Kentucky State Tax: A Comprehensive Guide To Your Refund

Understanding the intricacies of the Kentucky state tax system is crucial for individuals and businesses alike, especially when it comes to navigating the refund process. This comprehensive guide aims to provide an in-depth look at the Kentucky state tax system, covering everything from tax rates and deductions to the steps involved in claiming your refund.

The Kentucky State Tax System: An Overview

Kentucky’s tax system is designed to generate revenue for the state’s operations and public services. It consists of a range of taxes, including income tax, sales and use tax, property tax, and various other levies. Each of these taxes plays a significant role in funding state initiatives and ensuring the smooth functioning of government bodies.

Income Tax: The Backbone of Kentucky’s Revenue

Income tax is a critical component of Kentucky’s tax system, accounting for a significant portion of the state’s revenue. The state imposes a progressive income tax structure, meaning that the tax rate increases as taxable income rises. This system ensures that higher-income earners contribute a larger share of their income to the state’s coffers.

The current income tax rates in Kentucky are as follows:

| Tax Rate | Taxable Income Range |

|---|---|

| 5.8% | $0 - $3,000 |

| 6.0% | $3,001 - $4,000 |

| 5.0% | $4,001 - $8,000 |

| 5.8% | $8,001 - $75,000 |

| 6.0% | $75,001 and above |

It's important to note that Kentucky allows for various deductions and credits, which can significantly reduce the amount of tax owed. Some of the notable deductions include:

- Standard Deduction: Kentucky offers a standard deduction, which reduces taxable income for all filers. The amount of the standard deduction depends on the filer's filing status.

- Personal Exemptions: Kentucky allows personal exemptions for the taxpayer, their spouse, and eligible dependents. These exemptions further reduce taxable income.

- Itemized Deductions: Taxpayers have the option to itemize their deductions, which can include expenses such as mortgage interest, state and local taxes, charitable contributions, and medical expenses.

Sales and Use Tax: Funding Public Services

Kentucky imposes a sales and use tax on the sale or purchase of tangible personal property and certain services. The sales tax rate in Kentucky is 6%, which is applicable to most retail transactions. However, there are certain exemptions and special rates for specific goods and services.

For instance, Kentucky offers a reduced sales tax rate of 3% for certain food items, prescription drugs, and over-the-counter medications. Additionally, there are tax exemptions for specific items like clothing, school supplies, and non-prepared food items during certain promotional periods.

The use tax is applied to purchases made outside of Kentucky but used or consumed within the state. This ensures that all purchases are subject to taxation, regardless of where they are made.

Property Tax: Supporting Local Communities

Property tax is an essential revenue source for local governments in Kentucky. The tax is levied on both real property (land and buildings) and personal property (vehicles, boats, and other tangible assets). The tax rate varies depending on the county and the type of property.

Kentucky's property tax system is unique in that it has a "cyclical" assessment process. Property values are reassessed every four years, with the most recent reassessment occurring in 2020. This ensures that property taxes remain fair and up-to-date with market values.

Claiming Your Kentucky State Tax Refund

If you believe you are entitled to a refund on your Kentucky state taxes, it’s important to understand the process and the requirements for claiming it. Here’s a step-by-step guide to help you navigate the refund process.

Determining Your Eligibility

The first step in claiming your refund is to determine if you are eligible. Generally, you may be eligible for a refund if you have overpaid your taxes or if you are entitled to certain credits or deductions that were not applied to your tax liability.

To determine your eligibility, you should carefully review your tax return and compare it with your tax records. Look for any discrepancies or errors that may have resulted in an overpayment. Additionally, ensure that you have claimed all applicable deductions and credits.

