20172024 Financial Planning: A Comprehensive Wealth Guide

Financial planning is an essential aspect of building and maintaining wealth, especially in the long term. As we move into the latter half of the 2020s, it is crucial to assess and adapt our financial strategies to navigate the changing economic landscape and achieve our long-term goals. This comprehensive guide aims to provide a detailed roadmap for financial planning between 2017 and 2024, offering insights and strategies to help individuals and families secure their financial future.

Setting the Foundation: Understanding Your Financial Position

The first step in effective financial planning is to gain a clear understanding of your current financial situation. This involves assessing your assets, liabilities, and cash flow. By evaluating your net worth and analyzing your income and expenses, you can identify areas where you may be overspending or where you can allocate funds more efficiently.

Assessing Your Net Worth

Calculating your net worth is a crucial step in financial planning. It involves subtracting your total liabilities (debts and obligations) from your total assets (property, investments, and other valuables). This figure provides a snapshot of your financial health and can help you make informed decisions about saving, investing, and budgeting.

| Asset Category | Value |

|---|---|

| Real Estate | $500,000 |

| Investments (Stocks, Bonds) | $250,000 |

| Retirement Accounts | $150,000 |

| Savings Accounts | $50,000 |

| Other Assets (e.g., Vehicles, Art) | $100,000 |

| Total Assets | $1,050,000 |

| Liability Category | Value |

|---|---|

| Mortgage | $300,000 |

| Credit Card Debt | $10,000 |

| Student Loans | $50,000 |

| Other Loans (e.g., Car Loans) | $20,000 |

| Total Liabilities | $380,000 |

In this example, the individual's net worth is calculated as $1,050,000 - $380,000 = $670,000. This positive net worth indicates a healthy financial position, but it is important to regularly update and monitor these figures to ensure continued financial stability.

Analyzing Income and Expenses

Understanding your income and expenses is vital for effective financial planning. It involves tracking your monthly income sources, such as salaries, investments, and business profits, and comparing them to your expenses, including fixed costs like rent or mortgage payments, utilities, and variable expenses like groceries, entertainment, and discretionary spending.

By creating a detailed budget, you can identify areas where you may be able to reduce expenses or increase savings. For example, you might discover that a significant portion of your income is going towards dining out or entertainment. By adjusting your spending habits and allocating more funds to savings or investments, you can work towards your long-term financial goals.

Developing a Comprehensive Financial Plan

Once you have a clear understanding of your financial position, it’s time to develop a comprehensive financial plan. This plan should outline your short-term and long-term goals, as well as the strategies you will employ to achieve them. It is essential to regularly review and update your plan to adapt to changing economic conditions and personal circumstances.

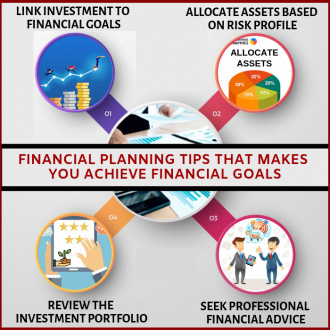

Defining Your Financial Goals

Setting clear and achievable financial goals is crucial for effective financial planning. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Some common financial goals include saving for a down payment on a home, funding a child’s education, building an emergency fund, or investing for retirement.

For example, if your goal is to save for a down payment on a home within the next five years, you would need to determine the amount you need to save each month to reach your target. This goal-setting process provides a clear direction for your financial plan and helps you stay motivated and focused on your long-term objectives.

Building an Emergency Fund

An emergency fund is a crucial component of any financial plan. It provides a safety net to cover unexpected expenses, such as medical emergencies, car repairs, or job loss. Financial experts typically recommend having three to six months’ worth of living expenses set aside in an easily accessible savings account.

For instance, if your monthly living expenses total $5,000, you should aim to have $15,000 to $30,000 in your emergency fund. This fund should be separate from your regular savings or investment accounts and should be readily available when needed. Building an emergency fund is a key step towards financial security and peace of mind.

Managing Debt and Credit

Effective debt management is essential for long-term financial health. It is important to distinguish between good debt (e.g., mortgages, student loans) and bad debt (e.g., high-interest credit card debt). While some debt may be necessary to achieve certain financial goals, it is crucial to ensure that it is manageable and does not become a burden.

If you have high-interest debt, such as credit card balances, it is advisable to prioritize paying off this debt before focusing on other financial goals. Consider consolidating your debt into a lower-interest loan or utilizing strategies like the "debt snowball" or "debt avalanche" methods to accelerate your debt repayment.

