10 Ways Zelle Enhances Navy Federal Banking

Zelle, a popular digital payment platform, has become an integral part of many banking experiences, and its integration with Navy Federal Credit Union has brought about significant enhancements. With a focus on convenience, security, and seamless transactions, Zelle has revolutionized the way members interact with their financial institution. In this article, we will explore ten ways Zelle has elevated the banking experience at Navy Federal, showcasing its impact on various aspects of financial management.

1. Instant Peer-to-Peer Transactions

One of the most notable advantages of Zelle’s integration is the ability to send and receive money instantly between Navy Federal members. Unlike traditional bank transfers, which can take several days, Zelle enables real-time transactions, making it ideal for split bills, reimbursements, or urgent financial needs. This feature has simplified the process of sending money to friends and family, eliminating the hassle of cash withdrawals or checks.

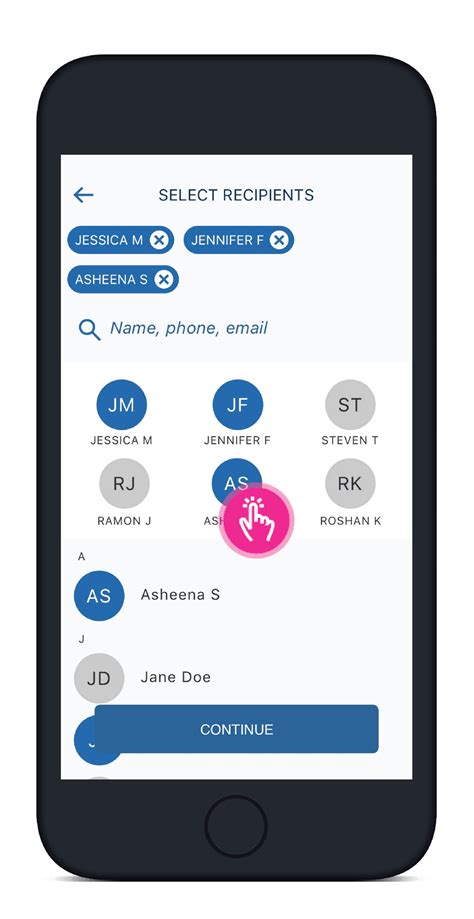

Seamless Integration with Mobile Banking

Zelle is seamlessly integrated into Navy Federal’s mobile banking app, providing a user-friendly interface for members to access the service. The app’s design ensures a smooth and intuitive experience, allowing users to send and receive payments with just a few taps. This integration has made Zelle a convenient and accessible tool for daily financial transactions.

Enhanced Security Measures

Security is a top priority for both Zelle and Navy Federal. The platform employs advanced encryption protocols to safeguard user data and transactions. Additionally, Zelle’s identity verification process ensures that only authorized individuals can access and use the service. This combination of robust security measures and user-friendly design has made Zelle a trusted choice for secure digital payments.

2. Simplified Payment Process

Zelle has streamlined the payment process, making it incredibly simple for Navy Federal members. Users can send money by entering the recipient’s email address or phone number, eliminating the need for complex account details. This user-friendly approach has reduced the barriers to digital payments, encouraging more members to adopt Zelle as their preferred method for transferring funds.

Quick Enrollment

Enrolling in Zelle through Navy Federal is a quick and straightforward process. Members can easily sign up for the service within the mobile banking app, requiring minimal personal information. This streamlined enrollment process has contributed to the platform’s widespread adoption, as it poses no significant barriers to entry.

Real-Time Transaction Updates

Zelle provides real-time updates on transaction status, ensuring that users are always informed about the progress of their payments. This feature adds a layer of transparency and peace of mind, as members can track their transactions from initiation to completion. Real-time updates have become a valuable tool for managing finances effectively.

3. Wide Network of Zelle Users

Navy Federal’s partnership with Zelle has granted its members access to a vast network of users across the United States. This extensive network allows for seamless transactions with individuals from various financial institutions, breaking down barriers and facilitating easy money transfers. The ability to connect with a wide range of Zelle users has enhanced the overall utility of the platform.

