operate:

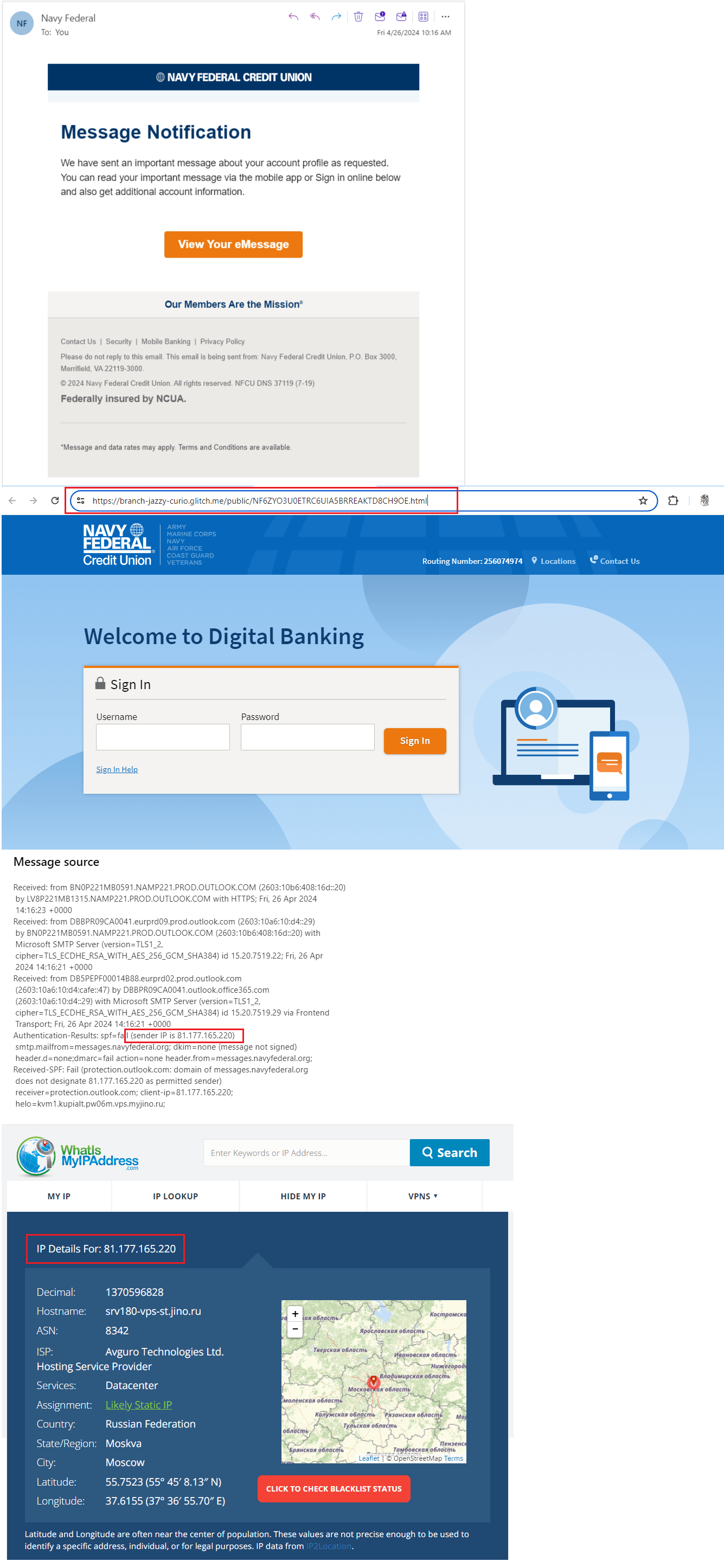

Phishing Scams

Phishing is a prevalent scam technique where fraudsters send fake emails, text messages, or even make phone calls pretending to be from Navy Federal. These messages often appear legitimate and may include official-looking logos and language. The goal is to trick the recipient into providing sensitive information such as account details, passwords, or Social Security numbers.

For instance, a phishing email might claim that there is an issue with the recipient's account and prompt them to click on a link to "verify" their information. This link leads to a fake website designed to mimic Navy Federal's actual site, where the scammer can collect the victim's data.

