Duncanville's Navy Federal: A Comprehensive Guide To Banking Benefits

Duncanville's Navy Federal Credit Union is a financial institution with a rich history and a unique mission to serve those who serve our country. With a focus on military personnel and their families, Navy Federal has become a trusted banking partner, offering a wide range of financial services and benefits. In this comprehensive guide, we will explore the various aspects of Duncanville's Navy Federal, including its history, services, and the advantages it provides to its members.

A Legacy of Service: The History of Navy Federal

Navy Federal Credit Union was founded in 1933 during the depths of the Great Depression. It began as a small, grassroots organization with a simple goal: to provide financial services to the members of the U.S. Navy and their families. Over the years, the credit union has grown exponentially, now serving over 11 million members and boasting assets of over $143 billion.

The credit union's humble beginnings can be traced back to the Navy Relief Society, which was established to offer financial assistance to sailors and their families. This early organization laid the foundation for what would become Navy Federal, with a focus on community, support, and financial well-being.

One of the key figures in Navy Federal's history is the late C.W. "Bill" Jenkins, who served as the credit union's first president. Jenkins, a retired Navy officer, played a pivotal role in shaping the organization's mission and values, ensuring that it remained true to its roots and dedicated to serving the military community.

A Diverse Range of Banking Services

Navy Federal offers a comprehensive suite of banking services tailored to meet the unique needs of its members. From everyday banking essentials to specialized financial products, the credit union provides a wide array of options.

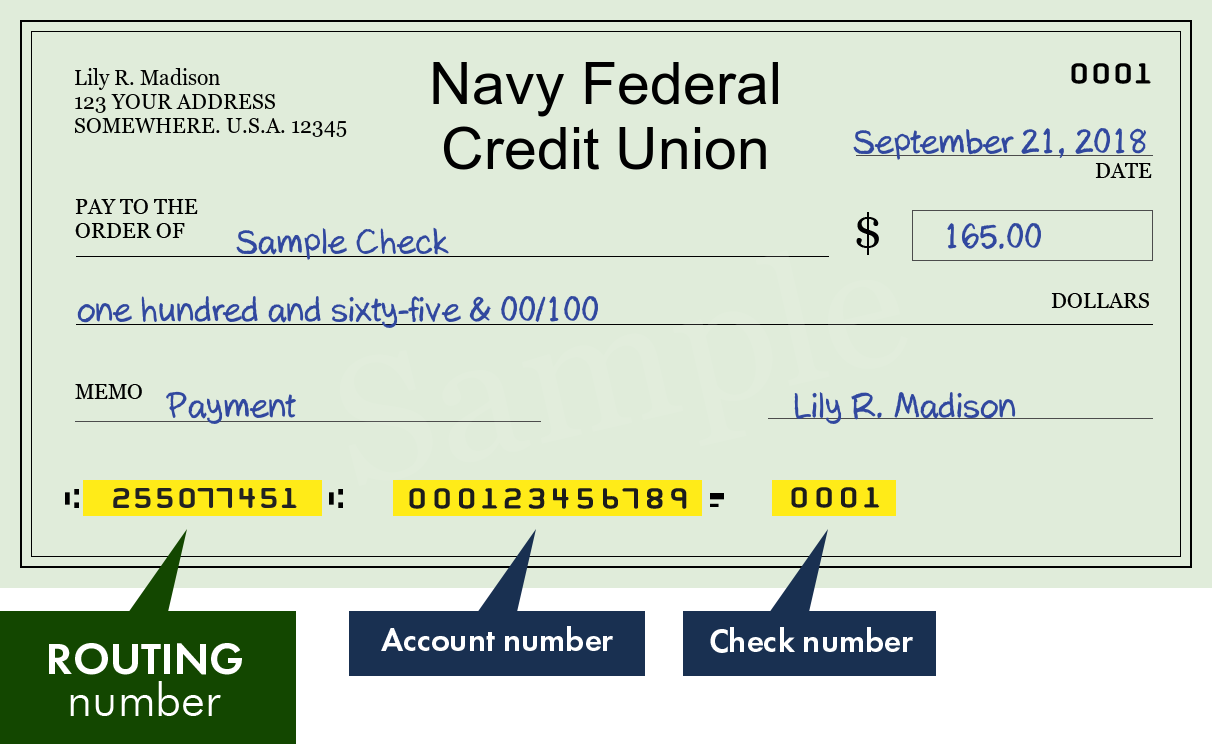

Checking and Savings Accounts

Navy Federal provides various checking and savings account options to cater to different financial needs. The credit union’s flagship checking account, the Navy Federal Share Savings Account, requires a low minimum balance and offers competitive interest rates. Additionally, Navy Federal offers high-yield savings accounts, such as the Navy Federal Money Market Account, which provides a higher interest rate for larger balances.

For those with specific savings goals, Navy Federal also offers specialized accounts like the Holiday Savings Account, which helps members save for seasonal expenses, and the Vacation Savings Account, designed for those planning their dream getaways.

Loans and Mortgages

When it comes to borrowing, Navy Federal offers competitive loan and mortgage products. The credit union’s Personal Loan options provide flexible terms and low interest rates, making it easier for members to consolidate debt or finance major purchases. Navy Federal also offers a range of Home Loan options, including VA loans, which are specifically designed for military personnel and veterans.

