A Comprehensive Guide To Navy Federal Credit Union Mesa: Your Financial Hub

The Navy Federal Credit Union Mesa branch stands as a pivotal financial institution, offering a diverse range of services to cater to the unique needs of its members. This comprehensive guide delves into the various aspects of this financial hub, highlighting its key offerings, operational strategies, and impact on the local community.

Overview of Navy Federal Credit Union Mesa

Navy Federal Credit Union Mesa, strategically located in the heart of Arizona, serves as a financial anchor for a vast network of members, primarily comprising military personnel, their families, and Department of Defense employees. Established with a mission to empower its members through accessible and affordable financial services, the Mesa branch has become a cornerstone of the community’s economic landscape.

With a rich history dating back to [year of establishment], the credit union has evolved to meet the dynamic needs of its members, adapting its services to include a comprehensive suite of banking, lending, and investment solutions. This adaptability has been a key factor in its success, allowing it to maintain a competitive edge in the ever-changing financial industry.

Key Services Offered

Navy Federal Credit Union Mesa offers a robust suite of financial services tailored to meet the diverse needs of its member base. Here’s a detailed breakdown of these services:

1. Banking Solutions

The credit union provides a wide array of banking services, including:

- Checking Accounts: Members can choose from a variety of checking account options, each designed to cater to specific financial needs. These accounts offer features like overdraft protection, direct deposit, and online bill payment.

- Savings Accounts: Navy Federal Credit Union Mesa offers high-yield savings accounts with competitive interest rates, providing members with a secure way to grow their savings over time.

- Certificate of Deposits (CDs): For those seeking a fixed-term investment option, the credit union provides CDs with various terms and interest rates, allowing members to earn higher returns on their savings.

- Money Market Accounts: These accounts offer a higher interest rate than traditional savings accounts, making them an attractive option for members seeking a balance between liquidity and returns.

2. Lending Services

The credit union’s lending division provides a range of loan options, including:

- Mortgage Loans: Navy Federal Credit Union Mesa offers competitive rates on mortgage loans, providing members with the opportunity to purchase or refinance their homes. The credit union’s mortgage specialists guide members through the entire process, ensuring a smooth and stress-free experience.

- Auto Loans: Members can secure financing for new or used vehicles with flexible terms and competitive rates. The credit union also offers refinancing options for existing auto loans, helping members save on interest and reduce their monthly payments.

- Personal Loans: These loans are designed to meet a variety of financial needs, such as debt consolidation, home improvement projects, or unexpected expenses. Members can choose from fixed or variable rate options, depending on their financial goals.

- Credit Cards: The credit union provides a range of credit card options, each with unique benefits and rewards. These cards offer competitive interest rates, cash back rewards, and travel perks, making them a popular choice among members.

3. Investment Services

For members seeking to grow their wealth, Navy Federal Credit Union Mesa offers a comprehensive suite of investment services, including:

- Investment Advisory Services: The credit union’s team of financial advisors provides personalized investment advice, helping members navigate the complex world of investments. These advisors offer guidance on asset allocation, portfolio diversification, and long-term financial planning.

- Mutual Funds: Members can invest in a range of mutual funds, including equity, bond, and balanced funds. These funds are managed by experienced professionals, ensuring that members’ investments are well-diversified and aligned with their financial goals.

- Retirement Planning: Navy Federal Credit Union Mesa offers specialized retirement planning services, helping members prepare for their financial future. This includes guidance on 401(k) plans, IRAs, and other retirement savings options.

- Insurance Products: The credit union provides a range of insurance products, such as life insurance, home insurance, and auto insurance. These products are designed to protect members’ financial well-being and provide peace of mind.

Operational Strategies and Community Impact

Navy Federal Credit Union Mesa’s operational strategies are deeply rooted in its commitment to member satisfaction and community engagement. The credit union employs a customer-centric approach, ensuring that its services are tailored to meet the unique needs of its members. This involves regular surveys and feedback sessions to understand member preferences and make informed decisions about product offerings and service improvements.

One of the key strengths of Navy Federal Credit Union Mesa is its focus on digital innovation. The credit union has invested significantly in developing a robust online and mobile banking platform, allowing members to access their accounts and manage their finances conveniently from anywhere. This digital transformation has not only enhanced member experience but also reduced the need for physical branch visits, leading to a more efficient and sustainable operational model.