Impersonation Scams

Scammers may impersonate Navy Federal representatives or even members' friends or family members. They often use social engineering tactics to gain the trust of their victims. For example, a scammer might call a member, claiming to be a Navy Federal employee, and inform them of a "suspicious activity" on their account. They might then ask for the member's login credentials or other personal information to "verify" the account.

Fake Loan or Investment Opportunities

Scammers sometimes create fake loan or investment schemes, claiming to offer attractive interest rates or high returns. These scams often target members in need of financial assistance or those looking for investment opportunities. The scammer might request an upfront fee or personal information as part of the "application process."

In one instance, a Navy Federal member received a call from a scammer posing as a loan officer. The scammer offered a low-interest loan but required the member to pay an "application fee" and provide their bank account details. Fortunately, the member recognized the signs of a scam and reported it to Navy Federal.

Fake Check Scams

Scammers may send fake checks to Navy Federal members, claiming they are prizes, refunds, or overpayments. They might instruct the recipient to deposit the check and then wire a portion of the funds back, keeping the rest as a "reward." However, the check is often counterfeit, and the member is left responsible for the full amount.

Identity Theft

Identity theft is a serious concern, and scammers often use various methods to steal personal information. This can include accessing members' online accounts, intercepting mail, or even hacking into unsecured Wi-Fi networks. With stolen identity information, scammers can open new accounts, make unauthorized transactions, or even commit crimes in the victim's name.

Navy Federal's Efforts to Combat Scams

Navy Federal Credit Union recognizes the importance of protecting its members from scams and has implemented several measures to combat fraudulent activities. These efforts aim to create a secure environment for members and prevent financial losses.

Advanced Security Measures

Navy Federal employs advanced security technologies to safeguard members' accounts and personal information. This includes encryption protocols, multi-factor authentication, and real-time fraud monitoring systems. These measures help detect and prevent unauthorized access to member accounts.

For example, Navy Federal's mobile app utilizes biometric authentication, such as fingerprint or facial recognition, to ensure that only authorized individuals can access the app and perform transactions.

Educational Resources and Awareness Campaigns

Navy Federal actively educates its members about the various scams and fraud techniques through online resources, newsletters, and awareness campaigns. They provide tips on how to identify and avoid scams, as well as steps to take if a member suspects they have fallen victim to a scam.

One of their awareness campaigns, "Stay Safe Online," offers members practical advice on securing their online presence, including creating strong passwords, recognizing phishing attempts, and reporting suspicious activities.

Fraud Detection and Response

Navy Federal has a dedicated fraud detection team that continuously monitors member accounts for any suspicious activities. They employ advanced analytics and machine learning algorithms to identify potential fraud patterns and take prompt action to protect members' finances.

In the event of suspected fraud, Navy Federal's response team works swiftly to freeze compromised accounts, investigate the incident, and assist members in recovering from the scam. They also collaborate with law enforcement agencies to track down and prosecute the perpetrators.

Secure Online Banking Platform

Navy Federal's online banking platform is designed with security as a top priority. The website and mobile app incorporate the latest security protocols to ensure that members' data is protected during transactions. This includes secure socket layer (SSL) encryption, which safeguards sensitive information during transmission.

Additionally, Navy Federal provides members with the option to set up transaction alerts, which notify them via email or text message whenever a transaction occurs on their account. This allows members to quickly identify any unauthorized activities.

Protecting Yourself from Navy Federal Scams

While Navy Federal works diligently to prevent scams, it is essential for members to take proactive measures to protect themselves. Here are some steps you can take to minimize the risk of falling victim to Navy Federal scams:

Stay Informed

Keep yourself updated on the latest scam techniques and fraud trends. Navy Federal's website and social media channels often share valuable information and resources to help members stay informed. Subscribe to their newsletters and follow their official accounts to receive timely updates.

Be Wary of Unsolicited Communication

Scammers often initiate contact through unsolicited emails, text messages, or phone calls. If you receive an unexpected communication claiming to be from Navy Federal, be cautious. Legitimate financial institutions rarely reach out unsolicited, especially to request personal information.

If you have any doubts, contact Navy Federal directly using the official contact information on their website. Never provide sensitive information to unsolicited sources.

Verify Website and Email Addresses

Always verify the authenticity of the website or email address before entering any personal or financial information. Navy Federal's official website URL should start with "https" and have a padlock icon in the address bar, indicating a secure connection. Be cautious of emails with spelling errors or suspicious domain names.

