Kentucky Minimum Wage: Stay Informed On The Latest Rate Changes

The minimum wage in Kentucky is an important topic for both employers and employees, as it directly impacts the state's workforce and the overall economy. Understanding the latest rate changes and staying informed about the legal requirements is crucial for ensuring compliance and fair labor practices. This article aims to provide a comprehensive guide to Kentucky's minimum wage, covering its history, recent developments, and implications for businesses and workers.

The Evolution of Kentucky’s Minimum Wage

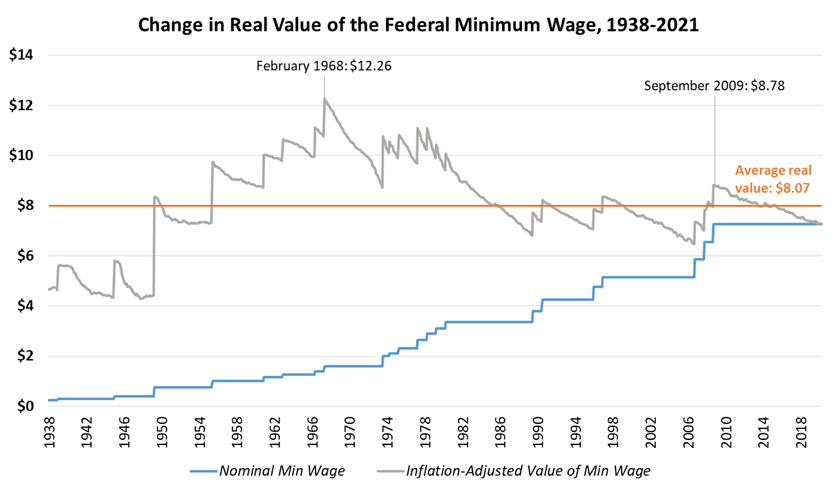

Kentucky’s minimum wage has a complex history, influenced by federal and state policies, economic conditions, and labor movements. The state’s minimum wage has been subject to numerous adjustments and policy debates, reflecting the ongoing discussions surrounding wage fairness and economic growth.

Federal vs. State Minimum Wage

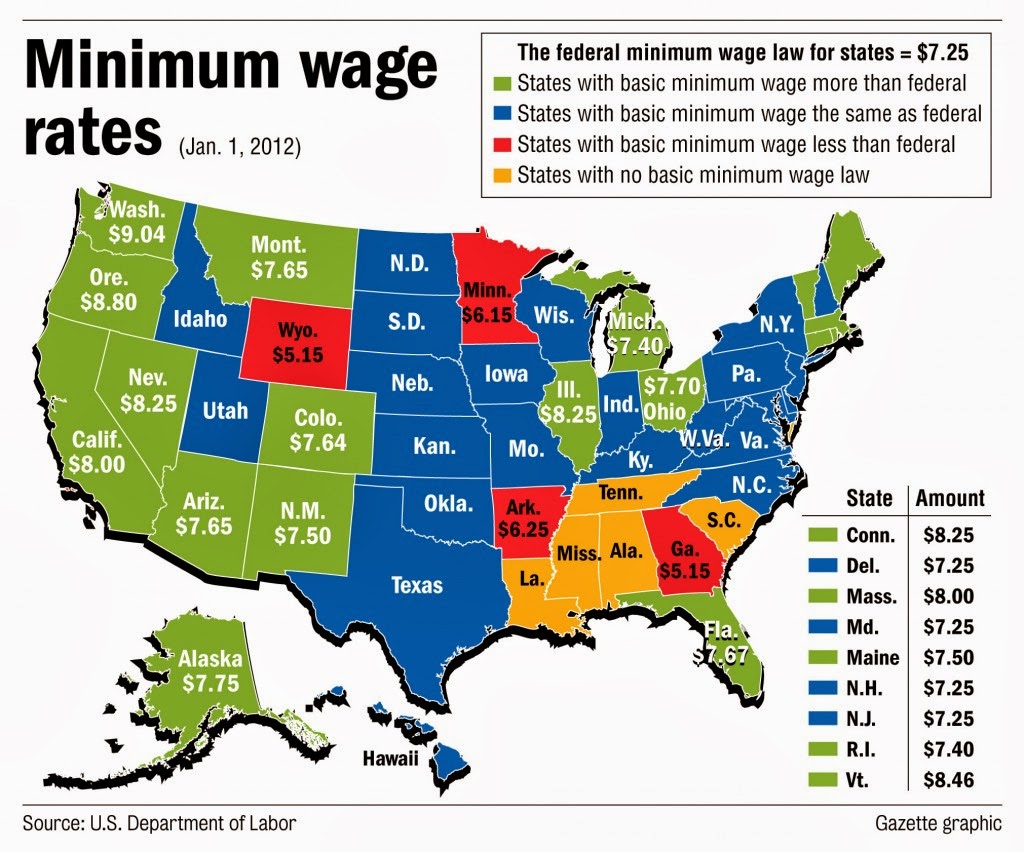

Kentucky, like many other states, has its own minimum wage laws, which can differ from the federal minimum wage. The Fair Labor Standards Act (FLSA), a federal law, sets the minimum wage for most workers in the United States. However, states have the authority to establish their own minimum wage rates, which can be higher than the federal minimum.

