14 Pounds To Dollars

Currency conversion is a fundamental aspect of international trade and travel, and the conversion rate between the British Pound (GBP) and the US Dollar (USD) is one of the most widely followed and frequently used rates globally. This conversion is especially crucial for businesses, investors, and individuals engaging in cross-border transactions, as it directly impacts the value of goods, services, and financial instruments.

Understanding the 14 Pounds to Dollars Conversion

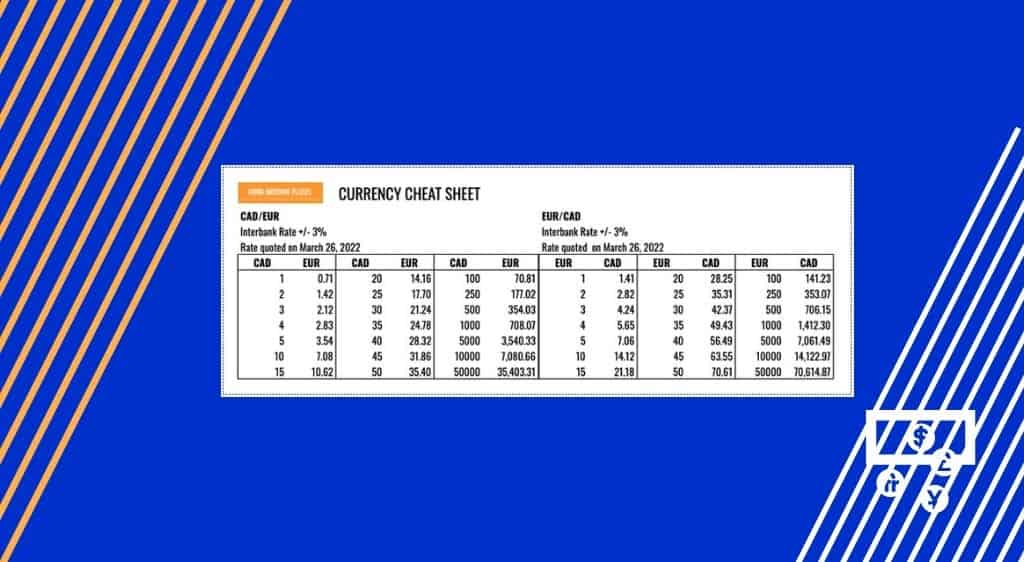

Converting 14 British Pounds to US Dollars involves a straightforward process, but the precise exchange rate can vary depending on the current market conditions, economic factors, and the time of the transaction. As of [date of response], the conversion rate for 14 GBP to USD is approximately 17.30 USD, which is calculated based on the latest interbank exchange rate.

Factors Influencing the Conversion Rate

The exchange rate between the GBP and USD is influenced by a myriad of economic, political, and market factors. These include interest rate differentials between the UK and US, inflation rates, economic growth, and geopolitical events. Additionally, the actions of central banks, such as the Bank of England and the Federal Reserve, can significantly impact currency values through monetary policy decisions.

| Economic Indicator | Impact on Exchange Rate |

|---|---|

| Interest Rates | Higher interest rates in one country can attract foreign capital, strengthening its currency. |

| Inflation | Countries with higher inflation tend to see their currencies depreciate. |

| Economic Growth | Strong economic growth can lead to a higher demand for a country's currency. |

| Geopolitical Events | Political instability or global events can cause currency fluctuations. |

