Navy Federal Auto Loan Pre Approval

The Navy Federal Auto Loan Pre-Approval process is a valuable tool for members of the armed forces and their families, offering a streamlined and efficient way to secure financing for their vehicle purchases. This process provides a preliminary assessment of a borrower's eligibility, allowing them to shop for vehicles with confidence and negotiate better deals. This article delves into the intricacies of the Navy Federal Auto Loan Pre-Approval, exploring its benefits, requirements, and the steps involved in obtaining it.

Understanding Navy Federal Auto Loan Pre-Approval

Navy Federal Credit Union, a leading financial institution serving the military community, offers a range of automotive financing options, including the Navy Federal Auto Loan Pre-Approval. This pre-approval is a preliminary step in the loan application process, providing borrowers with an indication of the loan amount they may qualify for, the associated interest rate, and the terms of the loan.

The primary benefit of this pre-approval is that it gives borrowers a negotiating advantage when shopping for vehicles. With a pre-approval in hand, borrowers can confidently approach dealerships, knowing their financing is already in place. This can lead to better deals on vehicles and potentially save borrowers time and money.

Eligibility and Requirements

To be eligible for Navy Federal Auto Loan Pre-Approval, borrowers must meet certain criteria. These include:

- Membership: Borrowers must be members of Navy Federal Credit Union, which typically requires a connection to the military community. This can include active-duty military personnel, veterans, DoD civilians, and their families.

- Credit Score: While specific credit score requirements may vary, borrowers generally need a good to excellent credit score to qualify for pre-approval. Navy Federal typically considers scores above 680 as good, with higher scores offering better loan terms.

- Income and Employment: Stable and sufficient income is a key factor in loan approval. Borrowers should have a steady source of income and be able to demonstrate their ability to repay the loan.

- Vehicle Selection: The vehicle being purchased must meet Navy Federal's eligibility criteria. This typically includes new and used vehicles, but there may be restrictions on the age and mileage of used vehicles.

The Pre-Approval Process

The Navy Federal Auto Loan Pre-Approval process can be completed online, by phone, or in person at a Navy Federal branch. Here’s a step-by-step guide to the online process:

