Adm Cash Bids: Maximise Returns With Strategic Bidding

In the world of finance and investment, the concept of Adm Cash Bids plays a crucial role in optimizing returns and managing risk. This strategy involves a thoughtful approach to bidding in the market, considering various factors to enhance overall portfolio performance. Understanding the intricacies of Adm Cash Bids is essential for investors seeking to maximize their returns while mitigating potential drawbacks.

Understanding Adm Cash Bids

Adm Cash Bids, an integral part of the financial market, refer to the process of placing bids for cash-based investments, primarily in the form of bonds, treasury bills, and other fixed-income securities. These bids are strategically placed to acquire assets at the most favorable price, considering market conditions, interest rates, and the investor’s financial goals.

The core objective of Adm Cash Bids is to ensure that investors can acquire high-quality, secure investments at competitive prices, thereby optimizing their returns. This strategy is particularly beneficial in a volatile market, where timely and strategic bidding can provide a significant advantage.

Key Factors Influencing Adm Cash Bids

- Market Conditions: The state of the financial market, including interest rates, economic indicators, and market sentiment, significantly impacts the effectiveness of Adm Cash Bids. For instance, in a low-interest-rate environment, investors may need to be more aggressive with their bids to secure attractive returns.

- Investment Goals: Understanding the investor’s financial goals is crucial. Whether the focus is on capital preservation, income generation, or growth, it guides the strategy and risk tolerance associated with Adm Cash Bids.

- Risk Management: Adm Cash Bids should be carefully managed to avoid excessive risk. This involves diversifying investments, considering credit quality, and monitoring market trends to ensure that bids align with the investor’s risk appetite.

The Strategic Approach to Adm Cash Bids

Maximizing returns through Adm Cash Bids requires a well-thought-out strategy. Here are some key considerations for a successful bidding approach:

Timing is Crucial

The timing of bids can significantly impact their success. Waiting for the right moment, whether it’s during a market downturn or a period of stability, can lead to more favorable outcomes. For instance, bidding during a market correction can result in acquiring assets at a discount, providing an opportunity for long-term capital appreciation.

Diversification and Risk Management

A diversified portfolio is essential for mitigating risk. Adm Cash Bids should consider a range of assets, including different bond types, maturities, and credit ratings. This approach ensures that the portfolio is not overly exposed to any single risk factor, providing a more stable and resilient investment strategy.

Monitoring and Adjusting

Adm Cash Bids is an ongoing process that requires regular monitoring and adjustment. Market conditions, interest rates, and economic indicators can change rapidly, necessitating a dynamic approach to bidding. Investors should regularly review their portfolio, assess its performance, and make necessary adjustments to stay aligned with their financial goals.

| Strategy | Key Benefits |

|---|---|

| Strategic Timing | Acquiring assets at favorable prices, especially during market corrections. |

| Diversification | Reducing risk exposure and enhancing portfolio stability. |

| Active Monitoring | Ensuring that the portfolio remains aligned with financial goals and market trends. |

Real-World Applications and Success Stories

Adm Cash Bids have proven to be an effective strategy for investors seeking to optimize their returns. Here are some real-world examples:

Case Study: Institutional Investor’s Success

A large institutional investor, aiming to enhance its fixed-income portfolio, employed a strategic Adm Cash Bids approach. By carefully timing their bids during a period of market volatility, they were able to acquire high-quality bonds at discounted prices. This strategy not only reduced their average cost but also positioned them for significant capital gains as the market recovered.

Individual Investor’s Journey

For an individual investor with a conservative approach, Adm Cash Bids offered a way to generate stable income. By focusing on short-term treasury bills and diversifying across different maturities, they were able to achieve a consistent income stream while maintaining a low-risk profile. This strategy provided a reliable source of income, especially during periods of market uncertainty.

Future Outlook and Potential Innovations

As the financial market continues to evolve, Adm Cash Bids are expected to play an even more significant role. Here’s a glimpse into the future:

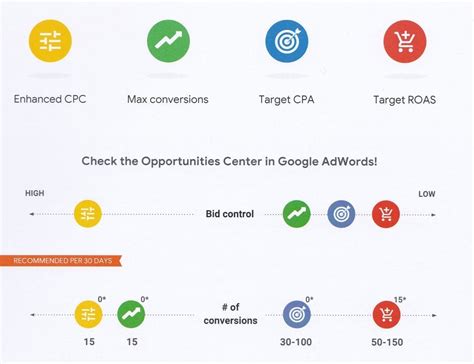

Technology and Automation

Advancements in technology are likely to enhance the Adm Cash Bids process. Automated bidding systems, powered by sophisticated algorithms, can analyze market data in real-time, making split-second decisions to place bids. This level of efficiency and speed can provide a competitive edge to investors.

Sustainable and Impact Investing

With a growing focus on sustainability and impact investing, Adm Cash Bids could be tailored to align with these principles. Investors may seek to bid on securities that not only offer financial returns but also have a positive environmental or social impact. This approach can attract a new generation of investors who prioritize sustainability in their investment decisions.

What are the potential risks associated with Adm Cash Bids?

+While Adm Cash Bids offer significant advantages, there are potential risks. These include market volatility, interest rate fluctuations, and credit risk. Investors should carefully assess these risks and implement appropriate risk management strategies to mitigate potential losses.

How can investors stay updated with market trends for effective Adm Cash Bids?

+Staying informed is crucial. Investors can leverage various resources, including financial news platforms, economic reports, and market analysis tools. Additionally, consulting with financial advisors or investment professionals can provide valuable insights into market trends and bidding strategies.

In conclusion, Adm Cash Bids present a strategic opportunity for investors to maximize returns and manage risk effectively. By understanding the key factors, employing a thoughtful approach, and staying informed about market trends, investors can navigate the financial market with confidence and success.