Navy Federal Overdraft Fee Lawsuit

The Navy Federal Overdraft Fee Lawsuit refers to a class-action lawsuit filed against Navy Federal Credit Union, one of the largest credit unions in the United States, for allegedly charging excessive and unfair overdraft fees to its members. The lawsuit, initiated by a group of credit union members, brought attention to the practices surrounding overdraft fees and sought compensation for those affected.

Background and Allegations

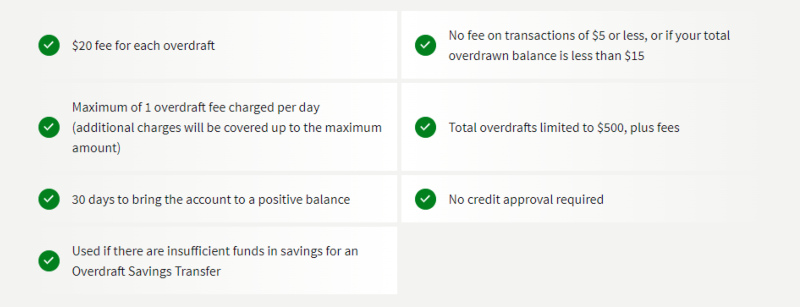

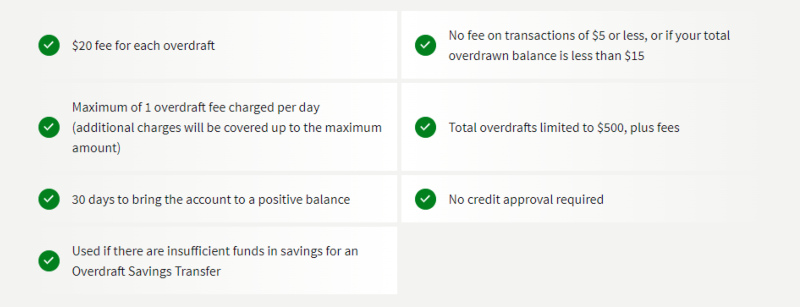

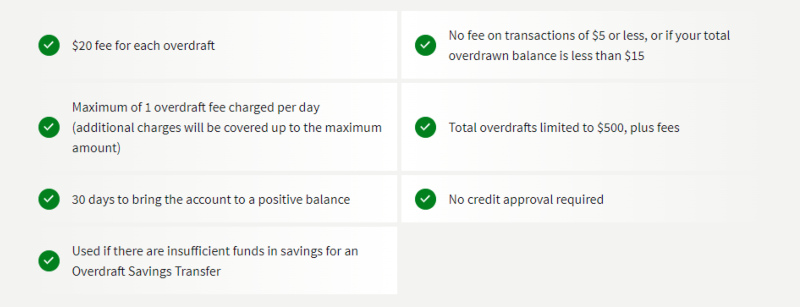

The lawsuit, which gained traction in the early 2020s, accused Navy Federal Credit Union of engaging in deceptive and unfair practices related to overdraft fees. The plaintiffs argued that the credit union manipulated the order of transactions, a practice known as “reordering,” to maximize the number of overdraft fees charged to account holders.

Specifically, the lawsuit alleged that Navy Federal reordered transactions from largest to smallest, which resulted in multiple overdraft fees being charged on a single day. This practice, according to the plaintiffs, was not transparent and violated the credit union's duty to act in the best interest of its members.

The Impact of Reordering

The reordering of transactions had a significant financial impact on credit union members. When a member’s account had insufficient funds to cover all transactions in a day, the credit union would typically charge an overdraft fee for each transaction that overdrew the account. By reordering transactions from largest to smallest, Navy Federal ensured that multiple overdraft fees were incurred, often totaling several hundred dollars in a single day.

This practice was particularly detrimental to low-income individuals and those who relied on their accounts for daily expenses. The excessive fees could quickly drain their accounts, leading to further financial strain and potential long-term consequences.

Legal Proceedings and Settlements

The Navy Federal Overdraft Fee Lawsuit garnered significant attention from the media and the financial industry. The plaintiffs sought class-action status, which, if granted, would have allowed a large number of credit union members to join the lawsuit and potentially receive compensation.