Interoperability with Other Banks

Zelle’s interoperability with other banks and financial institutions is a significant advantage for Navy Federal members. Users can send and receive money from individuals with accounts at different banks, making Zelle a versatile tool for managing finances. This interoperability has broken down the silos that often exist between financial institutions, creating a more unified and accessible digital payment ecosystem.

Expanded Payment Options

By integrating Zelle, Navy Federal has expanded its payment options, offering members a diverse range of choices. In addition to traditional bank transfers, members can now utilize Zelle for various financial needs, such as paying bills, sending gifts, or contributing to shared expenses. This diversification of payment methods has enhanced the overall convenience and flexibility of Navy Federal’s services.

4. Enhanced Fraud Protection

Zelle’s advanced fraud detection systems have significantly contributed to enhancing security at Navy Federal. The platform employs machine learning algorithms to identify and prevent potential fraudulent activities, providing an additional layer of protection for members’ financial transactions. This proactive approach to fraud prevention has instilled confidence in users, ensuring a safer banking experience.

Transaction Monitoring

Zelle continuously monitors transactions for any suspicious activity, employing sophisticated algorithms to detect anomalies. This real-time monitoring helps identify potential fraud attempts and takes immediate action to protect users’ accounts. Navy Federal’s integration of Zelle has allowed for more efficient and effective fraud detection, contributing to a safer overall banking environment.

User Education and Awareness

Navy Federal, in collaboration with Zelle, has implemented comprehensive user education programs to raise awareness about fraud prevention. These initiatives include informative resources, workshops, and campaigns that educate members on identifying and avoiding potential scams. By empowering users with knowledge, Navy Federal has created a more vigilant community, further strengthening the security of its digital payment ecosystem.

5. Increased Convenience for Members

Zelle’s integration has brought about a new level of convenience for Navy Federal members. The ability to send and receive money instantly, combined with the user-friendly interface, has simplified financial management. Members can now complete transactions quickly and efficiently, without the need for physical visits to branches or lengthy online processes. This increased convenience has improved overall member satisfaction and loyalty.

Mobile-First Approach

Zelle’s mobile-first design philosophy aligns perfectly with the modern banking needs of Navy Federal members. The platform’s focus on mobile accessibility ensures that users can access their financial services anytime, anywhere. This approach has been particularly beneficial for individuals with busy lifestyles, as it allows them to manage their finances on the go, without compromising on security or convenience.

Reduced Branch Visits

With the convenience of Zelle, Navy Federal members have experienced a significant reduction in the need for branch visits. Many routine transactions, such as sending money to family or paying bills, can now be completed digitally. This shift towards digital banking has not only improved member convenience but has also contributed to a more efficient and sustainable banking model.

6. Improved Customer Support

Zelle’s integration has enhanced Navy Federal’s customer support services, providing members with a dedicated team for digital payment-related inquiries. The platform’s user-friendly interface and comprehensive help resources have reduced the volume of general support requests, allowing the credit union to focus on more complex issues. This improvement in customer support has led to faster resolution times and increased member satisfaction.

Self-Service Options

Zelle’s comprehensive help center and FAQ section have empowered Navy Federal members to resolve common issues independently. The platform’s intuitive design and clear instructions have made it easier for users to navigate and troubleshoot basic problems. This self-service approach has not only reduced the burden on customer support but has also provided members with a sense of control over their digital payment experience.

Proactive Communication

Navy Federal, in collaboration with Zelle, has implemented a proactive communication strategy to keep members informed about their transactions. Users receive real-time notifications and updates, ensuring they are aware of any changes or potential issues. This timely communication has enhanced the overall user experience, as members feel more connected and involved in their financial activities.

7. Faster Bill Payments

Zelle’s integration has revolutionized bill payments at Navy Federal, making the process faster and more efficient. Members can now pay their bills directly from their mobile banking app, with the funds being transferred instantly. This streamlined approach has eliminated the delays associated with traditional bill payment methods, such as checks or online transfers. As a result, Navy Federal members can manage their finances more effectively and avoid late payment fees.

Automated Bill Pay

Zelle’s automated bill pay feature has further enhanced the convenience of bill payments for Navy Federal members. Users can set up recurring payments for regular expenses, such as utility bills or subscriptions. This automation ensures that payments are made on time, reducing the risk of missed payments and associated penalties. The ability to automate bill payments has become a valuable tool for members looking to streamline their financial management.