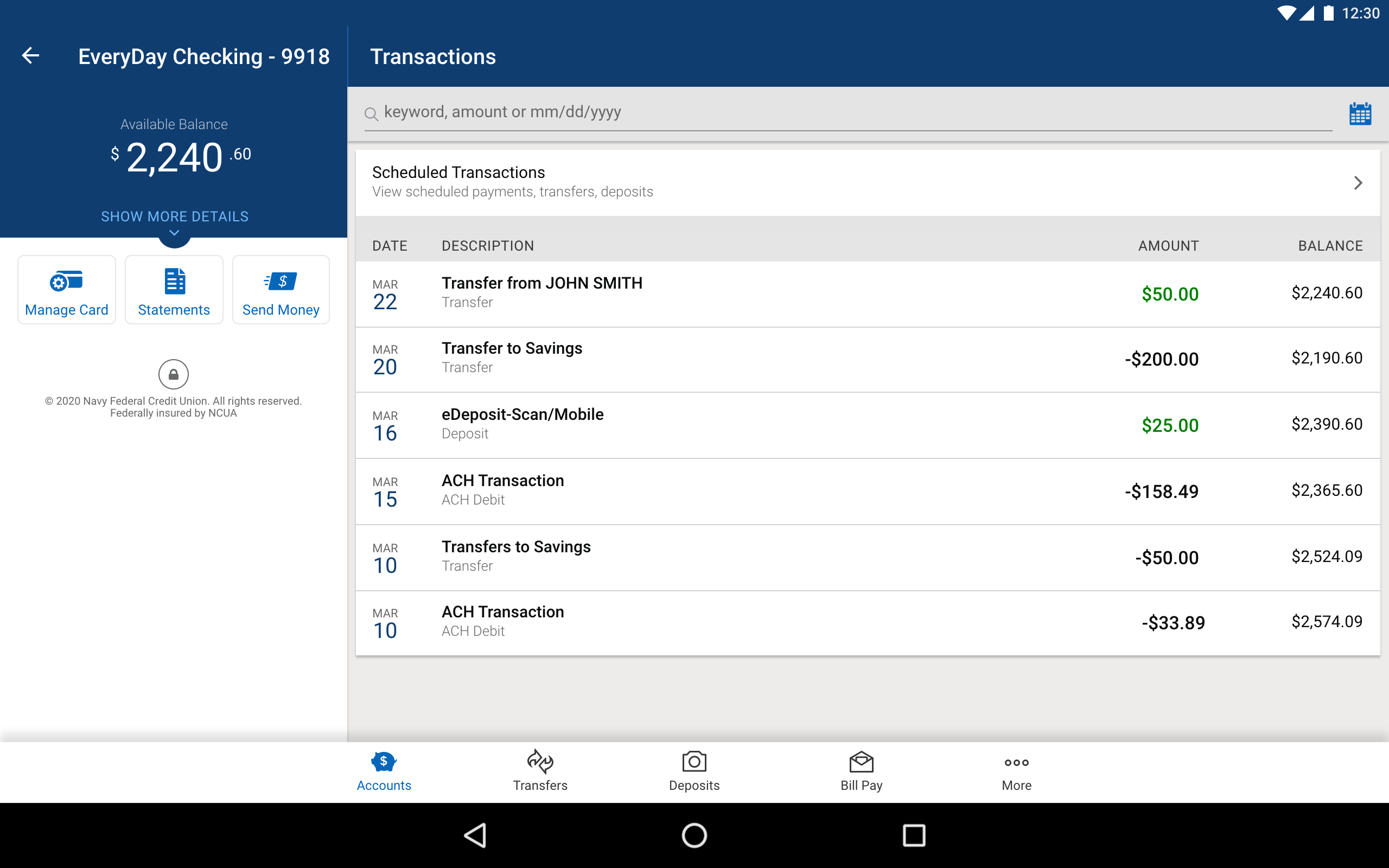

- Log In: Borrowers can start the process by logging into their Navy Federal online account. If they don't have an account, they can create one using their membership details.

- Access the Pre-Approval Form: Once logged in, borrowers can navigate to the auto loan section and locate the pre-approval form. This form will typically require personal and financial information.

- Provide Information: Borrowers will need to provide details such as their name, address, income, employment status, and the desired loan amount. They may also need to disclose their credit score and any existing debts.

- Submit the Form: After filling out the form, borrowers can submit it for review. Navy Federal will then assess the application and provide a decision, usually within a few business days.

- Receive Pre-Approval: If approved, borrowers will receive a pre-approval letter detailing the loan amount, interest rate, and terms. This letter can be used when shopping for vehicles to demonstrate their financing capability.

Benefits of Navy Federal Auto Loan Pre-Approval

Obtaining a Navy Federal Auto Loan Pre-Approval offers several advantages to borrowers:

1. Streamlined Loan Process

With pre-approval, borrowers can skip the initial loan application stage, saving time and effort. This is especially beneficial for those with busy schedules or those who want to streamline the car-buying process.

2. Negotiating Power

A pre-approval letter gives borrowers a strong negotiating position when shopping for vehicles. Dealers are more likely to offer better deals to borrowers with pre-approved financing, as it reduces the risk of financing falling through during the purchase process.

3. Peace of Mind

Knowing the loan amount and terms in advance can provide peace of mind to borrowers. They can focus on finding the right vehicle rather than worrying about financing, and they can make more informed decisions about their purchase.

4. Competitive Interest Rates

Navy Federal is known for offering competitive interest rates on auto loans. Pre-approval ensures borrowers can secure these rates, which can result in significant savings over the life of the loan.

Considerations and Alternatives

While Navy Federal Auto Loan Pre-Approval is a valuable tool, it’s essential to consider a few factors:

1. Loan Terms

The pre-approval is not a guarantee of the final loan terms. Actual terms may vary based on the vehicle chosen and the borrower’s financial situation at the time of the final loan application.

2. Credit Score Impact

Multiple loan inquiries can potentially impact a borrower’s credit score. However, Navy Federal groups multiple loan inquiries within a short period as a single inquiry, minimizing this impact.

3. Alternatives

If borrowers are not eligible for Navy Federal’s pre-approval or prefer other options, they can consider dealer financing or loans from other financial institutions. It’s always advisable to compare multiple offers to find the best deal.

Conclusion

The Navy Federal Auto Loan Pre-Approval process is a powerful tool for military personnel and their families, offering a streamlined and efficient way to secure financing for vehicle purchases. With its benefits of negotiating power, peace of mind, and competitive interest rates, it’s an attractive option for those in the market for a new or used vehicle. However, borrowers should carefully consider their financial situation and explore all available options to make an informed decision.

Can I use the pre-approval for any vehicle purchase, or are there restrictions?

+The pre-approval can be used for a wide range of vehicle purchases, including new and used cars, motorcycles, and even recreational vehicles. However, there may be restrictions on the age and condition of used vehicles. It’s always best to check with Navy Federal for specific eligibility criteria.

How long does the pre-approval remain valid?

+Navy Federal’s pre-approval typically remains valid for a period of 30 days. However, this can vary based on individual circumstances and market conditions. It’s advisable to use the pre-approval as soon as possible to ensure the best rates and terms.

What happens if I find a vehicle I want to purchase, but the pre-approval amount is insufficient?

+If the pre-approved loan amount is not sufficient for the vehicle you wish to purchase, you can discuss your options with a Navy Federal loan officer. They may be able to adjust the loan terms or suggest alternative financing options to help you secure the vehicle.