The legal proceedings involved complex financial analysis and expert testimony to establish the credit union's alleged wrongdoing. The plaintiffs argued that Navy Federal's practices violated various consumer protection laws and regulations, including the Electronic Fund Transfer Act (EFTA) and the Credit Union Membership Access Act (CUMAA).

Settlement Agreement

After several years of legal battles, Navy Federal Credit Union reached a settlement agreement with the plaintiffs in 2023. The settlement, valued at $100 million, was one of the largest overdraft fee settlements in history. The credit union agreed to reimburse affected members for overdraft fees incurred due to the reordering practice and make changes to its overdraft policies to ensure transparency and fairness.

The settlement provided relief to thousands of credit union members who had been charged excessive overdraft fees. It also served as a precedent for other financial institutions, highlighting the importance of fair and transparent practices when it comes to overdraft fees.

Reforming Overdraft Fee Practices

The Navy Federal Overdraft Fee Lawsuit and subsequent settlement brought much-needed attention to the issue of overdraft fees and their potential impact on consumers. It prompted a wider discussion about the need for regulatory reform and consumer protection in the financial industry.

Industry Responses

In response to the lawsuit and growing public scrutiny, many financial institutions, including credit unions and banks, began reevaluating their overdraft fee practices. Some institutions implemented changes such as eliminating overdraft fees altogether, while others introduced more transparent and customer-friendly policies, such as opt-in programs and lower fee structures.

The Consumer Financial Protection Bureau (CFPB) also took action, proposing new rules to enhance consumer protections related to overdraft fees. These proposed rules aimed to increase transparency, provide consumers with more control over their accounts, and limit the number of overdraft fees that can be charged in a given period.

Implications and Consumer Advocacy

The Navy Federal Overdraft Fee Lawsuit and its settlement had far-reaching implications for the financial industry and consumer rights. It demonstrated the power of class-action lawsuits in holding financial institutions accountable for unfair practices and protecting consumers from excessive fees.

Empowering Consumers

The lawsuit served as a catalyst for increased consumer advocacy and awareness regarding overdraft fees. It encouraged individuals to question the practices of their financial institutions and seek alternatives that align with their financial goals and values. Many consumers began exploring options such as overdraft protection programs, direct deposit, and budgeting tools to avoid costly overdraft fees.

Additionally, the lawsuit prompted a broader discussion about the role of credit unions and their commitment to serving their members. Credit unions, known for their not-for-profit status and member-centric approach, faced scrutiny over their practices, leading to a renewed focus on transparency and member satisfaction.

Conclusion

The Navy Federal Overdraft Fee Lawsuit was a significant milestone in the fight for consumer rights and financial transparency. It highlighted the potential for legal action to bring about positive change in the financial industry and protect consumers from excessive and unfair fees. The settlement not only provided relief to affected credit union members but also served as a wake-up call for financial institutions to prioritize fairness and transparency in their practices.

💡 The impact of the Navy Federal Overdraft Fee Lawsuit extended beyond the settlement, influencing regulatory reforms and shaping the way financial institutions approach overdraft fees. It underscores the importance of consumer advocacy and the role of legal action in holding financial institutions accountable for their practices.

What are the key takeaways from the Navy Federal Overdraft Fee Lawsuit?

+The lawsuit demonstrated the power of class-action lawsuits in holding financial institutions accountable and protecting consumers. It also highlighted the need for regulatory reforms and increased transparency in overdraft fee practices. The settlement provided a significant financial relief to affected credit union members.

How can consumers protect themselves from excessive overdraft fees?

+Consumers can protect themselves by being aware of their financial institution’s overdraft fee policies, opting out of overdraft protection programs if they prefer, and exploring alternative options such as direct deposit and budgeting tools. It’s essential to understand the terms and conditions of one’s account to avoid unexpected fees.

What changes did Navy Federal Credit Union implement after the lawsuit?

+Navy Federal Credit Union agreed to reimburse affected members for overdraft fees incurred due to the reordering practice. They also committed to implementing more transparent overdraft policies and procedures to ensure fairness and prevent similar issues in the future.