Use Strong Passwords and Enable Multi-Factor Authentication

Create strong, unique passwords for your Navy Federal accounts and other online services. Avoid using easily guessable information like your name, birthdate, or common phrases. Additionally, enable multi-factor authentication (MFA) whenever possible. MFA adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone.

Regularly Monitor Your Accounts

Regularly review your Navy Federal account statements and transaction history. Look for any unauthorized or suspicious activities. If you notice any discrepancies, report them to Navy Federal immediately. Prompt action can help minimize potential losses and prevent further fraud.

Protect Your Personal Information

Be cautious about sharing personal information, especially online. Avoid posting sensitive details like your address, phone number, or Social Security number on public platforms. Scammers can use this information to impersonate you or commit identity theft.

Report Suspected Scams

If you come across any suspicious activity or believe you have been a victim of a scam, report it to Navy Federal right away. They have dedicated fraud reporting channels, and their team will assist you in resolving the issue and preventing further damage.

Real-Life Navy Federal Scam Cases

Navy Federal Credit Union has encountered various real-life scam cases, and sharing these stories can help raise awareness and prevent future incidents. Here are a few examples of Navy Federal scams that have occurred:

Fake Job Scam

In one instance, a Navy Federal member received an email claiming to be from the credit union's human resources department. The email offered a job opportunity and requested the member's personal information, including their Social Security number and bank account details. The member, fortunately, recognized the signs of a scam and reported it to Navy Federal. The credit union's security team investigated the incident and took steps to prevent similar scams in the future.

Phishing Attack on Mobile App

Scammers created a fake mobile app that closely resembled the official Navy Federal app. The fake app was designed to steal login credentials and personal information from unsuspecting users. Navy Federal quickly identified the scam and issued a warning to its members, urging them to only use the official app and to report any suspicious activity.

Identity Theft through Data Breach

In a rare occurrence, Navy Federal experienced a data breach where an unauthorized individual gained access to a limited number of members' personal information. The credit union promptly notified the affected members and offered credit monitoring services to help protect their identities. They also implemented additional security measures to prevent similar breaches in the future.

Frequently Asked Questions

How can I report a suspected Navy Federal scam?

+If you suspect that you have encountered a Navy Federal scam, it is crucial to report it immediately. Navy Federal has dedicated fraud reporting channels. You can contact their fraud department through their official website or by calling their customer service hotline. Provide as much detail as possible about the incident, including any communication or suspicious activities you experienced. Navy Federal's fraud team will investigate the matter and take appropriate action to protect your accounts and personal information.

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I accidentally shared my personal information with a scammer?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you realize that you have shared sensitive information with a potential scammer, it is essential to act quickly. Contact Navy Federal's fraud department immediately and inform them about the incident. They will guide you through the necessary steps to secure your accounts and minimize potential risks. Additionally, consider monitoring your credit reports and placing a fraud alert to protect your identity.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I recognize fake Navy Federal websites or apps?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Fake Navy Federal websites or apps often have subtle differences from the official ones. Pay attention to the URL; ensure it starts with "https" and has the correct domain name. Look for official logos and verify that the website or app has proper security certificates. Be cautious of any website or app that requests excessive personal information or has poor design and grammar. If in doubt, navigate directly to Navy Federal's official website or use their official mobile app.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What steps does Navy Federal take to secure my online banking experience?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal employs various security measures to protect your online banking experience. These include encryption protocols, multi-factor authentication, and advanced fraud detection systems. They continuously monitor for suspicious activities and take immediate action to prevent fraud. Additionally, Navy Federal provides educational resources to help members stay informed about online security best practices.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I recover my losses if I fall victim to a Navy Federal scam?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Recovering losses from a Navy Federal scam depends on the specific circumstances and the type of scam involved. In some cases, Navy Federal may be able to reimburse you for fraudulent transactions, especially if you promptly report the incident and cooperate with their fraud investigation. However, it is essential to act quickly and follow the credit union's guidelines for reporting and resolving fraud. The sooner you report the scam, the better the chances of recovering your losses.</p>

</div>

</div>

</div>

By staying informed, vigilant, and proactive, Navy Federal members can significantly reduce the risk of falling victim to scams. Remember, if something seems too good to be true or raises any red flags, it is always best to err on the side of caution and report it to Navy Federal’s fraud team.