Manual Underwriting Mortgage: A Comprehensive Guide To Approval

The process of manual underwriting for a mortgage is an essential aspect of the lending industry, especially in today's regulatory environment. It involves a detailed and comprehensive evaluation of a borrower's financial health and creditworthiness, going beyond the automated credit scoring systems. This traditional method of assessing loan applications is often employed when automated systems cannot provide a clear picture of a borrower's ability to repay the loan. In this guide, we will delve into the intricacies of manual underwriting, exploring the steps, criteria, and factors that influence the approval process. We will also examine the advantages and challenges associated with this method, providing a comprehensive understanding of its role in the mortgage lending landscape.

Understanding the Manual Underwriting Process

Manual underwriting is a meticulous procedure that involves a manual, step-by-step evaluation of a borrower’s financial and credit profile. It is typically used when automated underwriting systems cannot provide a clear risk assessment or when borrowers have unique circumstances that require a more personalized evaluation. This process is especially relevant for borrowers with complex financial histories, non-traditional income sources, or those who have experienced credit issues in the past.

Step 1: Initial Application and Documentation Review

The manual underwriting process begins with a thorough review of the borrower’s initial loan application. This includes a detailed examination of the borrower’s financial statements, tax returns, pay stubs, bank statements, and other relevant documents. The underwriter will assess the accuracy and consistency of the information provided, looking for any discrepancies or red flags that may impact the borrower’s ability to repay the loan.

| Document | Purpose |

|---|---|

| Income Statements | Verifies the borrower's ability to generate consistent income to cover mortgage payments. |

| Tax Returns | Provides a comprehensive view of the borrower's financial health and tax obligations. |

| Bank Statements | Analyzes the borrower's cash flow and financial habits, including savings and debt repayment. |

| Credit Reports | Evaluates the borrower's credit history, including any delinquencies, bankruptcies, or foreclosures. |

Step 2: Income and Employment Verification

A critical aspect of manual underwriting is the verification of the borrower’s income and employment status. Underwriters will contact the borrower’s employer(s) to confirm their employment and income details. This step ensures that the borrower’s stated income aligns with their actual earnings and that their employment is stable and sustainable.