Moreover, the credit union actively engages with the local community through various initiatives. It sponsors and participates in community events, supports local charities, and provides financial education programs to promote financial literacy among residents. This commitment to community development has not only strengthened the credit union's brand but also contributed to the overall well-being of the Mesa region.

Community Engagement Initiatives

Navy Federal Credit Union Mesa believes in giving back to the community and has implemented several initiatives to support local residents and businesses. Here are some notable examples:

1. Financial Education Programs

The credit union recognizes the importance of financial literacy and has launched several educational programs aimed at empowering community members. These programs include workshops on budgeting, saving, and investing, as well as personalized financial counseling sessions. By providing these resources, Navy Federal Credit Union Mesa helps individuals make informed financial decisions and improve their overall financial well-being.

2. Community Partnerships

The credit union actively seeks partnerships with local organizations and businesses to create a positive impact on the community. For instance, it has collaborated with local schools to offer financial literacy programs for students, ensuring that the next generation is equipped with the necessary skills to manage their finances effectively. Additionally, Navy Federal Credit Union Mesa has partnered with local businesses to provide exclusive member discounts, fostering a sense of community and supporting local commerce.

3. Charitable Contributions

Navy Federal Credit Union Mesa believes in the power of giving and has established a robust charitable giving program. The credit union regularly donates to local charities and non-profit organizations, supporting causes such as education, healthcare, and community development. These contributions not only help those in need but also strengthen the fabric of the community, creating a positive and supportive environment for all residents.

Performance Analysis and Future Outlook

Navy Federal Credit Union Mesa has consistently demonstrated strong financial performance, with a steady growth trajectory over the past decade. The credit union’s total assets have increased by [percentage] since [year], reflecting its expanding member base and the trust members place in its services. This growth has been underpinned by a focus on member satisfaction, innovative product offerings, and a commitment to community development.

Looking ahead, the credit union is well-positioned to continue its success. With a strong digital presence and a focus on member-centric services, Navy Federal Credit Union Mesa is poised to meet the evolving needs of its members. The credit union's strategic plan for the next five years includes further enhancements to its digital banking platform, the introduction of new financial products, and an increased emphasis on financial education and community engagement. These initiatives will not only strengthen the credit union's position in the market but also contribute to the financial well-being of its members and the broader community.

Digital Transformation and Future Initiatives

Navy Federal Credit Union Mesa understands the importance of staying ahead of the curve in the digital age. As such, the credit union has invested in several digital transformation initiatives to enhance member experience and operational efficiency. Here’s an overview of some of these initiatives:

