10 Net Adjusted Income Calculator Tips To Maximise Your Returns

Welcome to an in-depth guide on one of the most crucial aspects of financial planning: the Net Adjusted Income Calculator. This tool is a powerful asset for individuals and businesses alike, as it provides an accurate assessment of your financial health and helps optimize your returns. Whether you're a seasoned investor or just starting your financial journey, understanding how to navigate this calculator is key to making informed decisions.

In this comprehensive guide, we'll explore ten expert tips to help you maximize your returns using the Net Adjusted Income Calculator. We'll delve into the intricacies of this tool, uncovering strategies to ensure you get the most out of your financial data. From understanding the nuances of income adjustments to leveraging advanced calculator features, we'll cover it all. So, let's dive in and unlock the secrets to financial success.

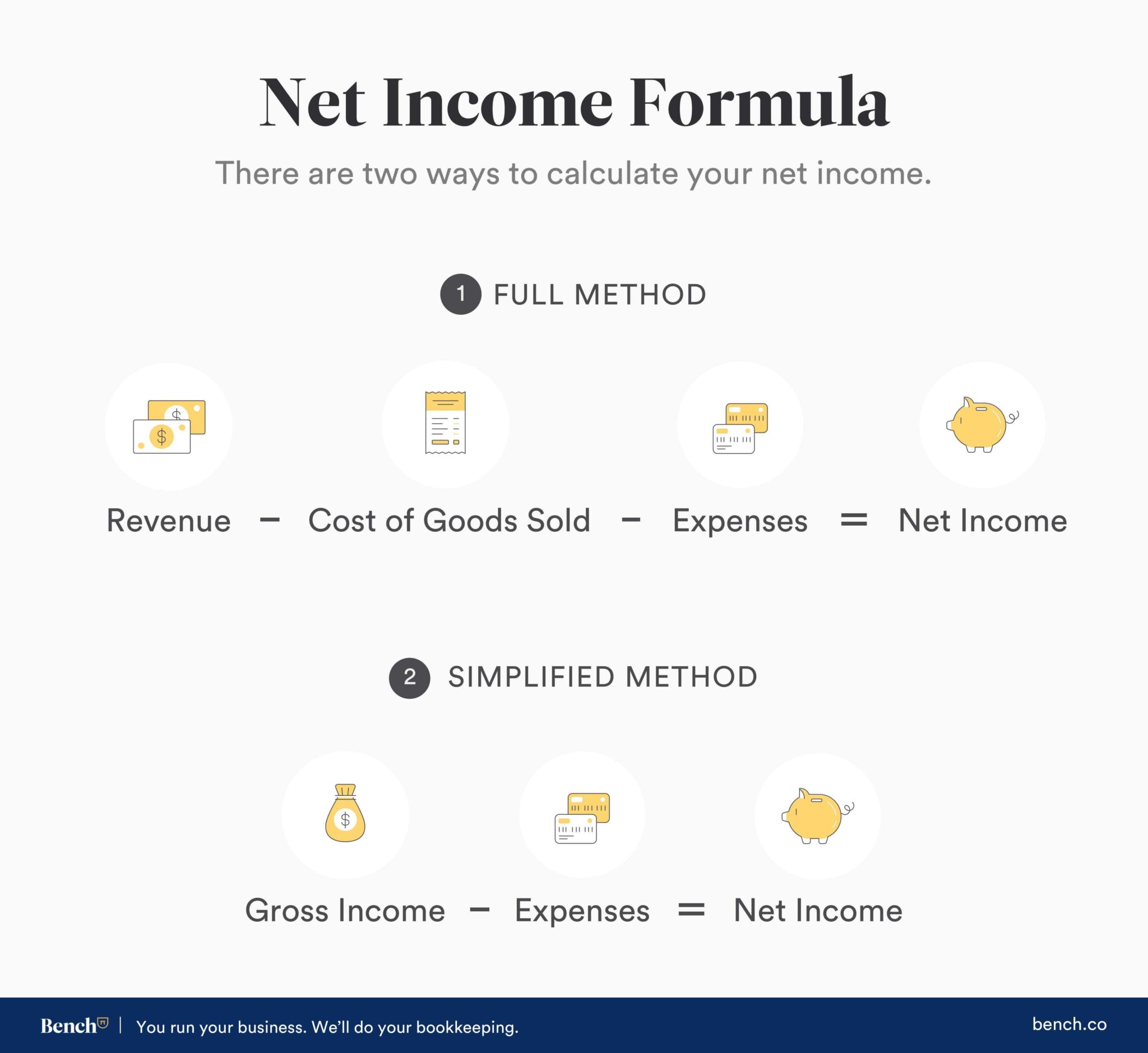

1. Grasp the Fundamentals of Net Adjusted Income

Before diving into the calculator, it's crucial to have a solid understanding of what Net Adjusted Income represents. In simple terms, it's the income you earn after accounting for various adjustments and deductions. These adjustments can include personal allowances, tax credits, and other specific deductions that vary based on your country's tax system and personal circumstances.

Understanding the components of Net Adjusted Income is vital. It ensures you can make accurate calculations and, more importantly, identify areas where you can optimize your income and reduce potential tax liabilities. Let's break down the key elements:

- Gross Income: This is your total income before any deductions or adjustments. It includes wages, salaries, interest, dividends, and other income sources.

- Deductions: These are specific amounts or percentages subtracted from your gross income. Deductions can include contributions to retirement plans, health insurance premiums, and certain business expenses.

- Adjustments: Adjustments are modifications made to your income to account for specific circumstances. For example, if you have qualifying business expenses, you might be able to adjust your income downward. Other adjustments might include student loan interest, moving expenses, or alimony payments.

- Tax Credits: Tax credits are a dollar-for-dollar reduction in your tax liability. They can significantly reduce the amount of tax you owe. Examples include the Child Tax Credit, Education Credits, and the Foreign Tax Credit.

Example: Calculating Net Adjusted Income

