Dot Dot Loans: A Comprehensive Guide To Navigating Your Financial Journey

In the realm of personal finance, Dot Dot Loans has emerged as a trusted partner for individuals seeking accessible and transparent lending solutions. This comprehensive guide aims to provide an in-depth exploration of Dot Dot Loans, offering valuable insights into its services, benefits, and the impact it has on the financial journeys of its customers.

Understanding Dot Dot Loans: A Vision for Financial Accessibility

Dot Dot Loans is a pioneering lending platform that has revolutionized the personal loan industry. With a focus on transparency, simplicity, and customer-centric practices, Dot Dot Loans has carved a unique niche in the market. Their mission is to empower individuals by providing them with the financial tools they need to achieve their goals, whether it’s consolidating debt, covering unexpected expenses, or making significant purchases.

One of the key strengths of Dot Dot Loans lies in its commitment to ethical lending practices. The platform prioritizes responsible borrowing by offering flexible loan terms, competitive interest rates, and a straightforward application process. This approach ensures that borrowers have a clear understanding of their financial obligations and are empowered to make informed decisions.

The Dot Dot Loans Difference: A Comparative Analysis

In an increasingly competitive lending landscape, Dot Dot Loans stands out for several reasons. Firstly, their emphasis on transparency sets them apart. Unlike some lenders who may hide fees or present complex loan structures, Dot Dot Loans provides clear and concise information, ensuring borrowers know exactly what they’re signing up for.

Secondly, Dot Dot Loans offers a personalized borrowing experience. Recognizing that every borrower's financial situation is unique, they tailor their loan offerings to individual needs. This personalized approach ensures that borrowers receive the most suitable loan terms, promoting financial stability and peace of mind.

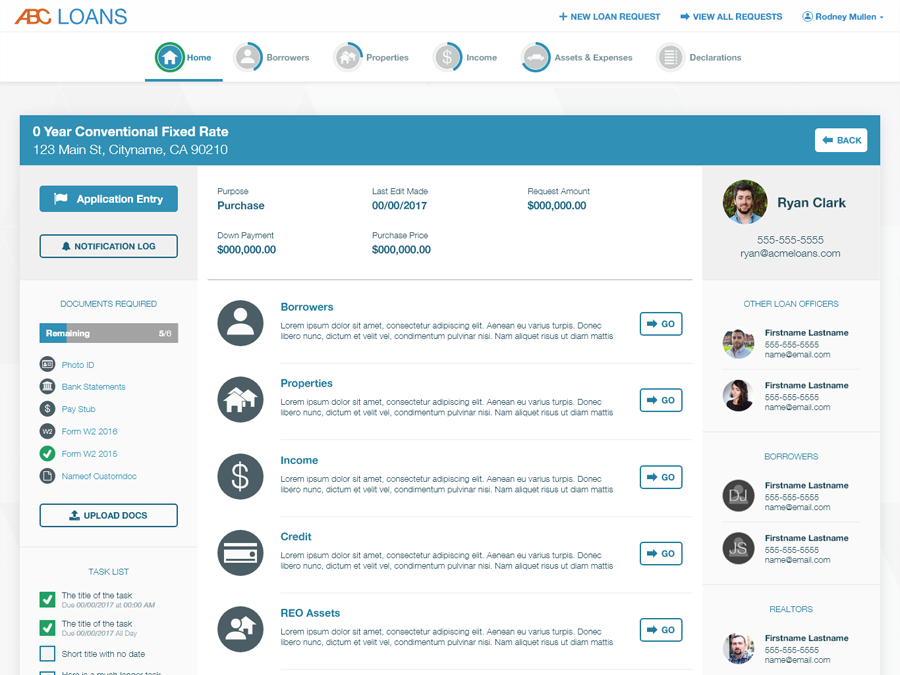

Furthermore, Dot Dot Loans boasts a robust online platform that simplifies the entire loan process. From application to repayment, borrowers can manage their loans efficiently and securely. This digital approach not only enhances convenience but also streamlines the lending process, making it more accessible to a wider range of individuals.

Key Features and Benefits of Dot Dot Loans

Dot Dot Loans offers a range of features and benefits that contribute to its reputation as a trusted lending partner. Here’s an overview of some of its standout attributes:

- Competitive Interest Rates: Dot Dot Loans is known for offering competitive interest rates, ensuring that borrowers can access affordable financing options. By maintaining a balanced approach between profitability and customer satisfaction, they provide rates that are both fair and attractive.

- Flexible Loan Terms: Understanding that every borrower's financial journey is unique, Dot Dot Loans offers flexible loan terms. Borrowers can choose loan durations that align with their repayment capabilities, promoting financial stability and avoiding unnecessary strain on their budgets.

- Quick and Efficient Application Process: In today's fast-paced world, time is of the essence. Dot Dot Loans recognizes this and has streamlined its application process to be quick and efficient. Borrowers can complete the application online, receiving a decision promptly, which allows them to access funds when they need them most.