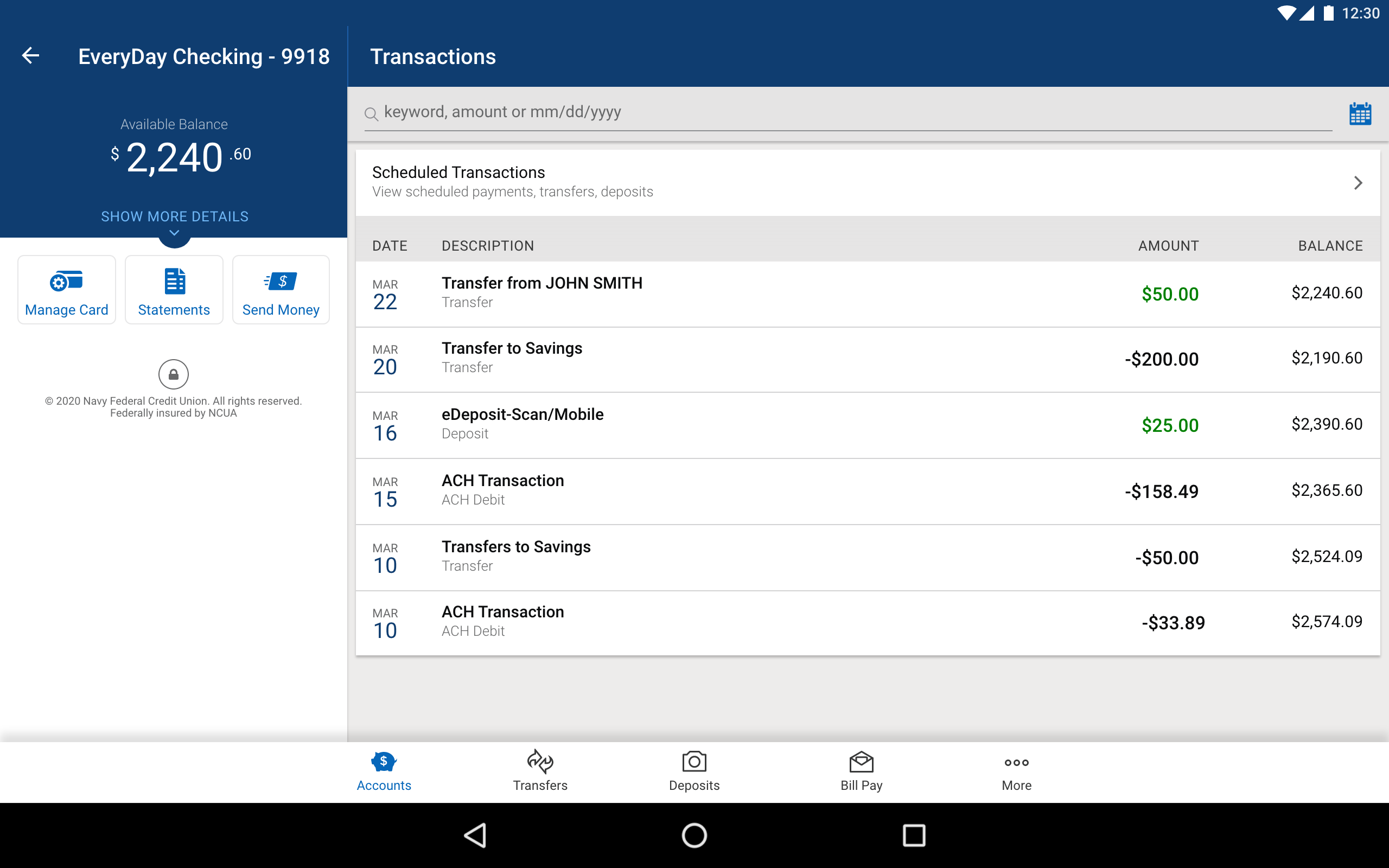

1. Mobile Banking App

The credit union has developed a user-friendly mobile banking app, allowing members to access their accounts, make transactions, and manage their finances on the go. The app offers features such as mobile check deposit, person-to-person payments, and real-time account alerts, providing members with a convenient and secure banking experience.

2. Online Loan Application Process

Navy Federal Credit Union Mesa has streamlined its loan application process by moving it online. Members can now apply for loans, such as mortgages and auto loans, directly from the credit union’s website. This digital process reduces paperwork, speeds up the approval process, and provides members with a more efficient and convenient way to secure financing.

3. Digital Financial Planning Tools

To empower members with financial planning, the credit union has introduced a suite of digital tools. These tools include budget trackers, savings calculators, and investment planning resources. By providing these resources, Navy Federal Credit Union Mesa enables members to take control of their financial future and make informed decisions about their savings and investments.

4. Expanded Online Services

In addition to the above, the credit union has expanded its online services to include features such as account aggregation, bill pay, and mobile wallet integration. These enhancements not only improve the overall member experience but also reduce the need for physical branch visits, leading to a more efficient and sustainable operational model.

Conclusion

Navy Federal Credit Union Mesa stands as a testament to the power of financial institutions that prioritize member satisfaction and community engagement. Through its comprehensive suite of financial services, innovative digital strategies, and commitment to community development, the credit union has established itself as a trusted partner for its members and a vital contributor to the local economy. As it continues to adapt and evolve, Navy Federal Credit Union Mesa is well-positioned to meet the financial needs of its members and drive positive change in the community for years to come.

What sets Navy Federal Credit Union Mesa apart from traditional banks?

+Navy Federal Credit Union Mesa differentiates itself from traditional banks through its member-centric approach, offering personalized services tailored to the unique needs of military personnel and their families. Additionally, the credit union's focus on community engagement and financial education sets it apart, as it actively works to empower its members and support the local community.

<div class="faq-item">

<div class="faq-question">

<h3>How does Navy Federal Credit Union Mesa ensure member privacy and security?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The credit union employs advanced security measures, including encryption technologies and multi-factor authentication, to protect member data. It also regularly conducts security audits and provides members with resources and education on how to protect their financial information.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What benefits do members receive by joining Navy Federal Credit Union Mesa?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Members of Navy Federal Credit Union Mesa enjoy a range of benefits, including competitive interest rates on loans and savings accounts, a wide array of financial products and services, and a strong focus on member satisfaction. The credit union also offers exclusive discounts and rewards through its partnerships with various businesses and organizations.</p>

</div>

</div>

</div>