Let's illustrate this with a simple example. Assume you have a gross income of $100,000 and the following deductions and adjustments:

| Deduction/Adjustment | Amount |

|---|---|

| Retirement Plan Contribution | $5,000 |

| Health Insurance Premium | $2,000 |

| Business Expenses | $3,000 |

| Student Loan Interest | $1,500 |

| Child Tax Credit | $2,000 |

To calculate your Net Adjusted Income:

- Subtract the deductions and adjustments from your gross income: $100,000 - ($5,000 + $2,000 + $3,000 + $1,500 + $2,000) = $86,500.

- This $86,500 is your Net Adjusted Income, which is the basis for calculating your tax liability.

2. Choose the Right Net Adjusted Income Calculator

Not all Net Adjusted Income calculators are created equal. There are various calculators available online, each with its own set of features and capabilities. It's essential to select a calculator that aligns with your needs and provides accurate results.

Key Considerations for Choosing a Calculator:

- Accuracy: Ensure the calculator is based on up-to-date tax laws and regulations. Inaccurate calculations can lead to unexpected tax liabilities or missed opportunities for deductions.

- User-Friendliness: Opt for a calculator with a simple and intuitive interface. Complex calculators can be daunting and may lead to errors.

- Comprehensiveness: Look for a calculator that covers a wide range of income sources, deductions, and adjustments. A comprehensive calculator will provide a more accurate assessment of your financial situation.

- Customization: Some calculators offer customization options, allowing you to input specific details like business expenses or investment income. Customization can lead to more precise calculations.

- Support and Updates: Choose a calculator from a reputable source that provides regular updates to reflect changes in tax laws. Additionally, consider calculators with good customer support in case you encounter issues.

Online Calculator Options:

Here are a few reputable online Net Adjusted Income calculators you can consider:

- IRS Tax Withholding Estimator: This calculator is provided by the Internal Revenue Service (IRS) and is designed to help you estimate your tax withholding. It's a great tool for understanding your potential tax liability.

- TurboTax TaxCaster: TurboTax offers a user-friendly calculator that estimates your tax refund or liability. It's particularly useful for those who use TurboTax for their tax filing.

- H&R Block Tax Refund Calculator: H&R Block's calculator estimates your tax refund and provides insights into potential deductions and credits. It's a comprehensive tool for understanding your tax situation.