- Transparent Fee Structure: Transparency is at the core of Dot Dot Loans' values. They provide a clear breakdown of all fees associated with the loan, ensuring borrowers have a comprehensive understanding of their financial obligations. This practice fosters trust and empowers borrowers to make informed choices.

- Excellent Customer Support: Dot Dot Loans understands the importance of exceptional customer support. Their dedicated team is readily available to assist borrowers throughout the loan process, providing guidance, answering queries, and ensuring a smooth and positive borrowing experience.

Case Study: How Dot Dot Loans Transformed a Customer’s Financial Journey

To illustrate the impact of Dot Dot Loans, let’s consider the story of Sarah, a young professional facing financial challenges. Sarah had accumulated high-interest debt through multiple credit cards, making it difficult to manage her monthly repayments. After exploring various options, she discovered Dot Dot Loans and decided to consolidate her debt with a personal loan.

With Dot Dot Loans, Sarah was able to secure a loan with a competitive interest rate and a flexible repayment plan. The transparent fee structure and clear terms gave her peace of mind, knowing exactly what she was committing to. The efficient application process allowed her to receive the funds promptly, enabling her to pay off her high-interest debt and start her journey towards financial freedom.

As Sarah made her repayments, she appreciated the convenience of the online platform, which allowed her to track her progress and manage her loan effortlessly. The excellent customer support team was always available to address her queries, providing her with the guidance and reassurance she needed.

Thanks to Dot Dot Loans, Sarah was able to regain control of her finances, reduce her overall interest burden, and work towards a brighter financial future. Her experience highlights the transformative power of Dot Dot Loans in empowering individuals to take charge of their financial journeys.

The Impact of Dot Dot Loans on the Lending Landscape

Dot Dot Loans has had a significant impact on the lending landscape, driving positive change and setting new standards for the industry. Its commitment to ethical lending practices and customer-centric approaches has influenced other lenders to adopt similar principles, fostering a more responsible and borrower-friendly lending environment.

By prioritizing transparency, flexibility, and accessibility, Dot Dot Loans has become a trusted ally for individuals seeking financial solutions. Its impact extends beyond individual borrowers, contributing to the overall financial well-being of communities and promoting economic stability.

Expanding Horizons: The Future of Dot Dot Loans

Looking ahead, Dot Dot Loans is poised for continued growth and innovation. With a strong foundation built on trust and customer satisfaction, the platform is well-positioned to expand its services and reach a wider audience.

Dot Dot Loans is committed to staying at the forefront of technological advancements, continuously enhancing its online platform to provide an even more seamless and secure borrowing experience. The introduction of new features, such as mobile-optimized applications and enhanced security measures, will further solidify its position as a leading lending platform.

Additionally, Dot Dot Loans recognizes the importance of financial education and empowerment. The platform aims to empower borrowers with valuable resources and tools to make informed financial decisions. By providing educational content, budgeting tips, and debt management strategies, Dot Dot Loans aims to foster a culture of financial literacy and long-term financial success.

Conclusion: Navigating Your Financial Journey with Confidence

In conclusion, Dot Dot Loans stands as a beacon of trust and reliability in the personal loan industry. Its commitment to ethical lending practices, transparency, and customer-centric approaches has made it a preferred choice for individuals seeking financial solutions. By offering competitive rates, flexible terms, and an efficient application process, Dot Dot Loans empowers borrowers to take control of their financial journeys.

As Dot Dot Loans continues to innovate and expand its services, it remains dedicated to its core values of transparency, accessibility, and borrower empowerment. With its impact on the lending landscape and its commitment to financial education, Dot Dot Loans is well-positioned to support individuals in achieving their financial goals and building a secure future.

What makes Dot Dot Loans different from traditional lenders?

+Dot Dot Loans distinguishes itself from traditional lenders through its emphasis on transparency, personalized loan offerings, and a streamlined digital platform. Their commitment to ethical lending practices and customer-centric approach sets them apart, ensuring borrowers receive fair and tailored financial solutions.

How can I apply for a loan with Dot Dot Loans?

+Applying for a loan with Dot Dot Loans is straightforward. Simply visit their website, navigate to the “Apply Now” section, and follow the step-by-step instructions. The online application process is quick and efficient, allowing you to receive a decision promptly.

What are the eligibility criteria for a Dot Dot Loans personal loan?

+To be eligible for a Dot Dot Loans personal loan, you must meet certain criteria, including being a UK resident, over the age of 18, and having a regular income. Additionally, you’ll need to provide proof of identity and address. It’s recommended to check their website for detailed eligibility requirements.

Can I repay my Dot Dot Loans early without any penalties?

+Yes, Dot Dot Loans understands the importance of financial flexibility. You have the option to repay your loan early without incurring any additional fees or penalties. This feature allows you to manage your finances efficiently and potentially save on interest.

How does Dot Dot Loans ensure data security and privacy?

+Dot Dot Loans prioritizes data security and privacy. They employ robust encryption technologies to protect your personal information during the application and repayment processes. Additionally, they adhere to strict data protection regulations to ensure your data remains secure.