The credit union's Mortgage Center provides a streamlined process for home buying, refinancing, and renovation loans. With a dedicated team of mortgage specialists, Navy Federal ensures a smooth and efficient experience for its members.

Credit Cards and Rewards

Navy Federal’s credit card offerings are designed to reward members for their everyday spending. The More Rewards American Express Card, for instance, offers points for every purchase, which can be redeemed for travel, cash back, or merchandise. The CashRewards Visa Signature Card provides members with cash back on their purchases, making it an attractive option for those who prefer more immediate rewards.

Navy Federal also introduces limited-time credit card promotions, such as the Platinum Rewards Card, which offers double points on eligible purchases for a limited period.

Online and Mobile Banking

In today’s digital age, Navy Federal has invested significantly in its online and mobile banking platforms. Members can access their accounts, transfer funds, pay bills, and manage their finances conveniently through the Navy Federal Mobile App or the credit union’s Online Banking portal.

The app and online platform offer real-time account updates, secure messaging with customer support, and the ability to deposit checks remotely, ensuring that members can manage their finances on the go.

The Advantages of Being a Navy Federal Member

Beyond the comprehensive range of banking services, Navy Federal offers a host of benefits and advantages to its members. These perks are designed to enhance the financial well-being of military personnel and their families, providing added value and peace of mind.

Discounts and Rewards

Navy Federal partners with various businesses and organizations to offer exclusive discounts and rewards to its members. Through the Navy Federal Perks program, members can access discounts on travel, entertainment, shopping, and more. Additionally, the credit union’s Rewards Center provides members with opportunities to redeem their rewards points for a wide range of merchandise and experiences.

Financial Education and Resources

Navy Federal is committed to empowering its members with financial knowledge and resources. The credit union offers a wealth of educational materials, including articles, webinars, and workshops, covering topics such as budgeting, investing, and credit management. These resources are designed to help members make informed financial decisions and achieve their long-term goals.

Community Support and Giving Back

Navy Federal has a strong commitment to giving back to the communities it serves. The credit union supports various charitable initiatives and organizations, with a particular focus on military-related causes. Through its Community Giving program, Navy Federal has donated millions of dollars to support military families, veterans, and other community organizations.

Additionally, Navy Federal actively promotes volunteerism among its employees, encouraging them to contribute their time and skills to make a positive impact in their local communities.

Military-Friendly Benefits

As a credit union dedicated to serving the military community, Navy Federal offers a range of benefits specifically tailored to the unique needs of military personnel and their families. These include:

- VA Loan Benefits: Navy Federal provides expert guidance and support for members interested in VA loans, helping them navigate the process and take advantage of the benefits offered by the U.S. Department of Veterans Affairs.

- Military Pay Deposit: Members can have their military pay directly deposited into their Navy Federal accounts, ensuring timely and convenient access to their funds.

- Deployment Services: The credit union offers specialized support for members who are deployed, including account monitoring, bill payment assistance, and financial counseling to help manage finances during their time away.

The Future of Navy Federal: Innovation and Growth

Navy Federal continues to innovate and adapt to the evolving needs of its members. With a focus on technology and digital transformation, the credit union is investing in new platforms and services to enhance the member experience.

One of the key areas of focus is digital banking, with Navy Federal aiming to provide even more robust and secure online and mobile banking solutions. The credit union is also exploring blockchain technology and cryptocurrency to offer members new and secure ways to manage their finances.

Additionally, Navy Federal is committed to expanding its physical presence, with plans to open new branches and ATM locations across the country. This expansion will ensure that members have convenient access to their financial services, regardless of their location.

Sustainable and Ethical Practices

Navy Federal is dedicated to operating in a sustainable and ethical manner. The credit union has implemented various initiatives to reduce its environmental impact, including energy-efficient practices and the use of renewable resources. Additionally, Navy Federal promotes ethical lending practices, ensuring that its members receive fair and transparent financial services.

Member Feedback and Improvement

Navy Federal places a strong emphasis on member feedback and continuously strives to improve its services. The credit union actively seeks input from its members through surveys, focus groups, and feedback channels, ensuring that its products and services remain aligned with the needs and expectations of the military community.

Conclusion: A Trusted Financial Partner

Duncanville’s Navy Federal Credit Union has a rich history of serving the military community with dedication and integrity. Through its comprehensive range of banking services, competitive loan products, and member-centric benefits, Navy Federal has established itself as a trusted financial partner for millions of military personnel and their families.

As the credit union continues to innovate and adapt, it remains focused on its core values of community, support, and financial well-being. With a strong commitment to its members and a dedication to giving back, Navy Federal is well-positioned to serve the financial needs of the military community for years to come.

How can I become a member of Navy Federal Credit Union?

+To become a member of Navy Federal Credit Union, you must meet specific eligibility criteria. Generally, membership is open to active duty military, veterans, DoD civilians, and their family members. You can apply for membership online or visit a local branch to complete the process.

<div class="faq-item">

<div class="faq-question">

<h3>What are the benefits of a Navy Federal VA Loan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Navy Federal's VA Loans offer several benefits, including no down payment requirement, competitive interest rates, and flexible terms. These loans are specifically designed to help military personnel and veterans achieve their homeownership goals.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Does Navy Federal offer student loans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Navy Federal offers a range of student loan options, including private student loans and parent loans. These loans provide competitive interest rates and flexible repayment terms to help members finance their education.</p>

</div>

</div>

</div>