12 Ways To Optimize Your Usda Mortgage Application

The United States Department of Agriculture (USDA) mortgage program offers a range of benefits to eligible borrowers, particularly those seeking to purchase homes in rural areas. Optimizing your application process can significantly increase your chances of securing a USDA loan and accessing the program's advantages. Here's a comprehensive guide to help you navigate the process effectively.

Understanding the USDA Mortgage Program

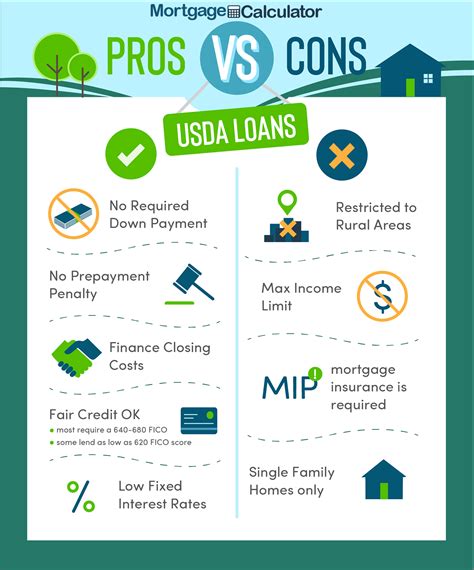

The USDA mortgage program, also known as the USDA Rural Development Guaranteed Housing Loan Program, is designed to assist low- to moderate-income borrowers in purchasing homes in rural communities. It aims to improve the quality of life in these areas by making homeownership more accessible. The program offers 100% financing, competitive interest rates, and flexible credit requirements, making it an attractive option for many prospective homeowners.

To qualify for a USDA mortgage, applicants must meet certain criteria, including income limits, credit score requirements, and property eligibility. The program primarily serves rural areas, with specific guidelines defining what constitutes a "rural" location. It's crucial to understand these eligibility criteria before beginning the application process.

Preparing for Your Application

Optimizing your USDA mortgage application starts well before you submit any paperwork. Here are some essential steps to prepare yourself and increase your chances of success:

1. Check Your Eligibility

Begin by determining if you meet the basic eligibility requirements. This includes ensuring that your income falls within the program’s limits, which vary based on family size and the county where the property is located. You can use the USDA’s income eligibility tool to check if you qualify.

Additionally, review the property eligibility guidelines. The USDA provides an online tool to search for eligible rural areas. Keep in mind that while the program primarily serves rural communities, some suburban areas may also qualify.

2. Improve Your Credit Score

While the USDA program has more flexible credit requirements than traditional mortgages, a higher credit score can still enhance your chances of approval and potentially secure a better interest rate. Review your credit report and take steps to improve your score, such as paying down debt, disputing any errors, and maintaining a consistent payment history.

3. Gather Required Documentation

To streamline the application process, gather all necessary documents in advance. This typically includes:

- Pay stubs or tax returns to verify income

- Bank statements showing assets and savings

- Debt statements, including credit card and loan balances

- Identification documents, such as a driver's license or passport

- Social Security numbers for all applicants

- Proof of rental payments or current mortgage statements

- A list of assets and liabilities

4. Choose the Right Lender

Not all mortgage lenders offer USDA loans, and those that do may have varying levels of experience and expertise. Research and compare lenders to find one that specializes in USDA mortgages and has a strong track record of successful applications. Consider factors like customer service, processing times, and any additional services or resources they offer.

Submitting Your Application

Once you’ve prepared all the necessary documentation and chosen a lender, it’s time to submit your USDA mortgage application. Here’s what you can expect during this process:

5. Complete the Application Form

The application form for a USDA mortgage is typically available through your chosen lender. It will require detailed information about your financial situation, including income, assets, and debts. Ensure that all information is accurate and complete, as any discrepancies may delay the approval process.

6. Provide Additional Documentation

In addition to the initial application, you may need to provide further documentation to support your financial statements. This could include letters of explanation for any unusual financial activity or discrepancies. Be prepared to supply any additional information promptly to avoid delays.

7. Underwriting Review

Once your application and supporting documentation are submitted, they will undergo an underwriting review. This process evaluates your financial stability, creditworthiness, and the overall risk associated with your loan. It’s crucial to maintain stable employment and avoid any significant financial changes during this period.

8. Property Appraisal

After your application is approved, the USDA will require an appraisal of the property you wish to purchase. This ensures that the home meets the program’s standards and is worth the loan amount. The appraisal fee is typically paid by the borrower and is due at the time of the appraisal.

Maximizing Your Chances of Success

Optimizing your USDA mortgage application goes beyond the initial submission. Here are some additional strategies to increase your chances of a successful outcome:

9. Communicate with Your Lender

Maintain open and frequent communication with your lender throughout the process. They can provide valuable guidance and help you navigate any potential challenges. Be responsive to their requests for additional information or documentation, and don’t hesitate to ask questions about the status of your application.

10. Consider a Co-Borrower

If you have a strong creditworthy co-borrower, such as a spouse or family member, consider including them on the loan application. This can improve your chances of approval and potentially lower your interest rate by reducing the perceived risk to the lender.

11. Explore Down Payment Assistance Programs

While the USDA mortgage program offers 100% financing, some borrowers may still struggle to cover closing costs and other upfront expenses. Consider researching down payment assistance programs, which can provide grants or low-interest loans to help cover these costs. Many states and local governments offer such programs specifically for USDA loans.

12. Understand the Loan Terms

Before finalizing your loan, take the time to thoroughly understand the terms and conditions. Review the loan agreement, including the interest rate, repayment schedule, and any potential fees or penalties. Ensure that you’re comfortable with the terms and can afford the monthly payments over the life of the loan.

USDA Mortgage Program Benefits

The USDA mortgage program offers several advantages to eligible borrowers, including:

- 100% financing, eliminating the need for a down payment

- Competitive interest rates, often lower than traditional mortgages

- Flexible credit requirements, making it accessible to a wider range of borrowers

- No mortgage insurance premiums, which can save borrowers thousands of dollars over the life of the loan

- Eligible for refinancing through the USDA's Rural Housing Service

Conclusion

Optimizing your USDA mortgage application can be a complex process, but with careful preparation and a strategic approach, you can increase your chances of securing this valuable home loan program. By understanding the eligibility criteria, preparing your documentation, and working closely with an experienced lender, you can take advantage of the many benefits the USDA mortgage program offers to rural homebuyers.

What is the maximum loan amount for a USDA mortgage?

+The maximum loan amount for a USDA mortgage depends on various factors, including the location of the property and the borrower’s income. The USDA sets loan limits based on county median home values and adjusts them annually. It’s essential to consult with a lender to determine the specific loan limit for your area.

Can I use a USDA mortgage to refinance my existing home loan?

+Yes, the USDA offers a refinancing option called the USDA Rural Housing Service Streamline Refinance program. This program allows eligible homeowners to refinance their existing USDA mortgage into a new loan with a lower interest rate, potentially reducing their monthly payments. However, there are specific eligibility criteria, and not all borrowers will qualify.

Are there any restrictions on the type of property I can purchase with a USDA mortgage?

+The USDA mortgage program primarily serves single-family homes, including manufactured homes and modular homes. There are some restrictions on the age and condition of the property, and it must be used as the borrower’s primary residence. Investment properties and vacation homes are not eligible for USDA financing.