Historically, Kentucky has opted to follow the federal minimum wage, choosing not to establish a higher state-specific rate. This decision has been a subject of debate, with advocates arguing for a higher minimum wage to boost the economy and reduce income inequality.

| Year | Federal Minimum Wage | Kentucky Minimum Wage |

|---|---|---|

| 2023 | $7.25 | $7.25 |

| 2022 | $7.25 | $7.25 |

| 2021 | $7.25 | $7.25 |

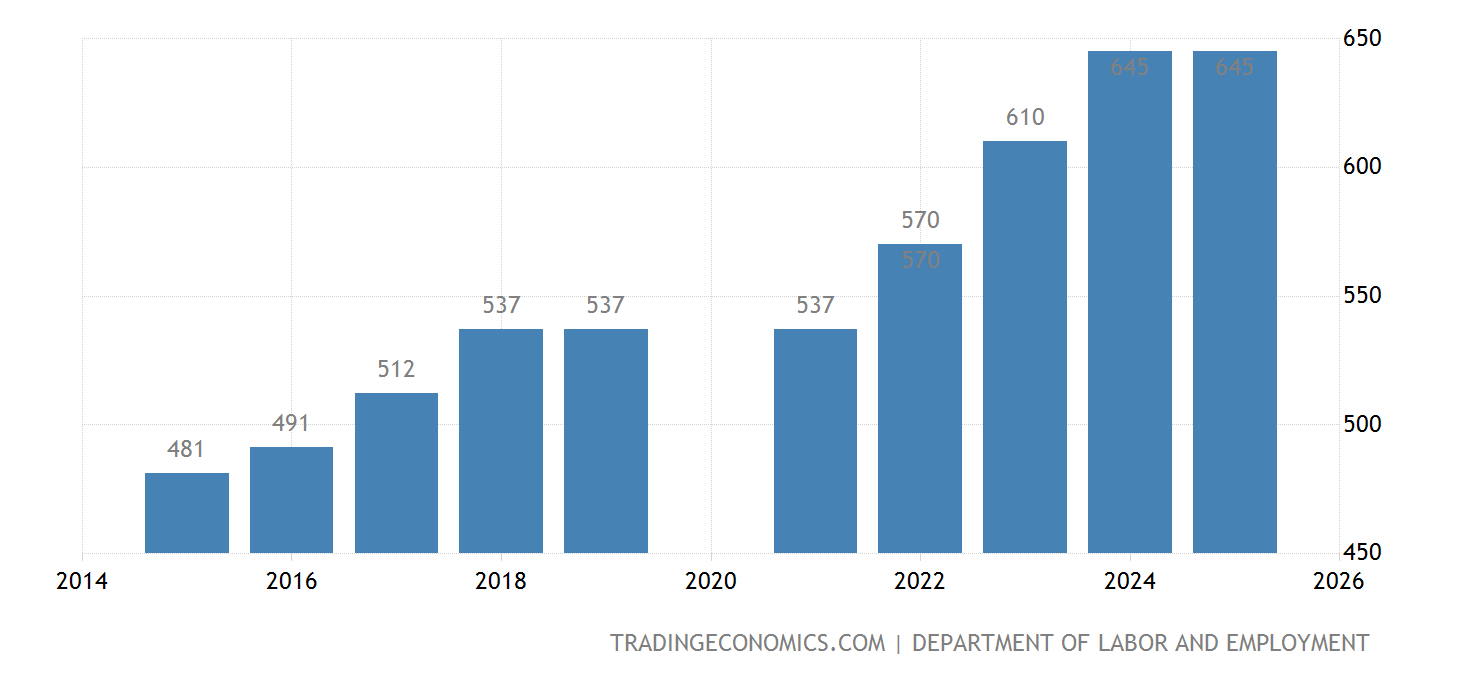

As of my last update in January 2023, Kentucky's minimum wage remains at $7.25 per hour, which is the same as the federal minimum wage. This rate has been in effect since 2009, with no adjustments made since then.

Minimum Wage Exemptions and Special Cases

It’s important to note that certain categories of workers may be exempt from the minimum wage requirements or subject to different wage rates. These exemptions typically apply to specific industries, occupations, or worker demographics.

- Tipped Employees: In Kentucky, employers can pay tipped employees a lower minimum wage, provided that the combination of the wage and tips equals at least the federal minimum wage. The current tipped wage rate in Kentucky is $2.13 per hour.

