Fort Knox Federal Credit Union: Your Guide To Secure And Convenient Banking

Welcome to the ultimate guide to Fort Knox Federal Credit Union, a financial institution renowned for its dedication to secure and convenient banking services. With a rich history spanning over [number] years, Fort Knox FCU has established itself as a trusted partner for individuals and businesses seeking a safe and reliable banking experience. In this comprehensive guide, we will delve into the various aspects of Fort Knox FCU, exploring its history, services, security measures, and the benefits it offers to its members.

A Legacy of Trust: The History of Fort Knox FCU

Fort Knox Federal Credit Union was founded in [year] with a vision to provide financial services to the employees of [founding organization/company]. Over the decades, the credit union has expanded its reach, welcoming members from diverse backgrounds and offering a wide range of banking solutions. Today, Fort Knox FCU boasts a strong presence in [locations], serving a growing community of satisfied members.

The credit union's commitment to its members is rooted in its cooperative philosophy, prioritizing the financial well-being of individuals and fostering a sense of community. Fort Knox FCU's mission is to empower its members by offering competitive rates, personalized service, and a secure banking environment.

Key Milestones in Fort Knox FCU’s Journey

-

[Year]: Fort Knox FCU expanded its services to include small business loans, recognizing the importance of supporting local entrepreneurs.

-

[Year]: The credit union introduced innovative online banking platforms, allowing members to manage their finances conveniently from anywhere.

-

[Year]: Fort Knox FCU celebrated its [anniversary] by launching a community outreach program, aiming to give back to the local population through financial education and support.

-

[Year]: With a focus on sustainability, the credit union implemented eco-friendly practices, reducing its environmental footprint and setting an example for the industry.

A Wide Array of Banking Services

Fort Knox Federal Credit Union understands that every member has unique financial needs. As such, it offers a comprehensive suite of banking services to cater to a diverse range of requirements.

Checking and Savings Accounts

Fort Knox FCU provides its members with a variety of checking and savings account options. From basic accounts with no minimum balance requirements to high-yield savings accounts, members can choose the option that best suits their financial goals.

Additionally, the credit union offers convenient features such as mobile check deposit, online bill payment, and overdraft protection to enhance the overall banking experience.

Loans and Mortgages

Whether you’re looking to purchase a new home, refinance an existing mortgage, or obtain a personal loan, Fort Knox FCU has got you covered. The credit union offers competitive interest rates and flexible repayment terms, ensuring that members can access the funds they need without compromising their financial stability.

Fort Knox FCU's mortgage specialists guide members through the entire process, providing expert advice and ensuring a smooth and stress-free experience.

Investment and Retirement Planning

Planning for the future is essential, and Fort Knox FCU recognizes this by offering a range of investment and retirement planning services. Members can seek advice from certified financial planners who can help them create tailored investment strategies and retirement plans.

The credit union also provides access to a variety of investment options, including stocks, bonds, mutual funds, and more, allowing members to grow their wealth and secure their financial future.

Business Banking Solutions

Fort Knox FCU understands the unique needs of small businesses and offers specialized business banking services. From business checking and savings accounts to business loans and merchant services, the credit union supports entrepreneurs in every stage of their business journey.

With Fort Knox FCU's business banking solutions, entrepreneurs can focus on growing their ventures while benefiting from competitive rates and personalized support.

Security: A Top Priority at Fort Knox FCU

At Fort Knox Federal Credit Union, security is not just a priority; it’s a cornerstone of their operations. The credit union employs state-of-the-art security measures to protect its members’ financial information and assets.

Advanced Encryption and Authentication

Fort Knox FCU utilizes advanced encryption technologies to safeguard online transactions and member data. Whether it’s logging into your account or making a payment, your information is encrypted, ensuring that it remains confidential and secure.

Additionally, the credit union employs multi-factor authentication methods, requiring members to provide additional verification steps beyond their passwords. This adds an extra layer of security, making it extremely difficult for unauthorized individuals to access member accounts.

Fraud Detection and Prevention

Fort Knox FCU has implemented robust fraud detection systems to monitor and identify any suspicious activity. The credit union’s dedicated fraud prevention team works tirelessly to protect members from potential scams and fraudulent activities.

Members are also provided with tools and resources to help them recognize and report potential fraud, ensuring a collaborative approach to maintaining a secure banking environment.