Gathering Necessary Documentation

Before initiating the refund process, it’s crucial to gather all the necessary documentation. This may include:

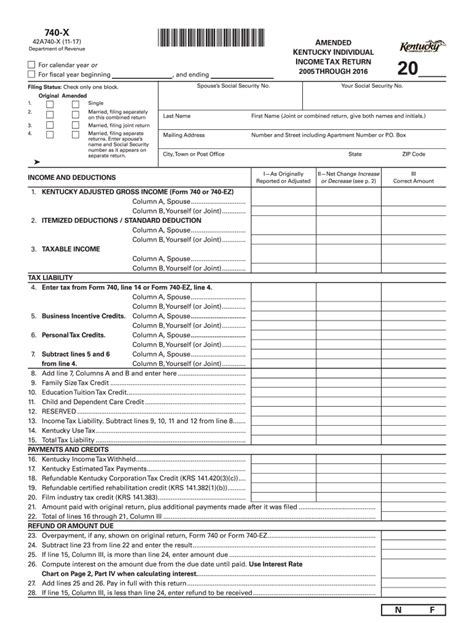

- A copy of your filed Kentucky tax return (Form 740)

- Supporting documentation for any deductions or credits claimed

- Proof of identity (driver's license, passport, etc.)

- Bank account information for direct deposit (if applicable)

- Any correspondence or notices received from the Kentucky Department of Revenue regarding your tax return

Submitting Your Refund Claim

Once you have determined your eligibility and gathered the required documentation, you can submit your refund claim to the Kentucky Department of Revenue. There are several ways to submit your claim:

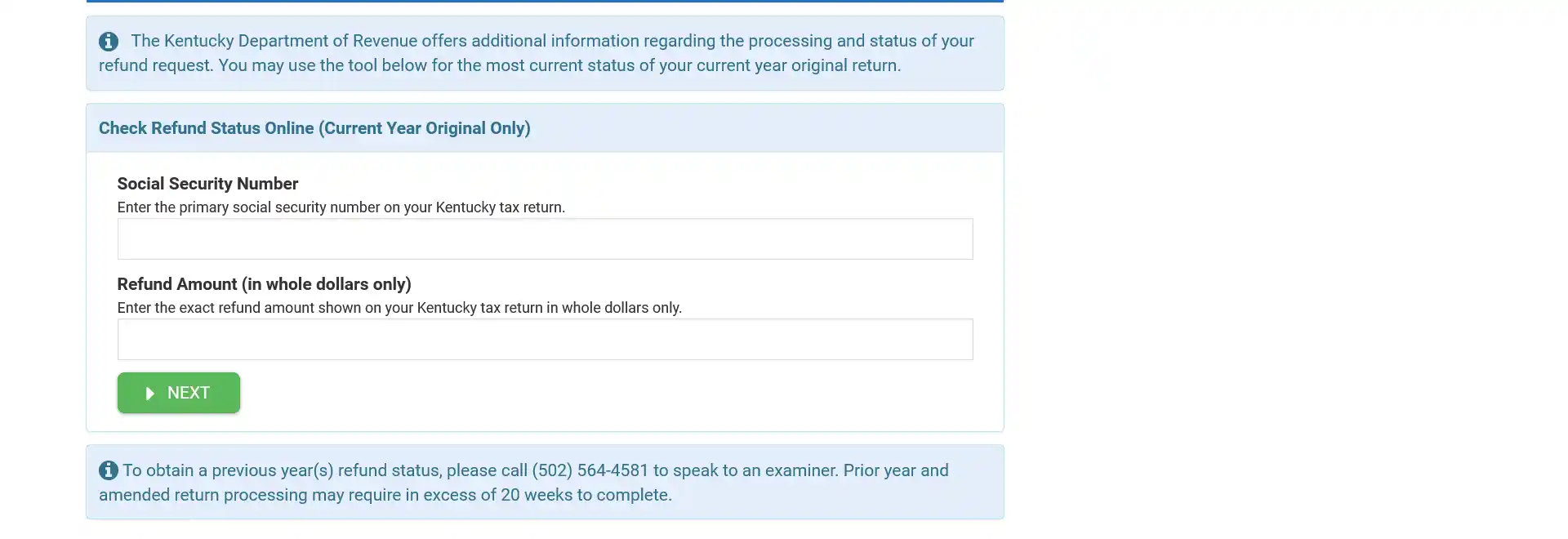

- Online: The most convenient and efficient way to submit your refund claim is through the Kentucky Department of Revenue's online portal. You can access the portal by visiting their website and creating an account. From there, you can upload your documentation and submit your claim electronically.

