Navy Federal Credit Union Location

Navy Federal Credit Union, often referred to as NFCU, is a prominent financial institution in the United States, specifically catering to military personnel, veterans, and their families. With a rich history dating back to 1933, Navy Federal has grown into one of the largest credit unions in the country, offering a wide range of financial services and products. As of my last update in January 2023, Navy Federal Credit Union operated an extensive network of physical branches and ATMs across the United States, providing convenient access to its members. Let's explore the details of Navy Federal's physical presence and its impact on the financial landscape.

The Extensive Branch Network

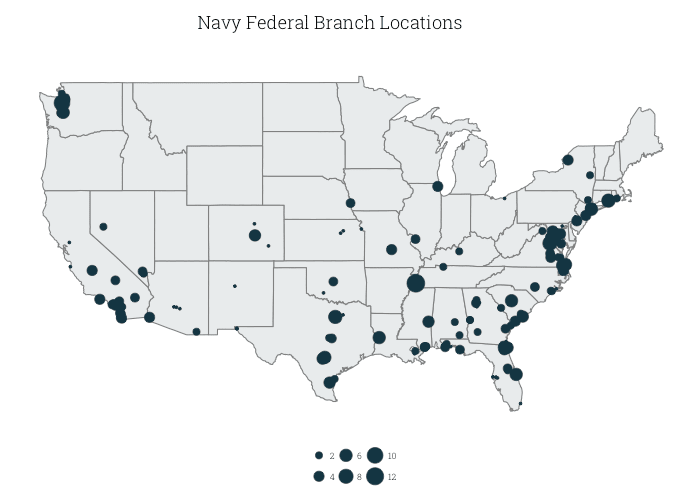

Navy Federal Credit Union has a significant physical presence with numerous branches strategically located across the United States. As of my information cutoff, the credit union had over 340 physical branches, each designed to cater to the unique needs of military personnel and their families. These branches are typically found in areas with a high concentration of military bases or installations, ensuring easy accessibility for the target demographic.

Here's a breakdown of some key aspects of Navy Federal's branch network:

Branch Locations and Distribution

Navy Federal's branches are spread across various states, with a particular focus on regions with a substantial military presence. Some of the states with the highest number of branches include Virginia, Florida, California, Texas, and North Carolina. These states are home to major military installations, making them ideal locations for Navy Federal's physical presence.

| State | Number of Branches |

|---|---|

| Virginia | 55 |

| Florida | 48 |

| California | 32 |

| Texas | 28 |

| North Carolina | 25 |

While these states have a significant number of branches, Navy Federal also maintains a presence in other regions, ensuring nationwide coverage.

Branch Amenities and Services

Navy Federal's branches offer a comprehensive range of services to cater to the diverse financial needs of its members. Here's an overview of some key amenities and services available at their branches:

- Full-Service Banking: Members can access a wide range of banking services, including opening new accounts, depositing checks, withdrawing cash, and conducting other routine transactions.

- Loan Services: Navy Federal provides various loan options, such as mortgage loans, auto loans, personal loans, and credit cards. Members can meet with loan officers to discuss their financial goals and apply for loans directly at the branch.

- Investment and Retirement Planning: Navy Federal offers investment and retirement planning services, helping members secure their financial future. Members can receive personalized advice and guidance on investment strategies and retirement planning.

- Insurance Services: The credit union also provides insurance services, including auto, home, and life insurance. Members can discuss their insurance needs and obtain coverage tailored to their circumstances.

- Military-Specific Services: Navy Federal understands the unique financial needs of military personnel. Branches offer services such as military pay allocation, emergency financial assistance, and support for deployment-related financial matters.

The Impact of Navy Federal's Physical Presence

Navy Federal Credit Union's extensive branch network has had a significant impact on the financial landscape, particularly for military personnel and their families. Here are some key aspects of its impact:

Convenience and Accessibility

By establishing a strong physical presence, Navy Federal has made it convenient for its members to access financial services. The strategic placement of branches near military bases ensures that members can easily visit a branch without traveling long distances. This accessibility is particularly beneficial for those who may not have reliable internet access or prefer face-to-face interactions.

Building Trust and Relationships

The physical branches play a crucial role in building trust and fostering strong relationships between Navy Federal and its members. Face-to-face interactions allow members to establish personal connections with financial advisors and loan officers, who can provide personalized guidance and support. This level of personalized service contributes to member satisfaction and loyalty.

Community Engagement

Navy Federal's branches often serve as community hubs, engaging with and supporting the local military community. The credit union actively participates in various initiatives and events, such as military appreciation days, financial literacy workshops, and fundraising activities. By being physically present, Navy Federal demonstrates its commitment to the well-being and financial empowerment of military personnel and their families.

Financial Education and Support

Navy Federal's branches serve as educational centers, offering financial literacy programs and workshops. These initiatives aim to empower members with the knowledge and skills needed to make informed financial decisions. Financial advisors and experts conduct seminars and provide one-on-one counseling, ensuring members have access to the resources they need to manage their finances effectively.

Frequently Asked Questions

Can anyone join Navy Federal Credit Union, or is it exclusive to military personnel and their families?

+Navy Federal Credit Union primarily serves active-duty military, veterans, DoD civilians, and their families. However, membership eligibility extends to certain other groups as well. Eligibility is determined by the credit union's membership criteria, which can include factors such as military affiliation, residence in specific areas, or membership in eligible organizations.

<div class="faq-item">

<div class="faq-question">

<h3>How can I locate the nearest Navy Federal branch to me?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can use Navy Federal's online branch locator tool on their website. Simply enter your location, and the tool will provide you with a list of nearby branches along with their contact information and hours of operation. This makes it convenient to find the branch most accessible to you.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any fees associated with using Navy Federal's branches or ATMs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal typically does not charge fees for using their own ATMs. However, there may be fees associated with using out-of-network ATMs, especially if you're using an ATM that belongs to another financial institution. It's always a good idea to check the fee structure and any potential charges before using an out-of-network ATM.</p>

</div>

</div>

</div>