10 Navy Federal Benefits For San Diego Members

Navy Federal Credit Union, a prominent financial institution in the United States, offers an array of benefits to its members, particularly those stationed in San Diego. This coastal city, known for its military presence, hosts a significant number of Navy Federal members, and the credit union's services are tailored to meet their unique needs. In this article, we will delve into ten key benefits that Navy Federal provides to its San Diego members, exploring how these advantages contribute to their financial well-being and overall satisfaction.

1. Competitive Interest Rates on Loans and Mortgages

Navy Federal understands the financial commitments that come with military service. To support its members in San Diego, the credit union offers competitive interest rates on various loan products, including mortgages. This benefit is particularly advantageous for service members who are looking to purchase a home or refinance their existing mortgage. With lower interest rates, members can save significantly over the life of their loan, making homeownership more affordable and achievable.

Real-World Example

Consider the case of Lieutenant Commander Sarah Miller, a Navy Federal member stationed at Naval Base San Diego. When she decided to purchase her first home, she explored mortgage options and discovered that Navy Federal’s rates were not only competitive but also offered flexibility in terms of loan terms and down payment requirements. This enabled her to secure a mortgage with a manageable monthly payment, allowing her to focus on her career and family without the burden of excessive debt.

2. Military-Friendly Banking Services

Navy Federal’s core mission is to serve those who serve. As such, the credit union provides a range of military-friendly banking services tailored to the unique needs of service members. These services include free checking accounts with no minimum balance requirements, waived fees for certain transactions, and specialized financial counseling for military-specific financial situations. This comprehensive approach ensures that San Diego members can manage their finances efficiently and effectively, regardless of their deployment status or location.

Financial Counseling for Military Families

Navy Federal recognizes the financial challenges that military families often face, such as frequent relocations and deployment-related expenses. To address these concerns, the credit union offers free financial counseling sessions, providing members with personalized guidance on budgeting, debt management, and long-term financial planning. These sessions are especially beneficial for members transitioning between duty stations or facing the financial implications of deployment.

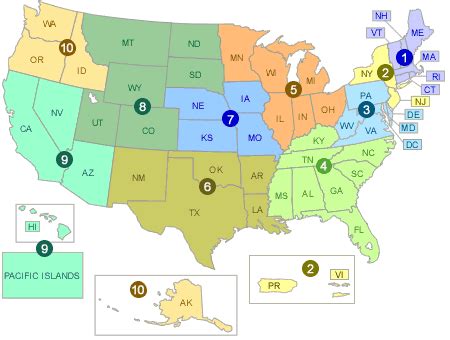

3. Extensive ATM Network and Fee Reimbursement

San Diego, with its diverse military installations, can present challenges when it comes to accessing cash or performing basic banking transactions. Navy Federal addresses this issue by maintaining an extensive ATM network throughout the city and the surrounding region. Members can easily locate ATMs within close proximity to their homes, workplaces, or military bases. Additionally, Navy Federal’s fee reimbursement policy ensures that members are not penalized for using non-Navy Federal ATMs. This benefit is particularly valuable for members who frequently travel or are stationed in remote areas.

| ATM Network Size | 30,000+ ATMs Nationwide |

|---|---|

| Fee Reimbursement | Up to $20 per month |

4. Robust Online and Mobile Banking Platforms

In today’s digital age, the convenience of online and mobile banking is invaluable. Navy Federal excels in this area, providing San Diego members with robust online and mobile banking platforms that offer a wide range of services. Members can access their accounts, transfer funds, pay bills, and even deposit checks remotely. The user-friendly interface and comprehensive features ensure that members can manage their finances efficiently, regardless of their physical location or deployment status.

Mobile Check Deposit

One standout feature of Navy Federal’s mobile app is its mobile check deposit functionality. Members can simply snap a photo of their check and deposit it directly into their account, eliminating the need to visit a physical branch or ATM. This feature is especially beneficial for service members who are frequently on the move or stationed in areas with limited access to banking facilities.

5. Discounted Insurance Products

Navy Federal partners with reputable insurance providers to offer its members discounted insurance products, including auto, home, and life insurance. This benefit is particularly advantageous for San Diego members, as it allows them to protect their assets and loved ones while enjoying significant cost savings. By bundling multiple insurance policies with Navy Federal, members can further maximize their savings and streamline their insurance management.

| Insurance Type | Discount Percentage |

|---|---|

| Auto Insurance | Up to 10% |

| Home Insurance | Up to 15% |

| Life Insurance | Up to 20% |

6. Military Pay Deposit and Direct Deposit Services

Navy Federal understands the importance of timely and secure military pay deposits. To ensure that San Diego members receive their pay promptly, the credit union offers military pay deposit services, allowing members to set up direct deposit for their military pay. This not only provides convenience but also ensures that members have immediate access to their funds, eliminating the need for physical paychecks and reducing the risk of lost or delayed payments.

