Navy Federal Overdraft: Avoid Fees & Protect Your Finances

Navy Federal Credit Union (NFCU) offers a range of financial services, including checking accounts with overdraft protection, to serve the unique needs of military personnel, their families, and eligible civilians. The Navy Federal Overdraft Protection feature is designed to help members avoid the high fees associated with overdrafts and protect their financial well-being. This comprehensive guide explores the features, benefits, and strategies to maximize the advantages of this protection while minimizing potential risks.

Understanding Navy Federal Overdraft Protection

Navy Federal Overdraft Protection is an optional service that acts as a safety net for members’ checking accounts. When enrolled, this feature transfers funds from a linked savings account or credit line to cover transactions that would otherwise result in an overdraft. This automatic transfer helps prevent the account from going into a negative balance, which can trigger expensive overdraft fees.

Key Features of Navy Federal Overdraft Protection

- Automatic Transfer: Funds are seamlessly transferred from the linked account to cover overdrafts, ensuring a smooth and uninterrupted transaction process.

- Multiple Linked Accounts: Members can link multiple savings accounts or credit lines to their checking account for overdraft protection, providing flexibility and control over their finances.

- Customizable Settings: The service allows for personalized settings, enabling members to choose the order of funds transfer and set transfer limits based on their preferences and financial goals.

Benefits of Navy Federal Overdraft Protection

The overdraft protection service offers several advantages to Navy Federal members, including:

- Fee Avoidance: By transferring funds to cover overdrafts, members can avoid costly overdraft fees, which can quickly accumulate and strain their finances.

- Financial Control: With the ability to link multiple accounts and customize transfer settings, members gain greater control over their finances and can manage their cash flow more effectively.

- Peace of Mind: Knowing that their transactions are covered in the event of an overdraft provides members with peace of mind, reducing the stress and anxiety associated with unexpected financial situations.

How to Maximize the Benefits of Navy Federal Overdraft Protection

To fully leverage the advantages of Navy Federal Overdraft Protection, members should consider the following strategies:

Monitor Account Activity

Regularly reviewing account activity is crucial to staying on top of transactions and understanding cash flow. By monitoring incoming and outgoing funds, members can identify potential overdraft situations and take proactive measures to avoid them.

Set Up Alerts

Navy Federal offers alert services that can notify members via text, email, or push notifications when their account balance falls below a certain threshold. These alerts can help members stay informed and take immediate action to prevent overdrafts.

Maintain Sufficient Funds

While overdraft protection provides a safety net, it is essential to maintain sufficient funds in the linked accounts to cover potential overdrafts. Regularly reviewing and adjusting account balances ensures that members have adequate funds available when needed.

Consider a Line of Credit

In addition to linking savings accounts, members can also link a Navy Federal Line of Credit to their checking account for overdraft protection. This option provides a larger pool of funds to cover overdrafts and can be particularly beneficial for members with irregular or unpredictable income.

Potential Risks and Mitigation Strategies

While Navy Federal Overdraft Protection offers significant advantages, there are potential risks and considerations that members should be aware of:

Fees and Interest

While overdraft protection helps avoid overdraft fees, it is important to note that there may be fees associated with the linked accounts or credit lines. Members should review the fee schedules and interest rates of their linked accounts to understand any potential costs.

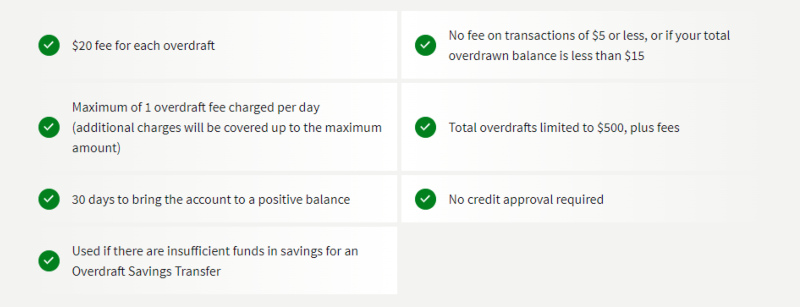

Overdraft Limits

Navy Federal sets limits on the amount that can be transferred from linked accounts to cover overdrafts. Members should be aware of these limits and ensure that their linked accounts have sufficient funds to cover potential overdrafts within these limits.

Responsible Financial Management

While overdraft protection provides a safety net, it is not a substitute for responsible financial management. Members should continue to budget, track expenses, and maintain a healthy financial outlook to avoid frequent overdraft situations.

Comparing Navy Federal Overdraft Protection to Other Options

Navy Federal’s Overdraft Protection service offers several advantages over traditional overdraft coverage options, such as standard overdraft coverage or third-party overdraft protection services. Here’s a comparison:

Standard Overdraft Coverage

- Pros: Standard overdraft coverage is often included with checking accounts and may provide coverage for a wider range of transactions.

- Cons: It can result in high fees and may not offer the same level of control and customization as Navy Federal’s Overdraft Protection.

Third-Party Overdraft Protection Services

- Pros: These services may offer additional features, such as budget tracking and expense management tools.

- Cons: They often come with monthly fees and may not provide the same level of integration with Navy Federal accounts as the credit union’s own Overdraft Protection service.

Frequently Asked Questions (FAQ)

What happens if my linked account doesn’t have sufficient funds to cover an overdraft?

+If the linked account doesn’t have enough funds to cover the overdraft, the transaction may be declined, and you may be charged a non-sufficient funds (NSF) fee. It’s important to monitor your account balances and ensure sufficient funds are available to avoid this situation.

<div class="faq-item">

<div class="faq-question">

<h3>Can I choose which account is used first for overdraft protection?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Navy Federal allows you to prioritize the order in which your linked accounts are used for overdraft protection. You can set this preference through online banking or by contacting customer service.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any fees associated with Navy Federal Overdraft Protection?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal Overdraft Protection itself does not have any fees. However, there may be fees associated with the linked accounts or credit lines, such as maintenance fees or interest charges. It's important to review the fee schedules of your linked accounts to understand any potential costs.</p>

</div>

</div>

Navy Federal Overdraft Protection is a valuable tool for members to manage their finances and avoid the financial strain of overdraft fees. By understanding the features, benefits, and potential risks, members can make informed decisions to protect their financial well-being and take control of their financial future.