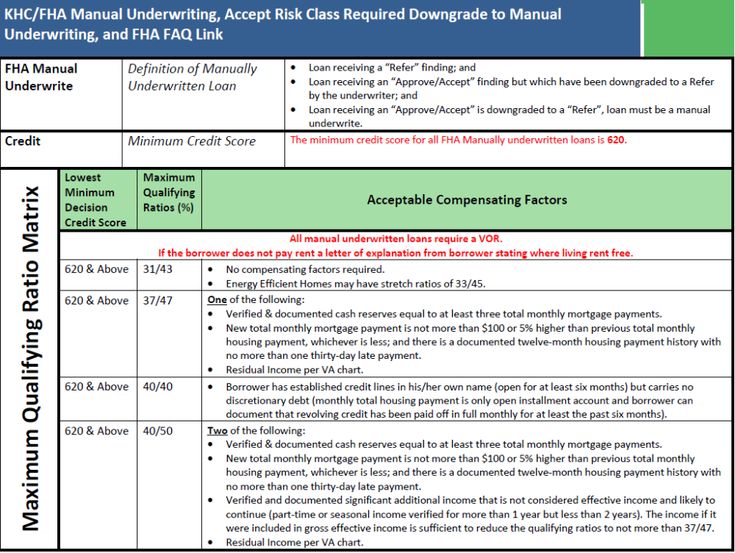

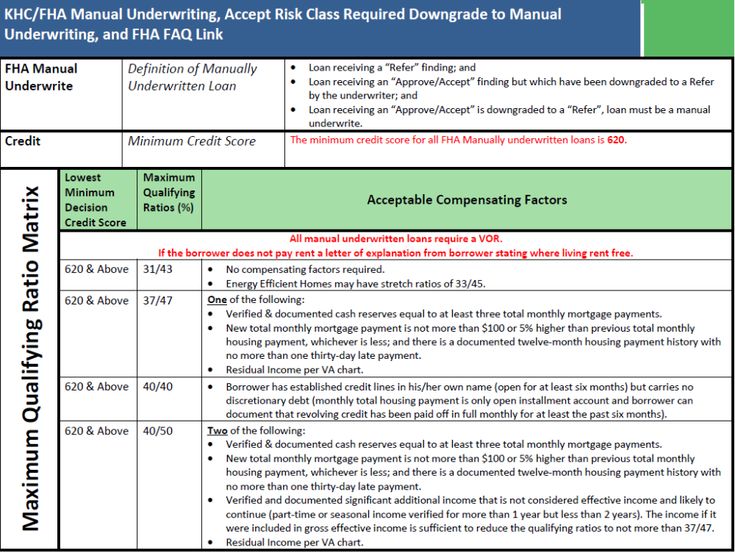

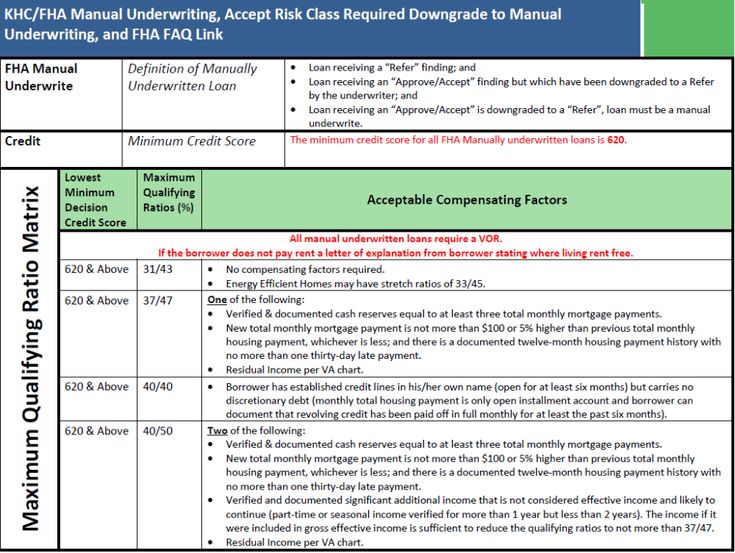

Step 3: Credit History Analysis

Underwriters will conduct a detailed analysis of the borrower’s credit history, including credit reports from all three major credit bureaus. They will examine the borrower’s credit score, credit utilization, and payment history. Any negative marks on the credit report, such as late payments, collections, or judgments, will be carefully evaluated to assess their impact on the borrower’s creditworthiness.

Step 4: Asset and Reserve Verification

Manual underwriting also involves verifying the borrower’s assets and reserves. This includes confirming the existence and value of any down payment funds, as well as assessing the borrower’s ability to access and utilize these funds. Underwriters may request additional documentation, such as brokerage statements or gift letters, to support the borrower’s financial position.

Step 5: Debt-to-Income Ratio Calculation

The debt-to-income (DTI) ratio is a critical factor in manual underwriting. Underwriters will calculate the borrower’s DTI by dividing their total monthly debt obligations by their gross monthly income. This ratio helps assess the borrower’s ability to manage their financial obligations alongside the proposed mortgage payment. A lower DTI is generally preferred, as it indicates a lower risk of default.

Step 6: Manual Underwriting Decision

Based on the comprehensive evaluation of the borrower’s financial profile, the underwriter will make a decision regarding the loan approval. This decision is influenced by a range of factors, including the borrower’s creditworthiness, income stability, debt obligations, and overall financial health. The underwriter may approve the loan as is, request additional documentation or clarifications, or deny the loan if the borrower’s financial situation does not meet the lender’s criteria.

Advantages of Manual Underwriting

Manual underwriting offers several advantages, particularly for borrowers with unique financial circumstances. It provides a more personalized and flexible evaluation process, allowing underwriters to consider factors beyond traditional credit scoring models. This method can be beneficial for borrowers with:

- Non-traditional income sources, such as commissions, bonuses, or self-employment income.

- Complex financial histories, including multiple sources of income or credit issues.

- Recent changes in employment or income that automated systems may not accurately reflect.

- Unique assets or investments that require a more detailed analysis.

Challenges and Considerations

While manual underwriting offers significant benefits, it also presents certain challenges and considerations. The process is typically more time-consuming and resource-intensive compared to automated underwriting, as it requires a higher level of manual review and analysis. Additionally, the subjective nature of the evaluation process can lead to inconsistencies in decision-making, especially when multiple underwriters are involved.

Consistency and Training

To mitigate the risk of inconsistent decision-making, lenders must ensure that their underwriters are well-trained and adhere to standardized guidelines. Regular training and updates on underwriting criteria and policies are essential to maintain a consistent evaluation process across the organization.

Time and Resource Management

Given the manual nature of the process, lenders must carefully manage their resources to ensure timely loan decisions. This may involve implementing efficient workflows, utilizing technology to streamline certain aspects of the evaluation, and maintaining an adequate staffing level to handle the volume of manual underwriting applications.

Conclusion: The Role of Manual Underwriting in Mortgage Lending

Manual underwriting plays a vital role in the mortgage lending landscape, providing a comprehensive and personalized evaluation of borrowers’ financial health. While it may be more time-consuming and resource-intensive than automated systems, it offers a necessary level of flexibility and personalization for borrowers with unique financial circumstances. By understanding the manual underwriting process, borrowers can better prepare their financial documentation and increase their chances of loan approval. Lenders, on the other hand, must invest in robust training programs and efficient workflows to ensure consistent and timely loan decisions.

What are the key factors considered in manual underwriting?

+Key factors include the borrower’s income stability, credit history, debt obligations, and overall financial health. Underwriters also consider the borrower’s ability to provide accurate and verifiable documentation to support their financial claims.

How long does the manual underwriting process typically take?

+The duration of the process can vary depending on the complexity of the borrower’s financial situation and the volume of applications being processed. On average, it can take anywhere from a few days to several weeks to complete the manual underwriting process.

What are the benefits of manual underwriting for borrowers?

+Manual underwriting offers a more personalized evaluation, taking into account unique financial circumstances. This can be especially beneficial for borrowers with non-traditional income sources or complex financial histories.