Mileage Reimbursement 2025: Master The Taxefficient Travel Strategy

Mileage reimbursement is a crucial aspect of business travel, especially for those who frequently drive for work-related purposes. As we look ahead to 2025, it is essential to stay updated on the tax-efficient strategies and trends in mileage reimbursement to ensure compliance and maximize cost savings. This comprehensive guide will delve into the evolving landscape of mileage reimbursement, providing insights and strategies to help businesses and individuals navigate this complex area.

The Evolution of Mileage Reimbursement

Mileage reimbursement has come a long way from the traditional paper-based mileage logs and manual calculations. With the advancement of technology and the increasing complexity of tax regulations, the process has become more sophisticated and digitalized. Here’s an overview of the key milestones and trends that have shaped mileage reimbursement over the years:

Traditional Mileage Tracking

In the past, employees would manually log their mileage using pen and paper, often relying on odometer readings and simple calculators to determine the reimbursement amount. This process was time-consuming, prone to errors, and lacked the necessary data security measures.

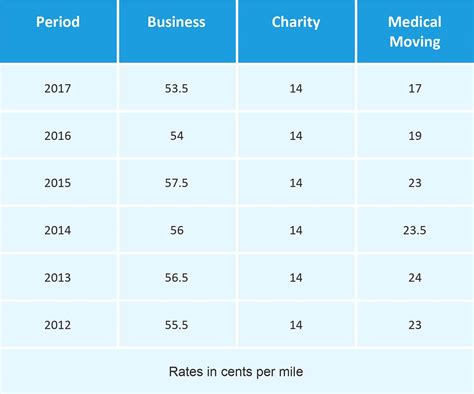

Introduction of Mileage Rate Tables

To simplify the reimbursement process, governments and tax authorities introduced standardized mileage rate tables. These tables provided a fixed rate per mile driven, making it easier for businesses to calculate and process mileage claims. However, this approach did not account for individual vehicle expenses and the varying costs of operating different types of vehicles.

| Year | Mileage Rate (USD/mile) |

|---|---|

| 2023 | 0.64 |

| 2022 | 0.62 |

| 2021 | 0.56 |

Rise of Digital Mileage Tracking Apps

The advent of smartphones and mobile applications revolutionized mileage tracking. Digital mileage tracking apps offer a convenient and efficient way to record and calculate mileage, providing real-time data and automated calculations. These apps often integrate with GPS systems, ensuring accurate mileage logs and reducing the risk of fraudulent claims.

Integration of Telematics and Connected Vehicles

With the increasing adoption of connected vehicles and telematics, mileage tracking has become even more precise and secure. Telematics systems use sensors and GPS technology to collect and transmit vehicle data, including mileage and location information. This integration allows for real-time monitoring and accurate reimbursement calculations, reducing the administrative burden on both employees and employers.

Tax Reform and Reimbursement Changes

Tax reforms and policy changes have had a significant impact on mileage reimbursement. In recent years, governments have introduced new regulations and guidelines to ensure fair and accurate reimbursement practices. These changes often involve adjustments to the standard mileage rates and the introduction of new tax deductions or credits for business travel expenses.

Mastering Tax-Efficient Mileage Reimbursement in 2025

As we approach 2025, businesses and individuals need to be well-prepared to navigate the complexities of tax-efficient mileage reimbursement. Here are some key strategies and considerations to help you stay ahead of the curve:

Adopting Digital Mileage Tracking Solutions

Investing in a reliable digital mileage tracking solution is essential for accurate and efficient mileage reimbursement. These platforms offer a range of features, including GPS tracking, automatic mileage calculation, and integration with accounting systems. By adopting a digital solution, businesses can streamline their reimbursement process, reduce administrative costs, and ensure compliance with tax regulations.

Understanding the Standard Mileage Rate

The standard mileage rate is a crucial component of mileage reimbursement. This rate, set by tax authorities, represents the average cost of operating a vehicle for business purposes. It includes expenses such as fuel, maintenance, and depreciation. For 2025, the standard mileage rate is expected to remain at $0.64 per mile for businesses. Understanding this rate and its implications is vital for both employers and employees.

Maximizing Tax Deductions and Credits

Businesses and individuals can take advantage of various tax deductions and credits related to business travel. These include deductions for vehicle expenses, such as fuel, repairs, and insurance, as well as credits for environmentally friendly vehicles. By carefully tracking and documenting these expenses, taxpayers can maximize their tax savings and reduce their overall tax liability.