- Mail: If you prefer a more traditional approach, you can mail your refund claim and supporting documentation to the Kentucky Department of Revenue. Be sure to include a cover letter explaining the reason for your refund request and any relevant details.

- In-Person: In certain circumstances, you may be able to submit your refund claim in person at a Kentucky Department of Revenue office. However, this option is typically reserved for complex cases or when other methods are not feasible.

Processing Time and Receipt of Refund

The processing time for Kentucky state tax refunds can vary depending on the method of submission and the complexity of your claim. Generally, online submissions are processed more quickly than mailed or in-person submissions.

Once your refund claim has been approved, you will receive your refund via the method you specified. If you provided bank account information, your refund will be deposited directly into your account. Otherwise, you will receive a check in the mail.

Maximizing Your Kentucky State Tax Refund

While claiming your refund is an important step, it’s equally crucial to ensure that you are maximizing your refund by taking advantage of all available deductions and credits. Here are some strategies to consider:

Common Deductions and Credits

Kentucky offers a range of deductions and credits that can significantly reduce your tax liability. Some of the most common deductions and credits include:

- Standard Deduction: As mentioned earlier, Kentucky provides a standard deduction based on your filing status. Be sure to claim this deduction to reduce your taxable income.

- Dependent Deduction: If you have eligible dependents, you can claim a deduction for each dependent. This can help reduce your taxable income and potentially increase your refund.

- Education Credits: Kentucky offers several education-related credits, including the Kentucky Education Excellence Scholarship (KEES) credit and the Kentucky Tuition Grant. These credits can provide significant savings for taxpayers pursuing higher education.

- Retirement Savings Credits: If you contribute to a retirement savings plan, such as a 401(k) or IRA, you may be eligible for a credit. This credit can further reduce your tax liability and encourage retirement savings.

Tax Planning and Strategies

To maximize your refund, it’s beneficial to engage in proactive tax planning. Here are some strategies to consider:

- Adjust Your Withholding: If you receive a large refund each year, you may be overpaying your taxes throughout the year. Consider adjusting your tax withholding so that you have more take-home pay and a smaller refund. This can be done by submitting a new W-4 form to your employer.

- Explore Investment Opportunities: Certain investments, such as municipal bonds or energy-efficient home improvements, may be eligible for tax credits or deductions. Researching and investing in these opportunities can help reduce your tax liability and increase your refund.

- Maximize Retirement Contributions: Contributing to retirement accounts like a 401(k) or IRA can provide significant tax benefits. Not only do these contributions reduce your taxable income, but they also grow tax-deferred, allowing for compound growth over time.

Conclusion: Navigating the Kentucky State Tax System

Understanding the Kentucky state tax system and the refund process is essential for ensuring you receive the maximum refund you’re entitled to. By familiarizing yourself with the tax rates, deductions, and credits available, you can make informed decisions to minimize your tax liability and maximize your refund.

Remember, tax laws and regulations can change, so it's important to stay up-to-date with any updates or amendments. Additionally, seeking professional tax advice or using reliable tax preparation software can further assist you in navigating the complexities of the Kentucky state tax system.

What is the deadline for filing Kentucky state taxes?

+The deadline for filing Kentucky state taxes is typically aligned with the federal tax deadline, which is usually April 15th. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a natural disaster or other unforeseen events. It’s always best to check the official Kentucky Department of Revenue website for the most up-to-date information on tax filing deadlines.

Can I file my Kentucky state taxes electronically?

+Yes, Kentucky offers electronic filing options for both individual and business taxpayers. The Kentucky Department of Revenue provides an online portal where taxpayers can file their returns securely and efficiently. Electronic filing is often the fastest and most convenient way to submit your tax return and receive your refund.

What if I owe more taxes than I can afford to pay?

+If you find yourself in a situation where you owe more taxes than you can afford to pay, it’s important to take action promptly. The Kentucky Department of Revenue offers various payment plans and options to help taxpayers manage their tax liabilities. You can contact the department to discuss your options and work out a suitable payment arrangement.