Secure Mobile Banking

With the increasing reliance on mobile banking, Fort Knox FCU has prioritized the security of its mobile platforms. The credit union’s mobile apps are designed with security in mind, featuring biometric authentication and secure data storage.

Members can rest assured that their financial information is protected even when accessing their accounts on the go.

The Benefits of Being a Fort Knox FCU Member

Becoming a member of Fort Knox Federal Credit Union offers a range of advantages that go beyond traditional banking services.

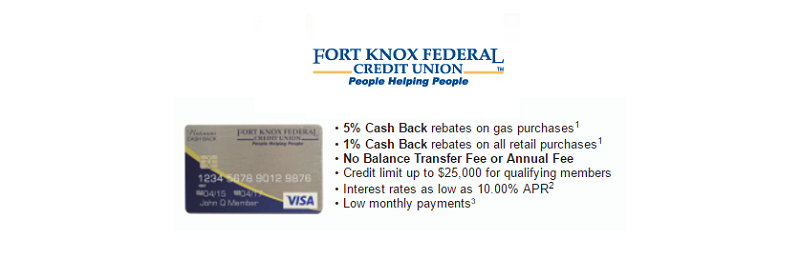

Competitive Rates and Fees

Fort Knox FCU is committed to offering competitive interest rates on loans and savings accounts, ensuring that members can maximize their earnings and minimize their borrowing costs.

Additionally, the credit union strives to keep fees low, providing members with affordable banking solutions without compromising on quality.

Personalized Service and Expert Advice

One of the key strengths of Fort Knox FCU is its focus on personalized service. Members can expect dedicated support from knowledgeable staff who are readily available to assist with any financial queries or concerns.

Whether it's opening an account, applying for a loan, or seeking investment advice, Fort Knox FCU's experts are committed to providing tailored solutions that align with each member's unique financial goals.

Community Involvement and Give-Back Programs

Fort Knox FCU believes in giving back to the communities it serves. The credit union actively participates in local initiatives, supporting causes that promote financial literacy, education, and overall well-being.

Through various community outreach programs, Fort Knox FCU aims to make a positive impact and create a brighter future for the regions it operates in.

A Strong Sense of Community

Being a member of a credit union fosters a sense of community and belonging. Fort Knox FCU members enjoy the benefits of a supportive network, where they can connect with like-minded individuals and share financial experiences and insights.

The credit union's events, workshops, and educational resources further enhance this sense of community, creating a vibrant and engaged membership base.

The Future of Fort Knox FCU: Innovation and Growth

As the financial landscape continues to evolve, Fort Knox Federal Credit Union remains dedicated to staying at the forefront of innovation. The credit union is constantly exploring new technologies and digital solutions to enhance the member experience.

With a focus on continuous improvement, Fort Knox FCU aims to expand its reach, offering even more convenient and secure banking services to a wider audience. The credit union's commitment to its members and the communities it serves remains unwavering, ensuring a bright and prosperous future.

How can I become a member of Fort Knox FCU?

+Membership in Fort Knox Federal Credit Union is open to individuals who meet specific eligibility criteria. To become a member, you must have a connection to the credit union's field of membership, which includes employees of certain organizations, residents of specific communities, or members of select groups. Once you meet the eligibility requirements, you can apply for membership online or by visiting a branch location.

What are the benefits of choosing a credit union over a traditional bank?

+Credit unions, like Fort Knox FCU, are known for their focus on member satisfaction and community involvement. They often offer more personalized service, lower fees, and competitive rates compared to traditional banks. Additionally, credit unions are not-for-profit institutions, which means any excess earnings are returned to members in the form of better rates and enhanced services.

How does Fort Knox FCU ensure the security of my financial information?

+Fort Knox FCU takes the security of its members' financial information very seriously. The credit union employs advanced encryption technologies, multi-factor authentication, and robust fraud detection systems to protect your data. Additionally, the credit union's staff is trained to handle sensitive information with the utmost care and confidentiality.

In conclusion, Fort Knox Federal Credit Union stands as a beacon of secure and convenient banking. With its rich history, comprehensive suite of services, and unwavering commitment to security, the credit union has earned the trust of its members. By prioritizing personalized service, community involvement, and innovation, Fort Knox FCU continues to thrive, offering a bright and stable financial future to its valued members.