Implementing Expense Management Systems

To streamline the reimbursement process and ensure accurate record-keeping, businesses should consider implementing expense management systems. These systems allow employees to easily submit and track their mileage claims, while providing employers with real-time visibility and control over reimbursement expenses. Expense management systems can also integrate with accounting software, simplifying the financial reporting process.

Staying Updated on Tax Regulations

Tax regulations are subject to change, and it is crucial to stay informed about any updates or amendments that may impact mileage reimbursement. Governments and tax authorities often publish guidelines and resources to help taxpayers understand the latest rules and requirements. Staying updated ensures compliance and helps businesses avoid potential penalties or audits.

Utilizing Mileage Reimbursement Software

Mileage reimbursement software has become an indispensable tool for businesses and individuals alike. These platforms offer advanced features such as automated mileage tracking, expense categorization, and tax calculation. By leveraging the power of technology, taxpayers can save time, reduce errors, and ensure accurate and compliant mileage reimbursement.

Embracing Sustainable Travel Practices

With the growing emphasis on environmental sustainability, businesses are encouraged to adopt eco-friendly travel practices. This includes promoting the use of public transportation, carpooling, and electric vehicles. By incorporating sustainable travel options, businesses can not only reduce their carbon footprint but also potentially benefit from tax incentives and credits.

Collaborating with Tax Professionals

Navigating the complex world of tax regulations and mileage reimbursement can be challenging. Collaborating with tax professionals, such as accountants or tax consultants, can provide valuable insights and guidance. These experts can help businesses and individuals optimize their mileage reimbursement strategies, ensure compliance, and maximize tax savings.

The Future of Mileage Reimbursement

As we look to the future, the mileage reimbursement landscape is expected to continue evolving. Here are some trends and developments to watch out for:

Increased Automation and AI Integration

The integration of artificial intelligence (AI) and machine learning into mileage reimbursement platforms is likely to enhance efficiency and accuracy. AI-powered systems can automate mileage tracking, expense categorization, and tax calculation, reducing the risk of errors and streamlining the reimbursement process.

Blockchain and Cryptocurrency Integration

The adoption of blockchain technology and cryptocurrency in the finance industry is expected to impact mileage reimbursement as well. Blockchain-based platforms can provide secure and transparent record-keeping, while cryptocurrency can offer new opportunities for reimbursing travel expenses, especially for international travel.

Enhanced Data Analytics and Insights

Advanced data analytics and business intelligence tools will play a significant role in mileage reimbursement. These tools can provide valuable insights into travel patterns, expense trends, and cost-saving opportunities. By leveraging data-driven decision-making, businesses can optimize their travel policies and reimbursement strategies.

Expansion of Telecommuting and Remote Work

The rise of remote work and telecommuting is expected to impact mileage reimbursement practices. As more employees work remotely, the need for business travel may decrease, leading to a shift in reimbursement focus towards other travel-related expenses, such as home office setup and internet connectivity.

Global Harmonization of Tax Regulations

With the increasing globalization of businesses, there is a growing need for harmonized tax regulations across borders. Efforts to simplify and standardize tax rules for cross-border business travel are likely to gain momentum, making it easier for businesses to navigate international mileage reimbursement.

Conclusion

Mileage reimbursement is a dynamic and evolving aspect of business travel, requiring continuous adaptation and innovation. By staying informed about the latest trends, technologies, and tax regulations, businesses and individuals can master tax-efficient mileage reimbursement strategies. The key lies in embracing digital solutions, staying compliant, and maximizing tax savings to ensure a smooth and efficient reimbursement process.

How often are mileage rates updated by tax authorities?

+Mileage rates are typically updated annually by tax authorities to reflect changes in fuel costs, maintenance expenses, and other relevant factors. It is important for businesses and individuals to stay updated on these changes to ensure accurate reimbursement calculations.

<div class="faq-item">

<div class="faq-question">

<h3>Can businesses claim mileage reimbursement for personal vehicles used for business purposes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, businesses can claim mileage reimbursement for personal vehicles used for business purposes. However, it is essential to maintain accurate records and documentation to support these claims. Mileage reimbursement for personal vehicles is subject to tax regulations and may vary depending on the jurisdiction.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the potential tax benefits of using an electric vehicle for business travel?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Using an electric vehicle for business travel can offer several tax benefits. These include potential tax credits for purchasing or leasing an electric vehicle, as well as reduced fuel and maintenance costs. Additionally, some jurisdictions offer tax incentives for businesses that promote sustainable travel practices.</p>

</div>

</div>

</div>