3. Master the Art of Income Adjustments

Income adjustments are a powerful tool for optimizing your Net Adjusted Income. By understanding which adjustments you're eligible for and how to maximize their benefits, you can significantly reduce your tax liability.

Common Income Adjustments:

- Retirement Plan Contributions: Contributing to retirement plans like 401(k)s or IRAs can reduce your taxable income. The amount you contribute is typically deducted from your gross income, lowering your tax liability. The key is to maximize your contributions within the legal limits to take full advantage of this adjustment.

- Health Insurance Premiums: If you pay for health insurance, you may be able to deduct a portion of these premiums from your gross income. This adjustment is particularly beneficial for self-employed individuals or those with high-deductible health plans.

- Business Expenses: If you operate a business, you can deduct ordinary and necessary business expenses from your income. This includes things like office rent, supplies, and travel expenses. It's crucial to keep detailed records of these expenses to ensure accurate deductions.

- Student Loan Interest: If you're paying off student loans, you may be able to deduct the interest you pay. This adjustment is particularly beneficial for recent graduates or those with large student loan balances.

- Alimony Payments: If you're paying alimony, you may be able to deduct these payments from your income. This adjustment is subject to specific rules and regulations, so it's important to consult a tax professional.

Maximizing Income Adjustments:

To get the most out of income adjustments, consider the following strategies:

- Stay Informed: Keep up-to-date with changes in tax laws and regulations. New adjustments or deductions may become available, and you don't want to miss out on potential savings.

- Optimize Contributions: If you contribute to retirement plans, consider maximizing your contributions, especially if you're close to the legal limits. This can significantly reduce your taxable income.

- Keep Records: Maintain detailed records of your expenses, especially if they qualify for deductions. This ensures you can accurately claim these adjustments when filing your taxes.

- Consult a Professional: Income adjustments can be complex, and the rules can vary based on your personal circumstances. Consider seeking advice from a tax professional to ensure you're maximizing your adjustments correctly.

4. Utilize Advanced Calculator Features

Many Net Adjusted Income calculators offer advanced features that can provide valuable insights and help you make informed financial decisions. These features can vary depending on the calculator, but here are some common ones to look out for:

Advanced Calculator Features:

- Scenario Analysis: This feature allows you to input different income levels, deductions, and adjustments to see how they impact your Net Adjusted Income and tax liability. It's a great way to understand the potential financial outcomes of various scenarios.

- Tax Bracket Analysis: By inputting your income and deductions, the calculator can determine your tax bracket and provide an estimate of your tax liability. This feature is especially useful for understanding how changes in income or deductions can affect your tax obligations.

- Deduction Maximizer: Some calculators offer tools to help you identify and maximize deductions. These tools can provide suggestions for deductions you may not have considered and ensure you're taking full advantage of available tax benefits.

- Tax Projection: Advanced calculators may offer projections of your future tax liability based on various assumptions. This feature can help you plan for future tax obligations and make informed decisions about your financial strategy.

- Investment Analysis: If you have investment income, some calculators can provide an analysis of the tax implications of different investment strategies. This can help you optimize your investment portfolio from a tax perspective.

Example: Scenario Analysis

Let's say you're considering a career change that might impact your income. You can use the scenario analysis feature to input different income levels and see how it affects your Net Adjusted Income and tax liability. This can help you make a more informed decision about the potential financial impact of the career change.

5. Stay Updated with Tax Law Changes

Tax laws are subject to change, and staying updated is crucial for accurate financial planning. Changes in tax laws can impact your deductions, credits, and overall tax liability. Here's how you can stay informed:

Staying Informed about Tax Law Changes:

- Government Websites: Visit the official websites of government tax agencies, such as the IRS in the United States or HM Revenue and Customs in the UK. These websites provide the latest information on tax law changes and updates.

- Tax News Sources: Follow reputable tax news sources and publications. They often provide in-depth analysis and explanations of tax law changes.

- Tax Professional Networks: Stay connected with tax professionals and industry experts. They are often well-informed about changes in tax laws and can provide valuable insights.

- Tax Software Updates: If you use tax software for your financial planning, ensure you install the latest updates. These updates often include changes in tax laws and regulations.