Direct Deposit Benefits

By utilizing Navy Federal’s direct deposit services, members can enjoy a range of benefits, including faster access to their pay, reduced risk of fraud, and convenient account management. Members can set up direct deposit for their military pay, government benefits, and even their civilian paychecks, streamlining their financial operations and reducing the administrative burden associated with traditional paper checks.

7. Rewards and Discounts on Everyday Purchases

Navy Federal partners with various retailers and service providers to offer its members exclusive rewards and discounts on everyday purchases. This benefit extends to San Diego members, providing them with opportunities to save on groceries, dining, entertainment, and more. By leveraging these discounts, members can stretch their budgets further and enjoy a higher quality of life while serving their country.

| Partner | Discount/Reward |

|---|---|

| Groceries (e.g., Walmart) | 5% off select items |

| Restaurants (e.g., Applebee's) | 10% off entire bill |

| Entertainment (e.g., AMC Theatres) | Buy one, get one free |

8. Financial Education and Resources

Navy Federal is committed to empowering its members with financial knowledge and resources. To this end, the credit union provides an extensive array of financial education materials, including online courses, webinars, and workshops. These resources cover a wide range of topics, from budgeting and saving to investing and retirement planning. By investing in financial education, Navy Federal equips San Diego members with the skills and confidence to make informed financial decisions throughout their careers and beyond.

Online Financial Courses

Navy Federal’s online financial courses are designed to be interactive and engaging, making complex financial concepts accessible to all members. Topics range from understanding credit scores and managing debt to investing for the future and planning for retirement. Members can access these courses at their convenience, allowing them to learn at their own pace and apply the knowledge directly to their financial situations.

9. Community Engagement and Philanthropy

Navy Federal believes in giving back to the communities it serves. As such, the credit union actively engages in community outreach and philanthropy, supporting various causes and initiatives in San Diego. This commitment to community extends beyond financial services, fostering a sense of trust and loyalty among members. By investing in local organizations and initiatives, Navy Federal strengthens the fabric of the community and demonstrates its commitment to the well-being of its members and their families.

Community Partnerships

Navy Federal has established partnerships with several local organizations in San Diego, including veteran support groups, education foundations, and charitable foundations. These partnerships enable the credit union to provide financial support, volunteer hours, and other resources to initiatives that align with its values and the needs of the community. Through these partnerships, Navy Federal makes a tangible impact on the lives of its members and their neighbors.

10. 24⁄7 Customer Support and Accessibility

Navy Federal understands that financial needs can arise at any time, especially for service members who may be deployed or on duty during regular business hours. To address this, the credit union offers 24⁄7 customer support, ensuring that San Diego members can access assistance whenever they need it. Whether it’s resolving account issues, providing technical support, or answering financial questions, Navy Federal’s dedicated customer service team is always available to provide timely and professional assistance.

Mobile App Accessibility

In addition to its robust online banking platform, Navy Federal’s mobile app is designed with accessibility in mind. Members can access their accounts, perform transactions, and manage their finances from their smartphones or tablets, regardless of their location or time of day. This level of accessibility is particularly beneficial for service members who are frequently on the move or have limited access to traditional banking facilities.

How does Navy Federal’s competitive interest rates benefit San Diego members?

+Navy Federal’s competitive interest rates on loans and mortgages enable San Diego members to save money over the life of their loans. This benefit is particularly advantageous for service members looking to purchase a home or refinance their existing mortgage, as it reduces their overall financial burden and makes homeownership more affordable.

What financial counseling services does Navy Federal offer to military families?

+Navy Federal provides free financial counseling sessions to military families, offering personalized guidance on budgeting, debt management, and long-term financial planning. These sessions are especially beneficial for members facing financial challenges due to frequent relocations or deployment-related expenses.

How does Navy Federal’s extensive ATM network benefit San Diego members?

+Navy Federal’s extensive ATM network throughout San Diego and the surrounding region ensures that members have easy access to cash and basic banking services. This benefit is particularly valuable for members who frequently travel or are stationed in remote areas, as it eliminates the need to rely solely on physical branches.