- Students and Learners: Kentucky allows for a lower minimum wage for students and learners, provided they are enrolled in a training program approved by the state. The student wage rate is $4.25 per hour for the first 90 days of employment.

- Small Business Exception: Businesses with gross annual sales or business done of less than $500,000 are exempt from paying the minimum wage to employees who are immediate family members.

Recent Developments and Rate Changes

In recent years, there have been ongoing discussions and proposals to raise Kentucky’s minimum wage. These efforts are driven by concerns about the purchasing power of low-wage workers and the potential benefits of a higher minimum wage on the state’s economy.

Legislative Proposals

Various legislative proposals have been introduced in Kentucky to increase the minimum wage. These proposals often aim to gradually raise the wage rate over several years, reaching a specified target wage. For example, one proposal suggested raising the minimum wage to $15 per hour by 2025.

However, these proposals have faced opposition and have not yet been enacted into law. The debate surrounding minimum wage increases often involves considerations of economic impacts, business viability, and the potential for job losses.

Ballot Initiatives and Public Opinion

In addition to legislative efforts, there have been attempts to raise the minimum wage through ballot initiatives. These initiatives aim to give voters a direct say in setting the minimum wage rate. While some states have successfully implemented minimum wage increases through ballot measures, Kentucky has not yet pursued this route.

Public opinion polls have shown varying levels of support for minimum wage increases in Kentucky. While many residents support the idea of a higher minimum wage, there are also concerns about the potential impacts on small businesses and the overall economy.

Impact on Businesses and Workers

Changes to the minimum wage can have significant implications for both businesses and workers in Kentucky. Understanding these impacts is crucial for stakeholders to make informed decisions and adapt to the evolving labor landscape.

Benefits for Workers

A higher minimum wage can provide several advantages for low-wage workers in Kentucky. These include:

- Increased Purchasing Power: A higher minimum wage allows workers to earn more money, which can lead to improved living standards and increased spending power. This, in turn, can stimulate the local economy and benefit businesses.

- Reduced Income Inequality: Raising the minimum wage can help narrow the income gap between low-wage earners and higher-income individuals, promoting a more equitable distribution of wealth.

- Improved Worker Retention: Higher wages can make it easier for employers to retain skilled workers, reducing turnover rates and the associated costs of recruitment and training.

Challenges for Businesses

While a higher minimum wage can bring benefits, it also presents challenges for businesses, particularly small businesses and those with tight profit margins. Some potential challenges include:

- Increased Labor Costs: A higher minimum wage directly increases labor costs for businesses, which may need to adjust their pricing or find other cost-saving measures to maintain profitability.

- Potential Job Losses: In some cases, businesses may respond to increased labor costs by reducing their workforce or automating certain tasks. This could lead to job losses, particularly for entry-level positions.

- Competitiveness: Higher labor costs can make it more difficult for Kentucky businesses to compete with businesses in states with lower minimum wages. This could impact the state's ability to attract and retain businesses.

Looking Ahead: Future Implications

The future of Kentucky’s minimum wage remains uncertain, with ongoing debates and proposals for change. As the state’s economy evolves and the national conversation around wage fairness continues, Kentucky’s policymakers will need to carefully consider the potential impacts of any adjustments to the minimum wage.

One potential development is the possibility of a federal minimum wage increase. If the federal minimum wage is raised, Kentucky would be required to follow suit, potentially bypassing the need for state-specific legislation. However, the likelihood and timing of a federal minimum wage increase are currently unclear.

Additionally, Kentucky's business community and labor advocates will continue to play a significant role in shaping the state's minimum wage policies. As stakeholders engage in dialogue and present their cases, the state's leaders will need to balance the interests of various groups to reach a decision that promotes economic growth and fairness.

What is the current minimum wage in Kentucky as of 2023?

+As of my last update in January 2023, the minimum wage in Kentucky is $7.25 per hour, which is the same as the federal minimum wage.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any minimum wage exemptions in Kentucky?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Kentucky has exemptions for certain categories of workers, including tipped employees and students. Tipped employees are paid a lower wage rate, and students can be paid a reduced wage for the first 90 days of employment.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does Kentucky's minimum wage compare to other states?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Kentucky's minimum wage is on the lower end compared to many other states. As of 2023, several states have minimum wages significantly higher than Kentucky's $7.25 rate. Some states have set their minimum wage at $15 per hour or more.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the potential impacts of a minimum wage increase in Kentucky?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>A minimum wage increase could have both positive and negative impacts. Benefits include increased purchasing power for workers, reduced income inequality, and improved worker retention. Challenges may include increased labor costs for businesses, potential job losses, and reduced competitiveness for Kentucky businesses.</p>

</div>

</div>

</div>