- Newsletters and Alerts: Subscribe to newsletters and alerts from tax organizations or financial institutions. They can provide timely updates on tax law changes and their potential impact.

Impact of Tax Law Changes:

Tax law changes can have a significant impact on your financial planning. For example, changes in tax rates, deductions, or credits can affect your Net Adjusted Income and tax liability. It's essential to understand these changes and adjust your financial strategies accordingly.

6. Optimize Your Deductions and Credits

Deductions and credits are powerful tools for reducing your tax liability. By understanding which deductions and credits you're eligible for and maximizing their benefits, you can significantly lower your tax bill.

Common Deductions and Credits:

- Standard Deduction: The standard deduction is a fixed amount that you can subtract from your income. It's available to most taxpayers and can reduce your taxable income. The amount of the standard deduction varies based on your filing status.

- Itemized Deductions: If your itemized deductions exceed the standard deduction, you may choose to itemize. Itemized deductions include things like mortgage interest, state and local taxes, and charitable contributions. It's important to keep detailed records of these expenses to claim them accurately.

- Child Tax Credit: If you have qualifying children, you may be eligible for the Child Tax Credit. This credit can significantly reduce your tax liability and even result in a refund.

- Education Credits: If you or a family member are pursuing higher education, you may be eligible for education credits. These credits can offset the cost of tuition and related expenses.

- Foreign Tax Credit: If you've paid taxes to a foreign government, you may be able to claim a credit for those taxes. This credit can reduce your U.S. tax liability.

Maximizing Deductions and Credits:

To get the most out of deductions and credits, consider the following strategies:

- Research Eligibility: Understand which deductions and credits you're eligible for based on your personal circumstances. Consult tax guides or seek advice from a tax professional.

- Keep Records: Maintain detailed records of expenses that qualify for deductions. This ensures you can accurately claim these deductions when filing your taxes.

- Explore All Options: Don't limit yourself to the most common deductions and credits. Explore a wide range of options, including those specific to your industry or personal situation.

- Consult a Professional: Deductions and credits can be complex, and the rules can vary. Consider seeking advice from a tax professional to ensure you're maximizing your benefits correctly.

7. Leverage Investment Income Strategies

If you have investment income, it's important to understand the tax implications and strategies to optimize your returns. Investment income can include dividends, capital gains, and interest from various sources.

Understanding Investment Income:

- Dividends: Dividends are distributions of a company's profits to its shareholders. They can be taxed at different rates depending on your income level and the type of dividend.

- Capital Gains: Capital gains are profits made from the sale of investments, such as stocks or real estate. The tax rate on capital gains depends on how long you held the investment and your income level.

- Interest Income: Interest income includes earnings from savings accounts, certificates of deposit (CDs), and bonds. The tax rate on interest income is typically the same as your ordinary income tax rate.

Maximizing Investment Income Returns:

To optimize your investment income returns, consider the following strategies:

- Understand Tax Rates: Familiarize yourself with the tax rates applicable to your investment income. This knowledge can help you make informed decisions about when to sell investments and how to structure your portfolio.

- Consider Tax-Advantaged Accounts: Explore tax-advantaged accounts like IRAs or 401(k)s. These accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals, which can significantly boost your investment returns.

- Harvest Losses: If you have losses from investments, consider selling those investments to offset gains. This strategy, known as "harvesting losses," can reduce your tax liability and improve your overall investment returns.

- Seek Professional Advice: Investment income strategies can be complex, especially if you have a diverse portfolio. Consider consulting a financial advisor or tax professional to ensure you're optimizing your investment income effectively.

8. Plan for Long-Term Financial Goals

While the Net Adjusted Income Calculator is a powerful tool for short-term financial planning, it's essential to consider your long-term financial goals as well. Planning for the future can help you make more informed decisions about your income, deductions, and investments.

Long-Term Financial Planning:

- Retirement Planning: Start planning for retirement early. Consider contributing to retirement accounts like 401(k)s or IRAs to take advantage of tax benefits and grow your retirement savings.

- Education Planning: If you have children or plan to pursue higher education, start saving early. Explore tax-advantaged education savings plans like 529 plans or Coverdell ESAs.