Secure Payment Processing

Zelle’s secure payment processing has instilled confidence in Navy Federal members when making bill payments. The platform’s robust security measures, including encryption and tokenization, protect sensitive financial information. This assurance of security has encouraged more members to adopt Zelle for bill payments, knowing that their personal and financial data are well-protected.

8. Enhanced Financial Management

Zelle’s integration has empowered Navy Federal members to take control of their financial management. The platform’s user-friendly interface and real-time transaction updates have made it easier for members to track their spending, monitor their budgets, and stay on top of their financial goals. This enhanced financial management has contributed to improved financial literacy and a more proactive approach to personal finances.

Budgeting Tools

Zelle’s integration with Navy Federal’s mobile banking app has introduced advanced budgeting tools, allowing members to set and track their financial goals. These tools provide a comprehensive overview of spending habits, helping users identify areas where they can save or allocate funds more efficiently. By offering these budgeting features, Navy Federal has enabled its members to make more informed financial decisions.

Personalized Financial Insights

Zelle’s analytics and insights have provided Navy Federal members with personalized financial recommendations. The platform’s algorithms analyze spending patterns and transaction history to offer tailored suggestions for saving, investing, or managing debt. These insights have become a valuable resource for members, empowering them to make strategic financial choices and achieve their long-term goals.

9. Increased Accessibility

Zelle’s integration has made Navy Federal’s services more accessible to members with diverse needs. The platform’s mobile-first design ensures that individuals with physical disabilities or limited mobility can access their financial services conveniently. Additionally, Zelle’s compatibility with various devices and operating systems has made it easier for members to manage their finances on their preferred platforms.

Inclusive Design

Zelle’s design philosophy prioritizes inclusivity, ensuring that the platform is accessible to individuals with visual, auditory, or motor impairments. Features such as voice-guided navigation, high-contrast modes, and customizable font sizes have made Zelle a more inclusive digital payment solution. Navy Federal’s commitment to accessibility has enhanced the overall user experience for members with diverse abilities.

Multilingual Support

Zelle’s multilingual support has made Navy Federal’s services more accessible to members who speak languages other than English. The platform offers a range of language options, allowing users to access its features and functions in their preferred language. This multilingual approach has broken down language barriers and made Navy Federal’s digital payment services more inclusive for a diverse member base.

10. Future Growth and Innovation

The integration of Zelle with Navy Federal has laid the foundation for future growth and innovation in digital banking. As the platform continues to evolve, Navy Federal can leverage its capabilities to offer even more advanced financial services. The potential for new features, such as international money transfers or advanced investment tools, showcases the endless possibilities for enhancing the member experience.

Continuous Improvement

Navy Federal’s partnership with Zelle is characterized by a commitment to continuous improvement. Both organizations are dedicated to staying at the forefront of digital banking innovation, regularly introducing new features and enhancements. This dedication to progress ensures that Navy Federal members will always have access to the latest and most advanced financial tools and services.

Exploring New Partnerships

Navy Federal’s success with Zelle has opened doors to potential partnerships with other innovative fintech companies. By exploring collaborations with startups and established players in the digital banking space, Navy Federal can further expand its suite of services and stay ahead of the curve. These partnerships will play a crucial role in shaping the future of digital banking at Navy Federal.

How secure is Zelle for Navy Federal members?

+Zelle employs advanced security measures, including encryption and identity verification, to protect user data and transactions. Navy Federal’s integration with Zelle ensures that members’ financial information is safeguarded, making it a secure choice for digital payments.

Can I use Zelle internationally?

+While Zelle is primarily focused on domestic transactions, Navy Federal is exploring partnerships with international money transfer services. These collaborations will enable members to send and receive funds globally, expanding the utility of Zelle for international transactions.

What are the transaction limits for Zelle at Navy Federal?

+Transaction limits for Zelle vary based on individual circumstances, including account history and risk assessment. Navy Federal may impose daily, weekly, or monthly limits to ensure the security of its members’ transactions. Members can contact Navy Federal for more information on their specific transaction limits.