Investing for the Future

Investing is a critical aspect of building wealth over the long term. It involves allocating your savings into assets such as stocks, bonds, mutual funds, or real estate with the goal of generating returns that outpace inflation. While investing carries risk, a well-diversified portfolio can help mitigate these risks and provide the potential for significant growth.

When investing, it is important to consider your risk tolerance, time horizon, and investment goals. For example, if you are saving for retirement, you may opt for a more conservative investment strategy with a focus on capital preservation. On the other hand, if you are investing for a shorter-term goal, such as a down payment on a home, you may consider a more aggressive strategy with higher potential returns.

Retirement Planning

Retirement planning is a key component of financial planning, especially as life expectancies continue to increase. It involves estimating your retirement income needs, determining the necessary savings to meet those needs, and implementing strategies to maximize your retirement savings.

This may include contributing to employer-sponsored retirement plans, such as 401(k)s or defined benefit plans, or setting up individual retirement accounts (IRAs). It is important to understand the tax advantages and contribution limits associated with these accounts and to regularly review and adjust your retirement savings strategy as your circumstances change.

Estate Planning

Estate planning is an often-overlooked aspect of financial planning, but it is crucial for ensuring that your assets are distributed according to your wishes upon your death. This involves creating a will, establishing trusts, and appointing power of attorney and guardianship for minor children.

By engaging in estate planning, you can minimize the tax burden on your heirs, ensure the smooth transfer of your assets, and provide for your loved ones' financial well-being after your passing. It is recommended to consult with a qualified estate planning attorney to ensure that your wishes are properly documented and legally binding.

Implementing and Monitoring Your Financial Plan

Once you have developed your comprehensive financial plan, it is essential to implement and regularly monitor its progress. This involves staying disciplined with your savings and investment strategies, reviewing and adjusting your budget as needed, and staying informed about economic trends and changes in your personal circumstances.

Automating Your Savings

Automating your savings is an effective way to ensure consistent progress towards your financial goals. You can set up automatic transfers from your paycheck or checking account into your savings or investment accounts. This removes the temptation to spend your money and helps you build your savings over time.

Regularly Reviewing and Adjusting Your Budget

Your financial plan and budget should not be set in stone. It is important to regularly review and adjust your budget to reflect changes in your income, expenses, and financial goals. This may involve increasing your savings rate, reallocating funds to different investment vehicles, or adjusting your emergency fund target.

Staying Informed and Adapting to Economic Changes

The economic landscape is constantly evolving, and it is crucial to stay informed about market trends, interest rate changes, and tax law updates. By staying up-to-date with financial news and consulting with financial advisors, you can make informed decisions about your investments and savings strategies.

For example, if interest rates are expected to rise, you may want to consider locking in a fixed-rate mortgage or adjusting your investment portfolio to include more fixed-income securities. Staying informed allows you to adapt your financial plan to take advantage of new opportunities and minimize potential risks.

Conclusion: A Secure Financial Future

Financial planning is a lifelong journey, and by following the comprehensive guide outlined above, you can take control of your financial future. By understanding your financial position, setting clear goals, and implementing effective strategies, you can achieve financial security and peace of mind. Remember, regular review and adaptation are key to staying on track and navigating the ever-changing economic landscape.

What are some common mistakes to avoid in financial planning?

+Some common mistakes to avoid in financial planning include neglecting to set clear financial goals, failing to diversify your investment portfolio, not regularly reviewing and updating your financial plan, and ignoring the importance of building an emergency fund. Additionally, it is crucial to avoid high-interest debt and to seek professional advice when needed to ensure your financial strategies are sound and tailored to your specific circumstances.

<div class="faq-item">

<div class="faq-question">

<h3>How often should I review and update my financial plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It is recommended to review your financial plan at least once a year, or more frequently if your personal circumstances or the economic landscape undergo significant changes. Regular reviews allow you to assess your progress towards your financial goals, make necessary adjustments, and stay on track for a secure financial future.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some strategies for increasing my savings rate?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To increase your savings rate, consider strategies such as automating your savings by setting up direct deposits into a dedicated savings or investment account, reducing unnecessary expenses by creating a detailed budget and identifying areas for cutbacks, and maximizing your income by exploring opportunities for career advancement or side hustles.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I diversify my investment portfolio effectively?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Diversifying your investment portfolio involves spreading your investments across different asset classes, sectors, and geographic regions. This can help mitigate risk and maximize potential returns. Consider working with a financial advisor to develop a well-diversified portfolio that aligns with your risk tolerance and financial goals.</p>

</div>

</div>

</div>