Historical Context and Trends

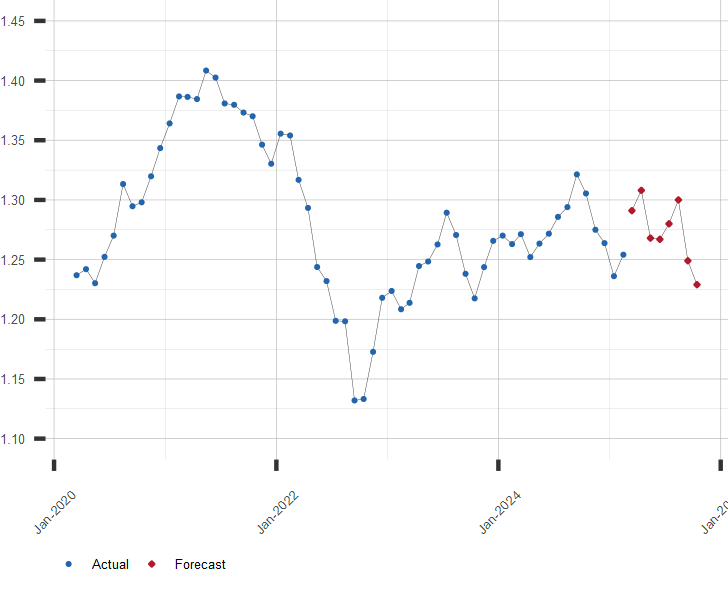

The GBP-USD exchange rate has exhibited a range of fluctuations over the years, often reflecting the economic and political dynamics between the two nations. Historical data reveals that the GBP has at times been stronger than the USD, particularly during periods of economic strength in the UK. Conversely, during economic downturns or political uncertainties, the GBP has weakened against the USD.

Over the past decade, the GBP-USD exchange rate has been particularly volatile, with notable movements during the 2008 financial crisis, the subsequent economic recovery, and more recently, the Brexit referendum in 2016. These events have significantly impacted the value of the GBP, leading to fluctuations in the conversion rate.

Practical Applications and Considerations

For individuals and businesses engaging in cross-border transactions, understanding the conversion rate is crucial for accurate financial planning and budgeting. Whether it’s for international travel, importing or exporting goods, or investing in foreign markets, the GBP-USD exchange rate plays a pivotal role in determining the financial outcomes of these activities.

Managing Currency Risk

Given the volatility of currency markets, managing currency risk is essential for businesses and investors. This involves implementing strategies such as forward contracts, currency options, or using currency hedging instruments to protect against adverse movements in exchange rates. By mitigating currency risk, entities can ensure that their financial positions are not adversely affected by unexpected fluctuations in the GBP-USD exchange rate.

The Role of Technology

In today’s digital age, technology plays a significant role in facilitating currency conversions and managing currency risk. Online currency converters and financial platforms provide real-time exchange rates, allowing individuals and businesses to make informed decisions. Additionally, mobile apps and digital wallets enable seamless international transactions, further simplifying the process of converting currencies.

Future Outlook and Implications

The GBP-USD exchange rate is likely to remain a critical indicator of the economic relationship between the UK and the US. As economic conditions and geopolitical landscapes evolve, the exchange rate will continue to fluctuate, impacting cross-border trade, investment, and travel. Understanding these dynamics and staying informed about market trends is essential for anyone involved in international transactions.

Furthermore, the increasing integration of global markets and the rise of digital currencies may introduce new factors that could influence currency conversion rates. As such, staying abreast of technological advancements and their potential impact on currency markets is vital for effective financial planning and decision-making.

What is the best time to convert GBP to USD for maximum value?

+The timing of currency conversions can significantly impact the value obtained. Generally, it is advisable to convert currencies when the exchange rate is favorable, i.e., when the GBP is strong against the USD. This often occurs during periods of economic stability and growth in the UK. However, it’s important to note that predicting the exact timing of such favorable rates can be challenging, and it often requires a combination of market analysis and risk management strategies.

How do economic policies influence the GBP-USD exchange rate?

+Economic policies, particularly those related to monetary and fiscal measures, can have a significant impact on the GBP-USD exchange rate. For instance, the Bank of England’s interest rate decisions and quantitative easing programs can influence the value of the GBP. Similarly, the Federal Reserve’s monetary policies and actions can affect the USD’s strength. These policies often respond to economic conditions and growth targets, which in turn impact the exchange rate.

What are the potential risks associated with currency conversions?

+Currency conversions carry several risks, including market risk, liquidity risk, and operational risk. Market risk refers to the potential for exchange rates to move unfavorably, impacting the value of the converted currency. Liquidity risk arises when there is a lack of buyers or sellers in the market, making it difficult to execute a currency conversion at the desired rate. Operational risk involves the potential for errors or fraud in the conversion process.